There is no question we live in a time of uncertainty, both in our personal lives and our personal finances. The COVID-19 has unleashed economic turmoil around the world, and yet stock markets keep hitting new highs. People wonder, how can that be? How long will it continue?

VectorVest’s most trusted gauge on overall market direction, the MTI, has hit extreme highs; then it has gone higher and stayed up there for weeks at a time. Fed interventions, vaccine news, stimulus and relief funding, low-interest rates, and even the Robinhood effect attracting young investors have skewed the markets for the time being. Yes, there were pullbacks, notably during September and October when the TSX fell 5.6%, but the major correction many analysts predicted for months and months just hasn’t happened, at least not yet.

Fortunately for VectorVest subscribers, even as the wall of worry was growing, green has been the dominant colour in the Color Guard since the Mar 23 market bottom. Buy or “Buy with Caution” was the general guidance.

So we have an overall bullish market, yet many investors and analysts remain fearful of a substantial correction. How should we deal with this apparent contradiction? One popular strategy is to buy safe dividend stocks that have proven they can endure economic downturns without cutting their dividends. VectorVest makes it easy to find such stocks.

Let’s go ahead and set up our search to find companies and ETFs that have maintained or raised their dividends in the last 12 months. We will filter out companies in three sectors that are either cyclical or predominantly event-driven.

| Sort VST+YSG DESC | |||

| Date/Time | Parameter | Opterator | Value |

| Time of Search | Stock DIV – (Dividend Paid) | >= | 52 weeks ago Stock DIV |

| Time of Search | Stock AvgVol – 50 day MA Volume | >= | 50000 |

| Time of Search | Stock DY – (Dividend Yield) | >= | 1 |

| Time of Search | Stock DS – (Dividend Safety) | >= | 50 |

| Time of Search | Stock Sector | <> | Drug, Mining, Petroleum |

In the blink of an eye, our search delivers a list of 93 stocks and ETFs as of 2/16/21. Now we are going to cherry-pick.

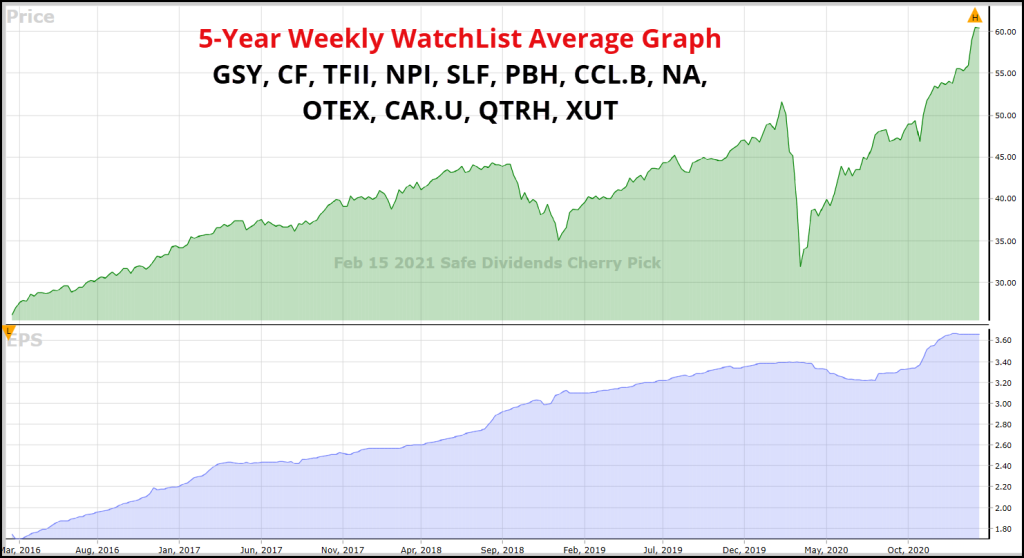

First, let’s do a Quicktest of all 90 stocks going back to Feb 15, 2016. Place all the stocks with a 10% ARR or higher in a WatchList that I named “Feb 15 2021 Safe Dividends”. Forty-two stocks and ETFs remain. A good sign, the 1-year and 5-year WatchList Average Graph of these stocks look smooth overall, bottom left to top right.

Sort your WatchList by VST+YSG DESC. This will bring the best combination of Value, Safety, and Timing and Dividend Yield, Safety, and Growth to the top. Fantastic! Goeasy (GSY), in the Business Services Sector, is the first choice. VectorVest’s capital appreciation indicators on a 0-2 scale are rock-solid. It is undervalued, has excellent upside potential with Relative Value, RV of 1.51, good Relative Safety, RS of 1.28, and excellent technicals with Relative Timing, RT of 1.61. The Dividend Yield, DY, is 1.57%, and Dividend Safety, DS is excellent at 83 on a scale of 0-99.

Here are a few other stocks I like in defensive Sectors that should hold up during market uncertainty, especially if the economic recovery takes hold with more stimulus.

Goeasy, GSY – Business Services; Canaccord, CF – Financial; TFI International, TFII – Transportation; Northland Power, NPI – Utility; Sun Life Financial, SLF – Insurance; Premium Brands, PBH – Retail; CCL Industries, CCL.B – Diversified Companies; National Bank, NA – Bank; Open Text, OTEX – Software; Canadian Apartments, CAR.U – REIT; Quarterhill, QTRH – Telecomm. The top ETF for this time is iShares Utilities, XUT.

The average DY of these 12 stocks is a robust 2.32%. Dividend Safety is above average at 66, and the Dividend Growth rate is 10%, far better than the inflation rate. This basket’s 5-year average gain is 32.08% ARR, not including dividends. That’s more than three times the TSX Composite gain of 9.45% ARR. Talk about consistency – the current 1-year average return is 30.11%, vastly outperforming the TSX, which has managed just 3.58%.

You might make different selections based on using the VectorVest tools and indicators that match your investment style, risk tolerance, and personal preferences. Whatever your choices, I hope you will agree the above study shows WHY NOW IS A GOOD TIME TO CONSIDER SAFE DIVIDEND STOCKS.

P.S. I have created a short video that explains step-by-step how you can use VectorVest to create your own list of Safe Dividend Stocks for these uncertain times. Please CLICK HERE to view this week’s video!

Like what I see