Written by: Mike Simonato, Ontario Presenter: “My Three Friends”, Dec. 3, 2016, VectorVest International Online User Group (Click here to View: My Three Friends and “Investing for the Long Term, presented to the Feb. 6 2021 International Online Forum, you can watch by CLICKING HERE.

The Importance of Watchlists.

Since nobody can tell from one minute to the next what the market is going to do and what is going to be hot or not, it’s best to be prepared.

My Strategy:

Create Watchlists of interest. As I’ve shown in the past, I create specialized Watchlists that I will actually trade. These allow me to know facts and not be distracted by all the hot air that is always in abundance. Two weeks ago I put out my weekly article saying the Top was in. Then last weekend I added that the volatility showed more indication of a top and then the market soared Monday to make a fool out of me, but then back to volatility. Some sectors I know and are easy to anticipate, such as Dividend Stocks sell-off when 10-year bond rates cross above key levels and vice versa when the reverse occurs.

Watchlists can instantly tell us 3 key things:

- Where if any there is a Bull Mkt

- Which Sectors/ Industries are selling off

- See where there is Rotation going on

Identify Bull Mkts First let me be clear in this market I’m sitting back waiting for the upcoming sale. However, for those who always like to be active, what is the reality?

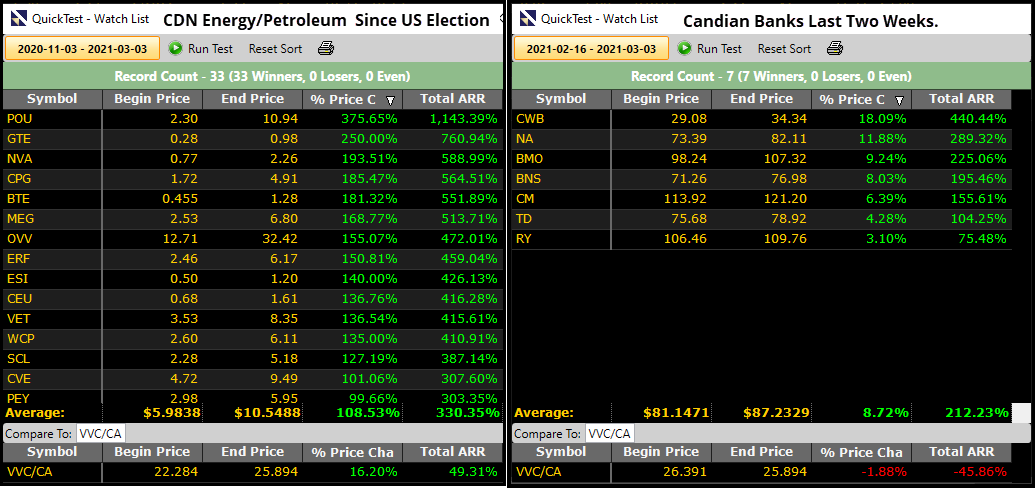

Most have gotten all excited about Green Energy and Crypto Currency since the USA Election and even more recently with everyone trying to get their Crypto ETFs etc out. However, as you’ll see in the attachment, the only two Bull Markets are CDN Energy (NOT GREEN) and CDN Banks.

Which Sectors/ Industries are selling off. I ran Quick Tests since I said the Top is in and see the Attachments to see the Sell Offs.

See Where there is Rotation. As I have said before, one area I am looking at is Credit/ Debit Card Payments and as I showed Paypal was my number one interest followed by Mastercard. However, Paypal has fallen off a cliff and Mastercard is number 1. This has not changed my game plan as I like a sale and the one I am interested in, Paypal, is going on sale.

Finally, another benefit of Watchlists if done right is you right-click on any stock (ie in the Canadian Banks Watchlists) and you can instantly see the Industry Graph to help make decisions.

Finally, I have mentioned several times I’ve been watching the $CDN to see when to convert. My level to watch was 85 cents. It has hit 80 cent level twice recently, and failed. However, I watch the graph and to me, it still looks Bullish with higher highs and higher lows so I’ll continue to watch and make sure I fully understand Norbert’s Gambit so I’m fully prepared when the time comes.

As always, nothing more than my 2 cents and I hope it’s of value and interest

Leave A Comment