Our Canadian stock market has been in a steady upward trend ever since the November 11th Confirmed Up Call, C/Up, keeping pace with the US market. The table below shows a comparison of the two markets using index-tracking ETFs and Quicktests. The ETFs are non-leveraged and tradeable in Canada except for CDNX which tracks the Venture Exchange.

| ETF | Symbol | Nov 11–Jul 2 | 5y | 6m | 3m | 1m |

|---|---|---|---|---|---|---|

| S&P/TSX Venture | CDNX | 32.97% | 29.50% | 8.93% | 0.74% | – 0.53% |

| iShrs Rus2000 | XSU | 31.83% | 83.90% | 18.31% | 1.72% | 0.22% |

| iShrs DowCaDiv | XDV | 26.80% | 32.96% | 23.39% | 8.60% | – 0.03% |

| iShrs NASDAQ100 | XQQ | 23.44% | 214.00% | 15.89% | 8.26% | 7.63% |

| iShrs S&P500 hg | XSP | 20.89% | 93.82% | 17.61% | 6.37% | 2.97% |

| iShrs TSX 60 | XIU | 20.61% | 46.74% | 16.74% | 6.69% | 1.69% |

| iShrs TSXCpdCmp | XIC | 20.46% | 42.32% | 15.52% | 6.21% | 0.94% |

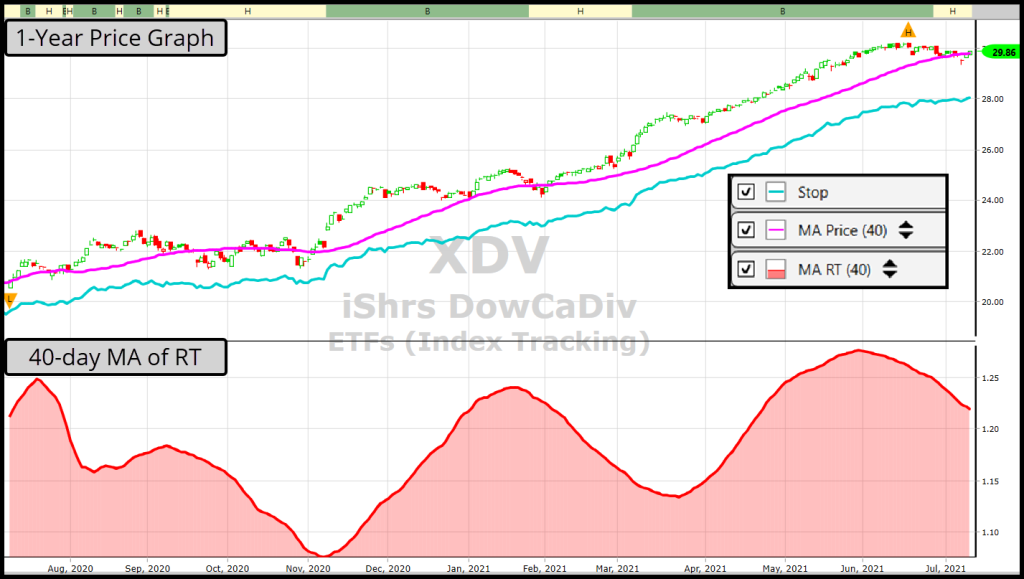

If you study the graphs of the seven ETFs, Price action plus a couple of key VectorVest moving average-based indicators can help you determine the trend for when to Buy, when to Hold, and when to Sell. Buy when price is above the 40-day SMA and VectorVest’s Stop-Price, and the slope of the indicators is rising toward 2 o’clock. Sell when market timing reverses to a Confirmed Down Call, C/Dn, or when Price falls below one or both of the indicators. For additional guidance, you can add the 40-MA of RT. To confirm a new buying opportunity, the 40-MA of RT should be rising from a valley. Be cautious and don’t add any new shares when the 40-MA of RT is falling.

The Performance Graph

For comparison studies and a clear visual of trend and momentum over different timeframes, use VectorVest’s Performance Graph. Add the above symbols and right-click on each one to change the style for colour and line width. I use solid lines for the Canadian index-tracking symbols and dotted lines for the US symbols, all medium width. Don’t forget to save your layout after you have everything set up the way you like it. I named my layout CA/US Index Tracking.

Using the preset period buttons, I can tab through 1m, 3m, 6m, 1y and 5y periods. The right axis shows the percent gain or loss for the period. I am most interested in the comparisons and slope of the Price trendlines which show the strength or weakness of the current trend. Here is what I saw on Friday, July 2:

On a 1m (1-month) period, XQQ has been the most consistent performer and has a 7.63% gain. The slope of XQQ is still up, so more opportunity lies ahead perhaps. The monthly gains for XSP and CDNX are considerably weaker than XQQ, but both are sloping up toward 2 o’clock, indicating current strength. The CDNX symbol is not tradeable, but when the CDNX is rising you can check out the TSX Venture 50 watchlist of stocks for trade ideas.

Switching to 3m, all the symbols are pointing up to varying degrees except for the broad-based US small-caps XSU, Russell 2000.

The DowCA dividend payers, XDV, shows the best 6m performance at 23.39%, but the Performance Graph reveals weakening momentum while the Canadian Venture stocks, CDNX, the US S&P 500, XSP, and the NASDAQ100, XQQ, are in strong uptrends.

A couple of things stand out when you click on the 5y preset button. First, the Performance Graph automatically switches to weekly from daily. Second, the NASDAQ100, XQQ, has been a beast, strongly outperforming all the other indices, and it is still pointing straight up, perhaps even closer to 12 o’clock than 2 o’clock. The other two US ETFs, the XSU and XSP have essentially doubled the performance of even the strongest Canadian index-tracking ETFs over the five years. The cool thing is, you can trade the US market using these ETFs without worrying about the currency risk of trading in US dollars.

New Video

For guidance on setting up and reading your graphs, please CLICK HERE.

Feeling more aggressive? Horizons offers 2x leveraged ETFs that trade in Canada but track the NASDAQ (HQU), and S&P500 (HSU). The 5-year performance is astounding – HQU up 640.26% or 128.21% ARR and HSU up 237.18% or 47.49% ARR. Again, no currency risk. No earnings miss on individual stocks to worry about. Just follow the slope of VectorVest’s moving averages and the Performance Graph comparisons. VectorVest makes it easy to find the BEST PERFORMING INDEX-TRACKING ETFs.

Leave A Comment