Our Saturday, June 6th International Online User Group Forum received rave reviews for the market guidance delivered by our guest presenters Dr. David Paul, Managing Director VectorVest UK, and Russell Markham, Managing Director, Australia.

In case you missed it, the International Forum replay can be found on our VectorVest YouTube Channel.

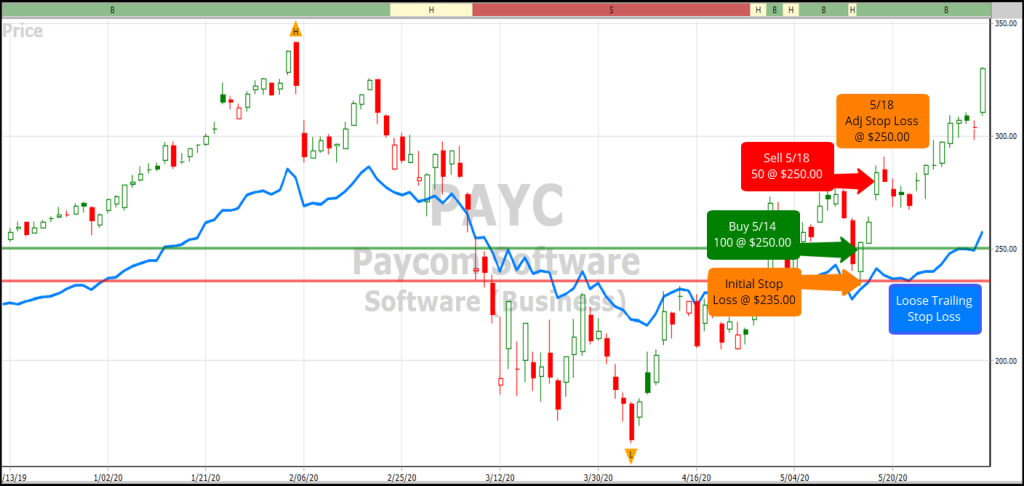

David explained a simple money management technique using the example of Paycom Software (PAYC), in the US, a stock that he owns. He said, “When I have made as much money as I have risked, I sell half of my shares as profit.

“So, If I bought 100 shares, I sell 50 shares and get the Stop-Price to entry on the remaining 50 shares. I allow those shares to move up the page using a VectorVest trailing stop. I am looking for a runner on this second half.”

This is such a simple, yet valuable, money management technique, it bears repeating with some numbers. These are not necessarily David’s numbers, but they illustrate the technique. I have not included commission costs to keep things simple.

STEP 1 – Buy 100 shares of PAYC at $250.00 per share as it is rising off a Support level on 5/14/20. Total cost: $25,000.00.

STEP 2 – Set your Stop-Loss below Support at $235.00. If price moves lower and takes you out, you will lose $1,500.00 (200 x $15.00). This loss must be less than 1% of your total account size if you wish to adhere to Dr. DiLiddo’s golden rule for risk management. It would be a reasonable 6.0% on the $25,000 purchase price

STEP 3 – If price goes up $15.00 to $265.00, which it did just two trading days later on 5/18/20, you will sell one-half of your opening position, 50 shares, for a profit of $750.00 (50 x $15). Why sell there? This is the amount you had “at-risk” when you opened your trade, $15 per share.

STEP 4 – Raise your Stop-Loss on the remaining 50 shares to $250.00, your original purchase price. This is what David describes as “Bringing your Stop-Loss ‘up to entry’.” You are now playing with house money and hoping for a “runner” with these shares. Your Stop-Loss will prevent you from losing more than you paid for the 50 shares, so you will not give up even a penny of the $750 profit that you already pocketed from the sale of the first 50 shares.

STEP 5 – Start trailing your Stop-Loss higher on the remaining 50 shares, making sure not to let price fall below your purchase price of $250 before you sell. David suggests, “I usually make the Stop on the second half of shares fairly loose. We don’t trade markets but beliefs about markets and to make this technique a big payer, I believe it is necessary to a have a wide trailing stop on the 2nd half.

“I have found that keeping the Stop loose on the second half is essential to getting the runner and avoids getting stopped out too frequently,” he says. “The technique is very profitable when you achieve around 40% runners. I think the ProfitLockerPro or ProfitLocker that tightens the stop when a desired profit has been achieved is a great idea.”

UPDATE. PAYC, as of Friday, June 5th, was trading at $329.78, so you would still be in the trade with another $3,989.00 in profits ($329.78 – $250.00 = $79.78 x 50). When you add the $750 profit from the sale of the first half of your position, you have a total profit of $4,739.00. That is a 19% gain on your initial investment – not too shabby.

The best part is, you never have any doubts about what to do after you set up the trade. No emotions causing a knee-jerk decision. No asking the brother-in-law if he thinks you should sell at any point along the way. You just follow your rules.

There are other ways to manage risk, but Dr. Paul’s method of scaling out is simple and easy to implement. Try it on your next few trades. I am sure you will find that having a pre-determined set of rules for selling will give you peace of mind and A PATHWAY TO BETTER RESULTS.

Leave A Comment