Written by: Mike Simonato, Ontario Presenter: “My Three Friends”, Dec. 3, 2016, VectorVest International Online User Group (Click here to View: My Three Friends and “Investing for the Long Term, presented to the Feb. 6 2021 International Online Forum, you can watch by CLICKING HERE.

Last weekend I wrote that the Top was in and showed what I was seeing. This week there was another signal of a top that being volatility. Mon-Wed showed a war between Bulls and Bears. Thurs and Fri the Bears showed who’s in charge. On Thursday the 10 yr Bond yield crossed above the S&P 500 Dividend payout leading to the selloff. The yield continued to soar on Fri leading to more jitters in the market. We got our first C/DN in Australia on Wed and unless things change drastically look for more next week. Stan’s Views are a Must Read. The man is Amazing and his essays are amazingly accurate and timely. CDN $ tried the 80 cent level again. I keep watching to see if it can break this key level.

Now for the Mkts:

USA Lots of Red and could get a C/DN next week.

DOW JONES: Price and RT fell hard Thurs and Fri RT at 91

NASDAQ: Price holding support just above the 79 SMA. RT fell hard to 90

S&P 500: Price in no man’s land RT fell to 92

MKT TIMING: RT, BSR and MTI Fell hard Price at a support line

Read Views and Strategy

CANADA Seeing red and could get a C/DN next week

PTSE: Held 40 SMA. RT falling fast

VENTURE: Long Wicks but it looks like the Buyers are losing the battle. RT falling fast

MKT TIMING: BSR, MTI and RT Falling fast. Price showing weakness

READ Views, Strategy, Climate. Earnings Indicator rose again.

Britain Lots of red could get a C/DN next week. Read Views and Strategy

Europe Lots of Red Could get a C/DN next week Read Views and Strategy

Australia C/DN on Wed Falling fastest of all. Economy similar to Canada, so watch.

This market gets me really excited. I’ve been waiting for a good sell off so what I want to buy goes on sale. The better the sale the more excited i get. As you have seen in my Feb 6, International Online Forum presentation, I have my plan in place. It would also be good to look at the Nov 2020 and Dec 2020 International Forum Presentations that have the potential to make you a lot of money if played right. NOTE Inflation and Bond Yields can have an effect for a while.

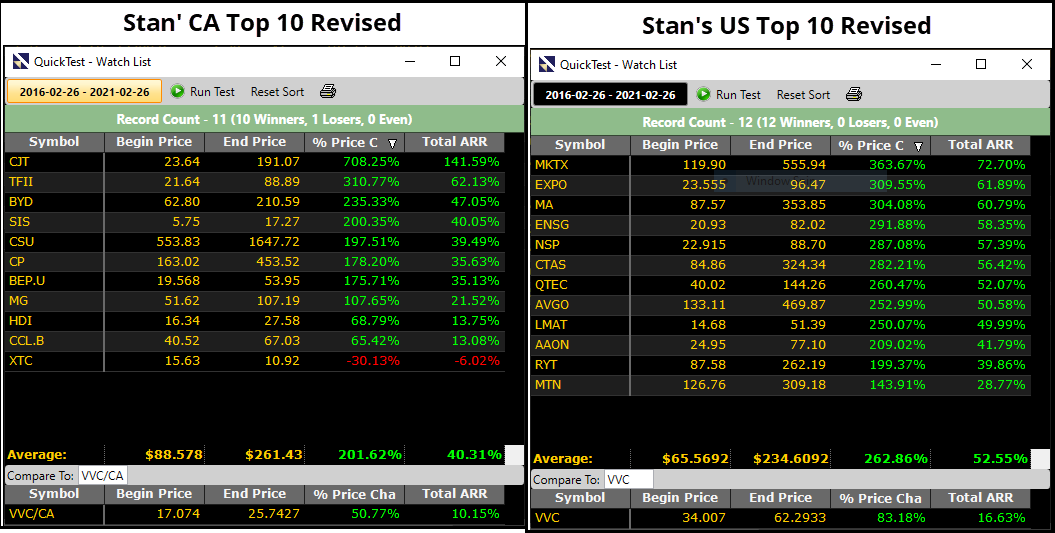

Another area to consider is what Stan highlights regularly, and that is Dividends. A couple of years back Stan Gave us his Top 40 Dividend Stocks for both USA and Canada.

What I do is Quick Test 10 yr, 5 yr, 1 yr and 2021. I enter the top 10 from each quick test. I then write a New Watchlist from the best of the top 10s. Must be in at least 2 of the top 10. I then run the Quick tests again to ensure it gets the results I would like. See the attachments to see the result.

NOTE Again the 10 yr Bond Yield rose above the S&P 500 Dividend yield which will cause a rotation out of Dividend stocks and into Bonds. Usually this happens when the 10 yr yield crosses above 2 but it’s starting a little early this year.

My uncle who is one of the best traders I’ve ever seen outside of Vector Vest has been doing Buy and Hold Dividend stocks for over 20 years and has had remarkable results, so this may be something to consider.

As always, nothing more than my 2 cents and I hope it’s of value and interest

Leave A Comment