Factset, VectorVest’s primary data provider, writes that more S&P 500 companies are beating EPS estimates for the second quarter than the average, and they are beating the estimates by a wider margin than average. The earnings of the TSX Composite Index in Canada paints a similar picture – earnings are rising. That’s good news for investors.

To see for yourself, just click on the Graphs tab, then on the dropdown arrow located in the upper left-hand corner of the screen, and select Market Climate. Click on Add Parameter and then select the 100 MA EPS and ETI. Note that the 100 MA EPS, which is the 100-day Moving Average of EPS on the TSX Composite Index WatchList, started rising from a bottom on October 16th, pulled back in April, and started rising again from there. The ETI, Earnings Trend Indicator, has risen steadily since the October 16th bottom. It crossed above 1.0 on April 30th and currently stands at 1.10 on a scale of 0.00 – 2.00.

Four times a year, publicly traded companies report their earnings and sales figures for the prior quarter. We are just getting underway in Canada with some big names reporting 2nd Quarter results in recent days, including Cogeco Cable (CCA), MTY Food Grp (MTY), and Blackberry (BB).

The latest numbers can pleasantly surprise analysts and investors, or bitterly disappoint. As a result, you will see several breakouts after an earnings “surprise” and at least a few noticeable breakdowns when companies “miss” their earnings. The difficulty is you never know for sure which way the chips will fall. Therefore, in most cases, it is best not to buy a stock just before earnings and, you may wish to consider selling a stock you own, especially if it is behaving badly in front of earnings. “Behaving badly” refers to a stock that has falling Price, Value, EPS, RS or Sales for example. It is an extreme warning if more than one or two of the above metrics is trending lower before earnings.

KNOW YOUR EARNINGS DATES

Before you buy a stock, you need to know if its Earnings Release Date is coming soon. You can avoid risk by waiting to purchase until after earnings. If you wish to be more aggressive and buy a stock before earnings, you can do some additional research and at least put probabilities on your side.

With VectorVest, you can get the earnings dates in three simple ways:

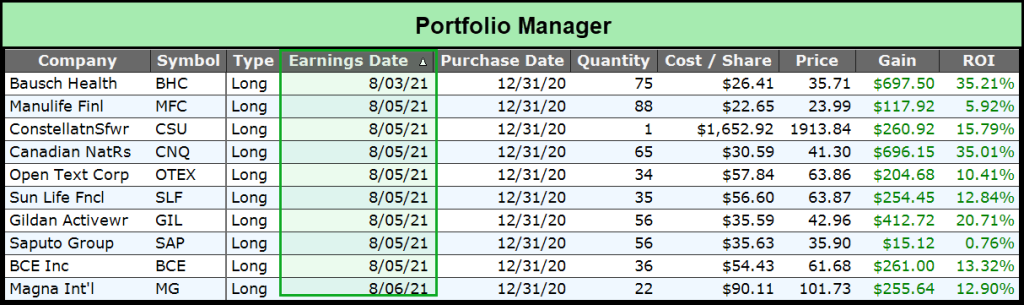

- Add the Earnings Dates to the stock viewer in your Portfolio Manager. This can be a Portfolio of stocks you own or a Portfolio that holds a WatchList of stocks you are studying for possible buying opportunities.

- Use UniSearch to find stocks with upcoming earnings within a specified date range, less than 30 days out for example. Here’s a tip: Filter your search with a WatchList such as the TSX Composite or S&P 500 and place the stocks into a Portfolio using Quickfolio. Once the stocks are in a Portfolio, you can add the Earnings Dates. You can even sort by the Earnings Date by clicking on the column header.

- Go to the Events Viewer to see which stocks are reporting on certain days. You can filter on stocks that you are interested in. Change the calendar to add more days and then scroll down to see what is coming.

Earnings season brings opportunities and pitfalls. VectorVest makes it easier to profit or simply avoid risk by making it easier to KNOW YOUR EARNINGS DATES.

P.S.

NEW VIDEO – Learn how to Maximize Profit and Minimize Risk this Earnings Season. Please click here to watch this brief video for valuable tips about trading earnings and step-by-step help in using VectorVest to track earnings dates of the companies you own or might wish to trade.

Leave A Comment