Written by: Mike Simonato, Ontario Presenter: “Investing for the Long Term, presented to the Feb. 6, 2021 International Online Forum, you can watch by CLICKING HERE.

I hope everyone is staying safe and well. Once again, what follows is my 2 cents and nothing more

For me, the Canary is singing louder and louder each week. Full disclosure – I never listen to BNN or CNBC. I know the markets are hitting new highs and my Thesis of Ride the Bull until he throws you off still stands. However, when the Bull gets that look in his eye that he’s tired of you riding him so much, there is nothing wrong with looking for a soft place to land if the inevitable happens. For me I’m expecting a pullback possibly this fall, so here is what I do in advance. I have my game plan in place so I know exactly what I’m going to buy when and ONLY when the conditions are right. I clearly do not know if and how big a pullback will happen, 5, 10 or 20% or more. I rely on my graph setup and VectorVest to guide me. Here is what I’m seeing that would cause me to believe a pullback/ correction is coming.

- I find it really hard to work in 30+ degree heat (90 – 100+ for USA readers) so I can’t even imagine trying to work in 50-degree heat with the air full of smoke from all the forest fires ie in BC, West coast USA and Europe etc. These conditions, along with people losing their homes, businesses and factories etc have to be affecting manufacturing, production and the ability to earn an income in so many places. The water is so hot they had to ban fishing in parts of BC.

- COVID numbers are soaring once again. Ontario went from around 100 a day a week ago to just shy of 600 today. If that was a stock price, I’d be packing a bag and going to Disneyland but with it being a Pandemic….. Restrictions are being put back in place around the world with Asia getting hit hard. New Zealand has closed its borders. Florida is just……. Once again this affects manufacturing, production, and the ability to earn an income, and if this leads to another lockdown in Ontario, for example, you will see a record number of bankruptcies.

- Govt and personal debt is at all-time highs. Now you see on the news everywhere Afterpay, Quad pay etc etc. Everyone is getting on the bandwagon (leading to me adding Square to my Buy list ) because people are still shopping online (Thank you very much) but they don’t have the money so these deferred payment systems are catching on like wildfire. But it’s causing consumers (especially Millennials and Gen Z ) to dig an even deeper hole that they won’t be able to get out of.

- Consumer confidence fell off a cliff this week, down to 2011 levels and well below the analysts’ estimates

- Recovery plays ie Banks, Transportation etc all fell hard this week. My future portfolio has been selling off as well. This is usually smart money, booking profits so they can buy back in at the sale price after the pullback. 10 yr Bond yield also fell this week

- It was announced this week as well that those who want to continue to work from home can expect a pay cut.

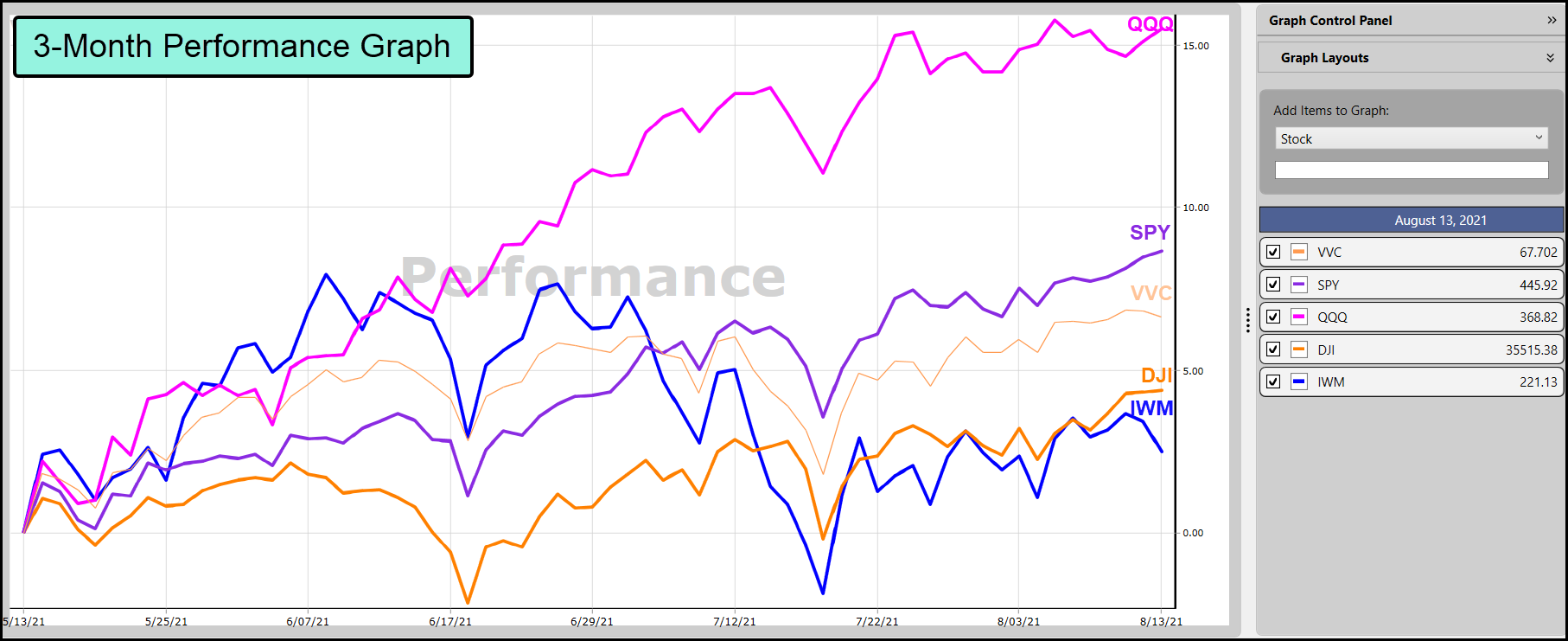

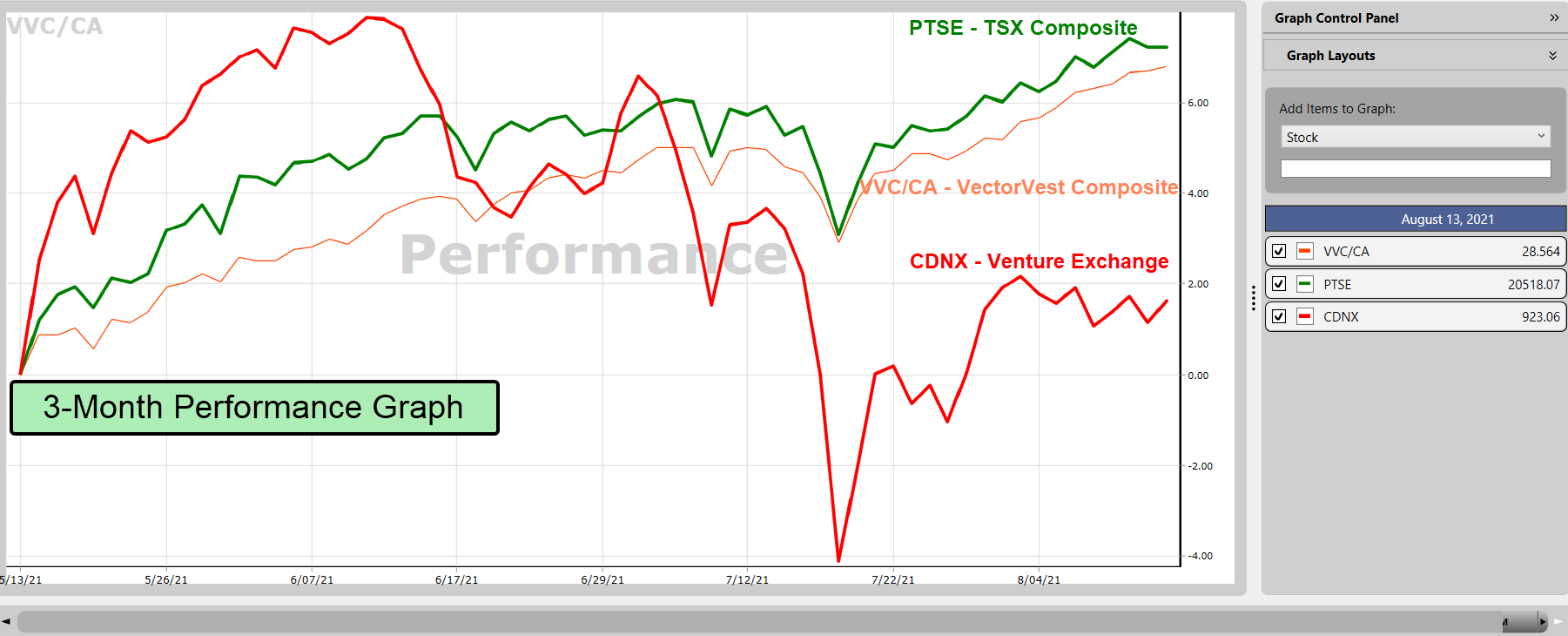

All in all, each week I see more and more canaries joining the choir. Again, I hope I’m wrong but the setup is scaring even me. So what should we be doing: Get your Game Plan in place. USA, Britain and Canadian views all give good insight on ways we can get ready if a pullback happens. VectorVest gives us all the tools we need we just have to know how to use them effectively so we can profit. Another effective tool from VectorVest is the PERFORMANCE GRAPH. Did you ever wonder how Bob Turnbull decided on his Brilliant “Bull Strategy”? (He buys the Nasdaq and S&P 500 ETFs). See the Performance Graph attachments and you’ll see how easy the decision was.

This also shows that while the Dow and S&P have been hitting new highs the Russell 2000 has been selling off so while “The Market” has been rising leading to people buying, that isn’t the case with all markets. The Performance Graph shows if we bought USA Small caps (Russell 2000) we may want to be a little more cautious. In Canada, the Venture (while it has had a nice run after the Covid bottom) is still a market you would exercise caution when buying stocks. In the attachments you will find an easy line you can add to any search to eliminate stocks from a weak or falling market. (I used the example of the Venture market in Canada for the illustration).

Anyway enough ranting. As usual, this is nothing more than my 2 cents and I hope it’s of interest and value

Now for the Markets

USA Despite many new highs the USA continues in a C/Dn, Confirmed Down because the BSR remains below 1.0. This means fewer and fewer stocks are taking part in the rally.

DOW JONES: Rose this week but Thurs and Fri were weak. Very choppy trading week

NASDAQ: Price fell slightly At this point the 20 SMA is acting as support

S&P 500: still looking reasonably good RT Flat this week

MKT TIMING: Bearish Divergence with 2 of 3 indicators falling and Price candles not showing any real strength

READ Views and Strategy

CANADA

PTSE: Since the pullback to the 79 SMA Price has been rising slow and steady RT fell below the channel again

VENTURE: Still stuck below the 40 SMA Price really didn’t go anywhere this week

MKT TIMING: Price rising slow and steady RT rose slightly MTI and BSR Flat this week

READ Views and Strategy

AUSTRALIA READ Views and Strategy

BRITAIN READ Views and Strategy

Leave A Comment