It’s no secret that Nvidia has been the AI poster child and Wall Street darling amidst this technology craze, delivering more than 220% growth in the past year and earning a market capitalization of $2.17 trillion.

However, the Google parent company Alphabet (GOOGL) is not far behind, and actually appears poised to overtake the chip maker given its latest quarterly earnings results. After this morning’s 10% gain, the stock has a market cap of $2.14 trillion.

All of this comes after the company delivered a solid first-quarter performance beating the analyst consensus on both the top and bottom lines. Revenue of $80.5 and earnings of $1.89 per share were comfortably above the $78.7 billion and $1.51 per share that was expected.

This was driven by Google Search revenue along with advertising sales from other businesses, which contributed more than half of the revenue for the quarter at $46.2 billion. Google Cloud revenue made its own improvements, up 28% to $9.6 billion.

It’s fair to say that a large part of today’s stock performance is the result of beating expectations, which had been lowered amid concerns about the company’s downfall.

There was speculation that AI could be detrimental to Google, but if the first quarter is any indication, all this emerging technology is going to do is empower the company to become more efficient and serve its users better, particularly in its cloud business.

Clearly, there’s a lot for GOOGL investors to be excited about – including the company’s first-ever dividend of 20 cents per share, a $70 billion stock buyback program, and an upbeat outlook for the future.

The stock is now up 24% so far in 2024 and 64% since this time last year. We’ve taken a deeper look at this opportunity in the VectorVest stocks software and found 3 additional reasons you may want to buy GOOGL today.

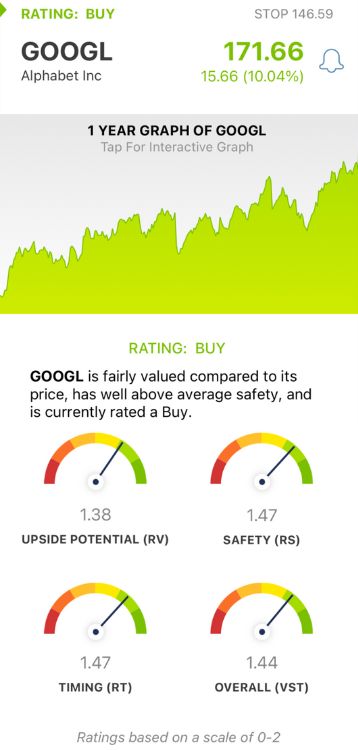

GOOGL Has Very Good Upside Potential With Excellent Safety and Timing

VectorVest is a proprietary stock rating system that takes complex technical data and simplifies it into clear, actionable insights, empowering you to save time and stress while winning more trades. You’re given everything you need to know in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. Better yet, you’re given a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what we found for GOOGL:

- Very Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This is a much better indicator than the typical comparison of price to value alone. GOOGL has a very good RV rating of 1.38 right now. The stock is slightly undervalued with a current value of $178.

- Excellent Safety: The RS rating is a risk indicator. It’s calculated through a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. GOOGL has an excellent RS rating of 1.47.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. The excellent RT rating of 1.47 reflects the stock’s performance in both the short and long term.

The overall VST rating of 1.44 is excellent for GOOGL and enough to earn the stock a BUY recommendation. But before you make your next move, be sure to learn more through a free stock analysis at VectorVest today to fully capitalize on this opportunity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. GOOGL delivered impressive results in the latest quarter on strong search revenue and AI improvements. The company is poised to overtake NVDA in terms of market cap, surpassing $2t today. The stock itself has very good upside potential with excellent safety and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment