Traders and investors are constantly looking for the holy grail indicator that will get them into a new position at just the right time before the stock breaks out and makes a big move to the upside.

How do I know? Well, I am one of those investors who for many years was always looking for the holy grail indicator. Oh, I still do, but now it’s because I like to compare the new stuff that’s out there with what we already have in VectorVest. I haven’t found anything better than VectorVest’s Buy REC.

Here is the definition of the BUY REC taken from the Full Stock Analysis Report:

“BUY REC reflects the cumulative effect of all the VectorVest parameters working together. These parameters are designed to help investors buy safe, undervalued stocks rising in price.”

What this means is that the stock has the fundamental qualities that make it worthy of being purchased, and, it is breaking out or in continuation pattern. What could be better than that?

A Buy rating is assigned to a stock when:

- A minimum level of fundamental quality is exceeded as defined by Relative Value, RV, and Relative Safety, RS.

- Relative Timing, RT, is above 1.00.

- VST-Vector, VST, is above 1.00.

- Price is above the Stop-Price and pulling up and away from the Stop-Price.

I like to purchase stocks soon after they get a fresh new Buy signal after a pullback. Pullbacks are easy to identify; the Buy REC has been replaced by a Hold or a Sell. The first Buy REC is the trigger. Confirmation is when the price closes above trigger candle the next day or within five days.

Let’s see how well it works. Access the graphs of the top 10 VST stocks in both CA and the US. Make sure you have added the Buy, Hold and Sell ratings to the top of your graphs by clicking on the REC button at the lower left of the page. On August 6th, below is what you should see with the first two stocks.

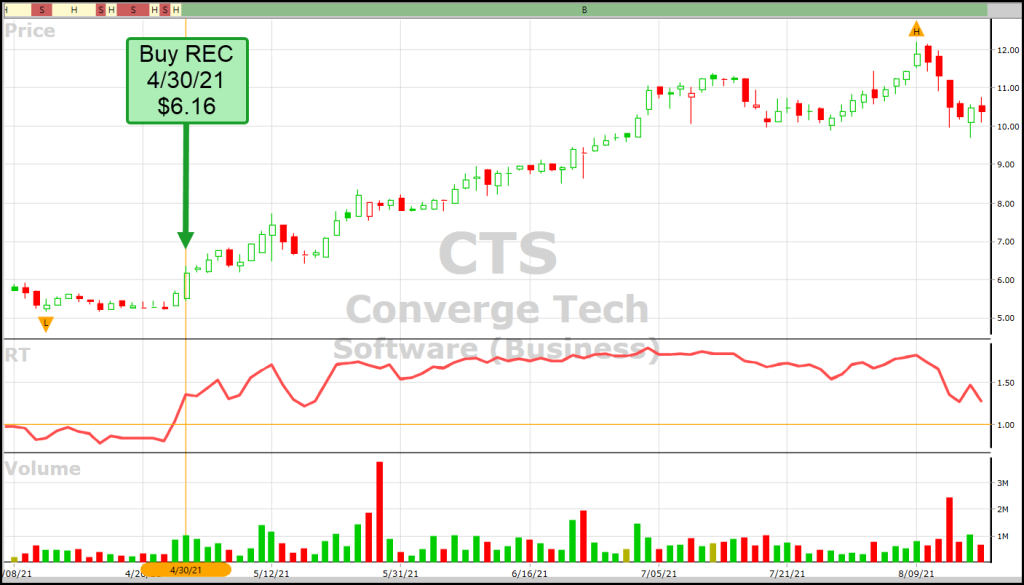

First in Canada. Converge Tech, CTS got a new Buy on 4/30/21 at $6.16. As of 08/06/21, it is now trading at $11.43. Goeasy, GSY, got a new Buy on 9/28/20 at $63.37. With just four brief one or two-day Holds from there, it is currently trading at $180.22. And on it goes. Every major advance in Price begins with a new Buy REC.

In the US, COVID-19 vaccine maker Moderna, MRNA, is at the top of the list. Its most recent new Buy was on 5/14/21 at $161.38 and the current price is $413.72. eXp World Holding, EXPI, got a new Buy on 6/22/21 at $35.63. After falling back to $32.84, it got another new Buy on 7/20/21 at $34.78 and from there it has gone up to $49.09 as of 08/06/21. Study the remaining stocks in the top 10 for yourself.

Here are three reasons why it pays to focus on Buy-Rated stocks when looking for breakouts and continuation patterns:

- You can incorporate them into any of your favourite searches, setups, or trading systems.

- They occur regularly, more frequently in up markets. As always, make sure the Color Guard is Bullish before you make a purchase, even if the stock is Buy rated.

- You can find Buy-rated stocks and the New Buys quickly and easily in Stock Viewer, UniSearch, WatchLists and Graphs. There is even a New Buy Rated Stocks search in the Trends – New Stuff folder.

Finding and purchasing Buy-rated stocks is Step 3 in my August 7th presentation to the International Online Forum titled, 4 Simple Steps to Find the Best Stocks. I show how I use the 40-MA of RT rising from a valley or trough to confirm the momentum behind the new Buy and rising price. If you missed the presentation, PLEASE CLICK HERE https://youtu.be/mb5fMXsfWCo to watch it now.

There is risk in investing and no indicator is perfect one hundred percent of the time, but when you have market timing on your side and the discipline to only buy rising stocks that have a BUY REC, that’s about as close as it gets to THE HOLY GRAIL.

Leave A Comment