Unprecedented. Worse than the financial crisis of 2008. The business media could not deliver a more stark analysis of the economic fallout from the Coronavirus than they did this week. Stock market corrections happen every few years, but 30% in less than a month? That doesn’t happen. Investors recognize this is not just a monetary problem; it is a health and social problem.

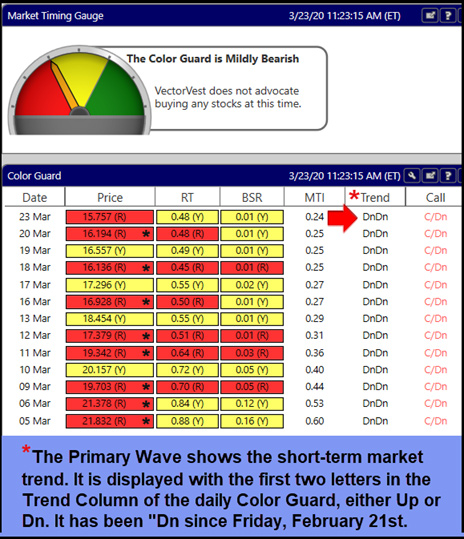

VectorVest guidance has been consistent, urging caution and advocating do not buy stocks. One big up day here and there does not make a trend. Continue to honor your Stop-Prices and, to avoid any potential major collapse, consider Selling even earlier when you must. VectorVest’s Primary Wave Up is the earliest indication of a possible change in trend, sending an alert that the market is beginning to move in that direction and has the potential for a sustained move. Bargain basement prices will still be there when it comes.

Listen, I understand that dividend yields are attractive, and stocks are “on-sale” from where they were just a month ago. However, if you don’t need the income, or if you are genuinely a prudent investor, not an aggressive one, be patient. Wait at least for VectorVest’s Primary Wave Up timing signal. A green light in the price column would add more confirmation of a possible sustained uptrend.

It was reassuring to hear during our weekly Q&A Tuesday, March 17th that most people were in cash to the extent they wanted to be. For most, that meant all cash—others, around 50%, and the rest somewhere in-between. A few said they didn’t get there as fast as they would have liked but, using VectorVest timing signals and their Stop-Prices, they got there.

A few members chatted in that they were in “day trading” mode, buying contra ETFs on down days and stocks long on up days, but not holding anything overnight. Huge volatility almost daily is driving this approach, making it possible to hedge and achieve decent gains without taking on too much risk. Even so, tight Stops are a must. Options traders are using strategies to protect and make money, some under the guidance of instructors Ron Wheeler and Jim Penna.

With our VectorVest MTI and BSR at lows we haven’t seen since the 2008 financial crisis, a few Q&A members said they are starting “to nibble” at high yield dividend payers. One said he bought TD and RY because “the dividends are looking too good to pass up.”

If you are a retiree and income is your primary goal, perhaps even your greatest need, there are many quality companies on sale now whose dividend yields are 4%, 5% and even higher. Just be careful. Favour ETFs and companies in the least affected sectors that also have high Dividend Safety scores (DS), indicating a solid track record of maintaining their dividends. And step in slowly if you must, opening small positions.

If you are a younger person, this could soon be a lifetime opportunity to begin your DRIP program with small, monthly contributions. You have time on your side and, stocks are on sale compared to where they were just a month ago. Just be patient, and wait for guidance from VectorVest that it’s okay to buy stocks.

How much on sale? RY was $109, with a dividend yield of 3.9% on February 21st. Now, Tuesday, March 17th, it’s $89 and 4.9% DY. Three days earlier, it was $78 and 5.5% DY. Things can change quickly, both ways.

THE PRIMARY WAVE

When the Primary Wave Up comes and, the market opens higher the next day, it can be a huge advantage to get in ahead of the crowd. Let any pent-up buying frenzy push your stocks higher. The rally may not last, we need to see green lights in the Price column of the Color Guard and a second move higher over another five-day trading period to confirm a sustained trend, but at least you’re in with a cushion from the bounce off of market lows. It’s an excellent time to favour VectorVest’s bottom fishing searches or modify your own with a Sort that divides a desirable factor such as RV, RS or VST by RT. It looks like this: RS/RT. That approach finds better quality stocks, including dividend payers, that have been beaten down and poised to ‘spring’ higher.

First and foremost, this is a health crisis. All of us at VectorVest are hoping you stay safe and healthy in body, mind and spirit. To that end, VectorVest has cancelled live events for the foreseeable future, including workshops and User Group meetings. Stay connected through our free webinars and by calling Support as often as you need to. Connect with friends and fellow investors by email and phone. Some User Groups are setting up meetings through web conferencing—listen in. We appreciate so much the volunteer leaders of all our User Groups.

Follow VectorVest guidance in the Color Guard and the Views. Watch the nightly US Color Guard Enhanced Reports and the Friday night Timing the Market video reports in both Canada and US. We’re sure things will look better in time, hopefully soon. In the meantime, stay healthy and use the extra time to become truly familiar with the VectorVest System and all that we offer. Keep your WatchLists up-to-date and BE PREPARED TO GET IN AHEAD OF THE CROWD WITH THE PRIMARY WAVE.

Leave A Comment