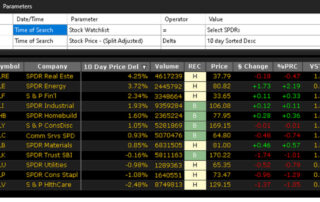

ETF Watchlists – Tracking the Top Ranked ETFs

by Leslie N. Masonson, MBA The investment arena is very large with multiple stock exchanges listing thousands of companies, over 26,000 mutual funds with multiple share classes, and 3,149 ETFs, as well as options on stocks and ETFs, and Futures, among other choices. How does an investor or trader decide where to start? That [...]