Investors seem to be waiting for the next shoe to drop, but so far it hasn’t. Defying common sense and logic, it seems, global markets continue their volatile, zigzag climb, with some indices at or at least near their pre-Coronavirus highs. When trying to assess which stocks to trade in such an uncertain market, one sound approach is to follow the lead of thematic ETFs. That is, trade stocks in a specific niche that are striving to meet a clear societal need or desire with innovation or technological advancement.

Investors can follow these “themed” stocks grouped together in a WatchList and buy the top ones when the basket is trending higher. VectorVest’s WatchList Average Graph feature is ideally suited for this analysis.

The ETF Example

The number of thematic ETFs has exploded in the last couple of years. Thematic ETFs allow investors to buy shares in an assortment of companies involved in specific megatrends or niches such as artificial intelligence, cybersecurity, robotics, services and products related to healthcare and our ageing population, social, cultural and climate change, and much more. Some stocks held by the ETF will do exceptionally well, others will be average or less than average. For example, Biotech ETFs hold companies involved in the competition to introduce a vaccine for the COVID-19 or provide related therapies, services and equipment. From March 23rd to June 16th in VectorVest US, XBI is up 52.6%, BBH 37.6%, VHT 37.1%, IBB 35.7%, and XLV 34.3%.

Within our VectorVest community, Ed Subak, a member of Florida, The Villages User Group, is a leader in tracking, analyzing and ranking the rapidly emerging number of Thematic ETFs. He has delivered three outstanding presentations on the topic to our VectorVest International Online User Group Forums. The first, on February 10th, 2018, was the first time many of us learned about this emerging investment instrument. On February 1st this year, Ed updated the Forum with his current list. Of the 20 Thematic ETFs he presented that day, the basket has returned an average of 10.2% or 27.1% ARR to June 16th, handily beating the VectorVest Composite which fell -6.7%. Eighteen winners and only two losers. ARKG, an ETF that tracks innovative Genomic Revolution companies across multiple Sectors, delivered an eye-popping 42.0% or 112.0% ARR.

Why Not Trade The Stocks?

You can trade the ETFs themselves, but if you know how to pick the best stocks by tracking them in a Themed WatchList, you can outperform the ETF by a wide margin. With our exclusive analysis tools, ranking functionality, and exceptional charting tools, VectorVest WatchLists allow you to make faster, better informed decisions. There are a few pre-built, “Themed WatchLists” in the US software such as 5G, Apple Suppliers, Gene Therapy, and now, Coronavirus Stocks. You can also create your own “Themed WatchList”.

Here is one idea. If a thematic ETF like ARKG, FIVG, HACK, or XBI is performing well, use Google to discover which stocks it is holding and place them in a new WatchList. When the WatchList is rising, you might buy shares in the top-performing two, three or more stocks. For example, XBI holds 121 stocks. It might surprise you to know that, while XBI has gained a very nice 52.6% since the March 23rd market bottom, 15 of its 121 stocks gained more than 100%. Two of the 15 are also in the Coronavirus WatchList – MRNA, up 142.2% and BCRX, 123.0%. MRNA is touted by analysts as a frontrunner to develop the first COVID-19 vaccine.

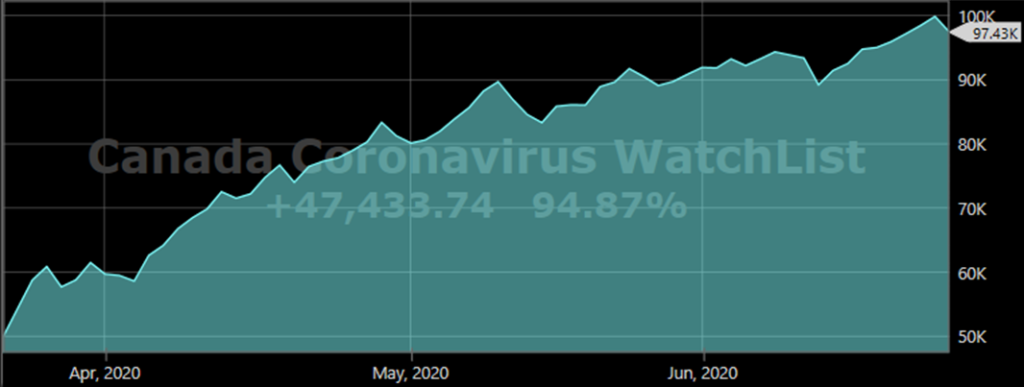

My Canadian Coronavirus WatchList, although smaller and more eclectic than the US Coronavirus WatchList, is doing very well. For your convenience, VectorVest has added the WatchList under the Overview WatchLists folder. The basket is up an average of 94% since March 23rd, led by BOS, 258.7%, LSPD, 157.0%, and VMD, 144.4%.

The overall market will almost certainly struggle at times until the COVID-19 health crisis is more under control, and economies open more thoroughly. A focused approach to stock picking from leaders in groups of stocks with a common theme that are innovative and striving to address a crucial need or desire is sound. I encourage you this weekend to get busy and create your own THEMATIC WATCHLISTS.

Hello, Stan!

Nice article — been looking at this for about a year — lots of opportunity here since March 23rd. Hope all is well!!

Hi Ed, thank you for your email and kind words. You got the ball rolling with your studies and sharing of Thematic ETFs. All is going well here in Alberta, and I hope the same for you. Best Regards.