THE SEVEN DEADLY SINS OF INVESTING

Written by: Stan Heller

Madoff: The Monster of Wall Street. This Netflix 4-part docuseries is riveting entertainment and must-watch TV for investors.

VectorVest Founder, Dr. Bart DiLiddo, brought the series to the attention of VectorVest instructors in early January. He wrote, “In the first five minutes, they cited three of the Seven Deadly Sins of Investing.” Over the next several weeks, he got us thinking about how VectorVest helps traders and investors avoid the Seven Deadly Sins of Investing.

I picked out the three Deadly Sins in Madoff and possibly a fourth. Greed, Deceit, and Sloth are the three that jumped out to me, but there was also Hypocrisy. Madoff was Greedy and Deceitful, as were many of his employees, the banks and hedge funds. They knew Madoff had to be doing something shady to get such high returns month after month. It wasn’t realistic. They also knew it was probably illegal, but they looked the other way to line their pockets.

The individual investors, the victims, were also Greedy. Their intense desire to increase their wealth caused them to commit another deadly sin – Sloth. In other words, they were lazy, careless and accepting without carrying out the necessary due diligence before entrusting Madoff with their life savings in many cases. They ignored the sage and true adage, “If it seems too good to be true, it probably is.”

VectorVest defends against greed by advocating asset allocation and risk management. It’s why VectorVest gives a Sell rating on weak stocks that are falling in price, and instructors teach never to risk more than 1% of your account size on any single trade.

Hypocrisy was the fourth sin in Madoff. The SEC regulators were exposed for not following their rules and processes when it came to investigating Bernie Madoff. Another example of Hypocrisy, Dr. DiLiddo cites Wall Street analysts who say you can’t time the market, but they constantly try to predict it. VectorVest defends its subscribers in two ways. First, providing fast and slow Market Timing signals and a Daily Color Guard that lets investors know when buying stocks is okay. Second, by advocating rule-based trading systems and showing how it’s done in the Trading System Viewer.

The last three of the Seven Deadly Sins are Wrath, Pride and Envy.

Wrath is uncontrolled feelings of anger and impatience. These feelings often lead to impulsive and revenge trading. Revenge trading is when an investor throws good money after bad, trying to make up for a losing trade. Dr. DiLiddo says Wrath often results from being victimized by the above Deadly Sins. To defend from this, VectorVest teaches risk management and buying safe stocks that are rising in price in a rising market.

The next Deadly Sin, Pride, is the irrational belief in one’s abilities to a point where the investor refuses guidance from knowledgeable, experienced and reputable coaches, such as those at VectorVest. Dr. DiLiddo says this is the most destructive of all the Seven Deadly Sins. “It has ruined kings and others who believe they are high and mighty.”

Envy is the 7th and final Deadly Sin of Investing. Coveting the success, status or traits of others causes investors to blindly follow the masses and take poor advice, often from family and friends. Dr. DiLiddo says, “Why else would someone say there must be a Bull Market somewhere, and I’ll help you find it. Trust, but verify.”

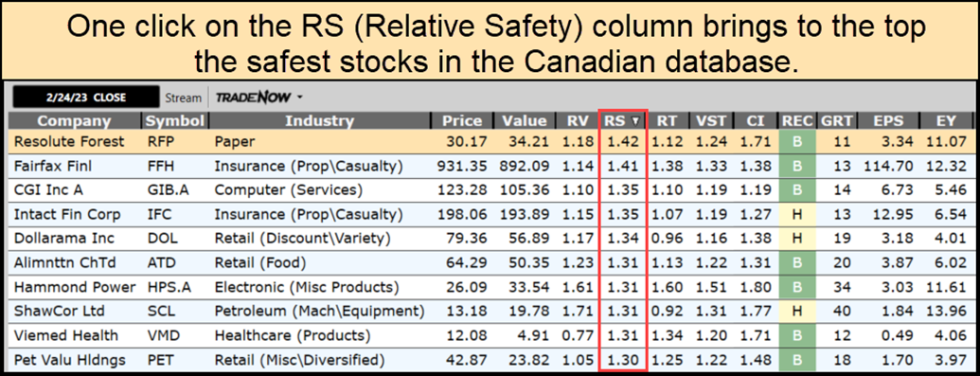

I believe VectorVest does an excellent job defending investors against the Seven Deadly Sins. We provide clear, mathematical and objective information about more than 18,000 stocks worldwide. We advocate best practices of diversification and risk management. We use proven Market Timing indicators to tell us when it’s okay to buy stocks and not okay. We advocate buying safe, undervalued stocks rising in price and avoiding risky bets on low RV and RS stocks. There’s no Hypocrisy, no Deceit and no self-serving recommendations.

With a well-organized suite of indicators as shown below, complete stock analysis reports, and the ability to rank and sort stocks, industries and sectors by any measure, VectorVest removes any excuse for Sloth.

Finally, VectorVest’s Educational services, including regular coaching on Market Timing, position-sizing, diversification, risk management and more, helps investors keep the Seven Deadly Sins in check. At VectorVest, we strive to do everything we can to help investors avoid THE SEVEN DEADLY SINS OF INVESTING.

PS. Go to the Welcome tab and download the latest version of Dr. DiLiddo’s updated little green book, “Stocks, Strategies & Common Sense.” Go to Chapter 2, Pages 12 and 13, to read about the SEVEN DEADLY SINS OF INVESTING.

Leave A Comment