Before I start, let me say thank you for all the kind words I get, as well as phone calls and timely insights. I received an email this week from someone new to my email list that was so kind, well thought out, and encouraging. It really meant a lot to me. My goal is to get people from all over the world to work together, share insights on different economies and guidance. We are well on our way with North America, England, Europe and China covered. To show the importance of this to successful trading, consider CryptoCurrency. Recently it was highlighted that Kazakhstan was the second-biggest Crypto mining country in the world, so the turmoil it was experiencing affected this industry. This week it was announced that Texas was cutting back on Crypto mining to take pressure off the electrical grid. Result was a $4,000 pop in Bitcoin (See below for more detail). So once again, thank you so much for the emails, phone calls, and your continued encouragement

Now for the markets:

Summary: Every country except Australia had Green Light Buyer signals and PW up signals. No country had DEW Buy signals which is the favourite timer of many. All countries except the USA could get C/UP Buy signals next week. One as early as Monday, so watch next week closely.

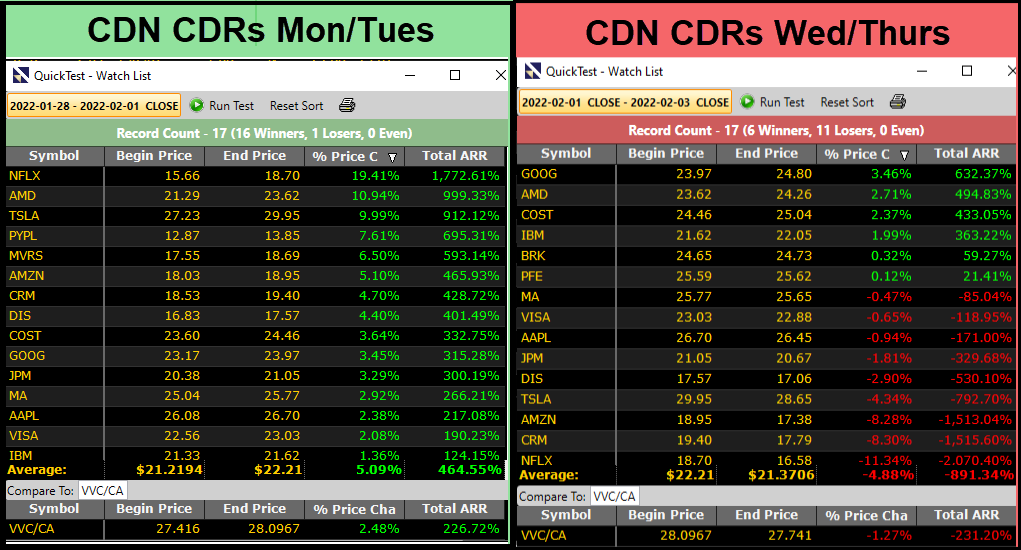

To say this week was volatile is an understatement. Monday and Tuesday looked like we got follow-through from last Friday and with Green lights in the price column, it looked good and maybe sucked some into buying in early. Then Wed and Thurs fell off a cliff. Facebook’s Meta Platforms crash was the worst one-day crash in the Stock Market’s history. But then I came to the rescue Friday with my Amazon and lifted the market higher. However, selling into the close Friday is a reason for concern.

Things I’m watching going forward. Job numbers were encouraging. Even though Canada had job losses, it was temporary due to restrictions that are being lifted gradually. Another key is the USA 10 yr Bond Yield. It is currently just under 2%; if it goes above this key level, it tends to cause a mkt sell off especially among Dividend stocks. Another key level for me is the VIX. My key level is 25. Above this could get explosive moves either up or down. Currently, it is just below 25. There is another metric I’m trying out, but I’ll leave that for another day.

USA MTI 60 BSR 27 ETI Stable

DOW JONES: Failed at the 79 SMA but held the 200 SMA

NASDAQ: Stuck below strong resistance

S&P 500: Failed below the 79 SMA but held the 200 SMA All 3 sold off into the close

MKT TIMING: Bounced off support but failed at the 20 SMA

READ Views and Strategy

CANADA MTI 73 BSR 30 ETI Rose 1 point

PTSE: Held the 200 SMA Now stuck between the 79 SMA and resistance Could break out next week

VENTURE: Holding one support but closed below strong resistance

MKT TIMING: Failed at Strong resistance See if it can break out next week

READ Views and Strategy

GOLD Went nowhere this week Staying above another support line

EUROPE MTI 86 BSR 61 ETI Rose 1 point

MKT TIMING Failed at 50% Fib Retracement Pulling back to major support

READ Views and Strategy

BRITAIN MTI 79 BSR 53 ETI Stable

MKT TIMING: Pulled back to and held major support

READ Views and Strategy

AUSTRALIA MTI 78 BSR 24 ETI Stable

MKT TIMING: Failed at Fib Retracement line. Pulled back and closed just above strong support

READ Views and Strategy

MY PROCESS FOR STAYING IN CONTROL

NOTE For those who are new, I hope you find the following on interest and value. Those who know me know I’m not arrogant or think more of myself than necessary. The following may come across that way, but I assure you this is nothing more than info I hope all will find of benefit in all areas of life, including, of course, in trading.

For those who don’t know, I own a very successful window cleaning business. I have no employees as nobody can find anybody any good to work and at 68 years old, I have no desire to take on more stress than I need to. I know what it’s like to have no work, no food, and even no heat and to have nobody care. The low point was when we got snubbed by the homeless. We still laugh about that to this day. Here is what has helped me build what I have today and help me to be successful in trading. I hope others find it useful as well.

In my business, I have many amazing clients who treat us very well, many of whom have become good friends. As such, I always try me best for them and treat everyone with utmost respect which is how I expect to be treated as well. In business you face many challenges and how you deal with these challenges can determine success or failure. In business, the ability to see potential problems in advance and be able to adapt is crucial. Also, controlling expenses is also key.

In my business/ personal life this is what I do:

- Every day I write down what I made (Income), what I spent, and what each dollar was spent on. At the end of the month, I total everything and put it on a master sheet. This allows me to see my situation perfectly ie are any expenses getting out of control and if so, what can I do about it? Is my income rising or falling and if so why? What can I do to correct any situation? Here are some real-life examples:

- Doing the above has allowed me to catch crooked companies from trying to pull a fast one on me. (Yes, an insane amount of crimes are being committed regularly and most have no idea) I caught one company and saved over $10,000 in a 2 week period because I record everything and have proof. They were shocked and had to concede. Every year this saves me between $5,000 – $10,000.

- I have never raised my prices on clients. People will say that’s impossible. Here are some secrets. My clients really appreciate my honesty and how I treat them, so they tip really well. But I also do my part. Food inflation is getting to be an ever-growing problem. I countered by buying shelves and stocking up when things were cheap therefore, food inflation has next to no influence on us as my figures show. Gas has gone up huge, which is a big cost for me. I have switched and now only drive when necessary and fill up at native gas bars. Price in Jan $1.29. Yesterday filled up at $1.37 so I control my cost instead of doing what the competition does by passing on all costs to their customers.

- I manage money well. I don’t live beyond my means. What is going on today is scary. Many business owners are so screwed financially they need to ask for advances just to finish a job they’re on because they’ve already spent the money on other things. At some point, it’s all going to end badly

- Another benefit of recording everything is I know exactly what I need to retire. We also have to be prepared for the unexpected. For example, my mom is extremely good with money. (She taught me) However last year she fell and broke her neck and the cost for her care was enormous. I also had many crimes committed against me last year costing me just under $30,000. As such, being prepared can lessen the sting.

How does this affect trading? We need to be careful where we put our retirement dollars to work. Personally, I’m interested in low-risk well-managed companies. Recently, the market has given us an amazing gift that very few will take advantage of. This week was volatile, to say the least. My off-season market curse continues. Good news though I start back up in April and the trading opportunities will abound at that point. What I did was examine stocks/ ETFs that I’m watching with the following breakdowns.

- Mon Tues

- Wed Thurs

- Fri

- Buy and Hold

Last week’s essay I showed where money flowed in and said to watch for follow-through. In Tuesday’s CA Q&A webinar, Stan posted a question I posed, ie is this a V Bottom or a trap. The rest of the week answered it pretty well. Even a highly skilled trader like David Paul is still in 70% cash. NOTE: From this morning’s International Online Forum presentation. You NEVER Buy and Hold Leveraged ETFs!!

The things I looked at were the same as last week:

Bob Turnbull’s ETFs. USA and Canada Note I included the CDN Mkt ETFs but I personally at this point am only interested in Bob’s Mkt ETFs (Singles)

CDN CDRs Top USA Stocks

Bob Turnbull’s USA ETFs

My Watchlist USA Stocks

By breaking it down the way I did, it will show the degree of volatility in a drawdown. Helps determine if you can handle that amount of volatility in trading.

Shows which stocks have adapted best to the current business environment

Helps us make wise decisions going forward.

NOTE Something I’m looking at is using Don Reitsma’s 12 and 26 moving averages on a Mkt Timing Graph to see how it would work. Didn’t want to say anything before now out of respect. (Didn’t want to steal his thunder in any way)

As always nothing more than my 2 cents and I hope It’s of value and interest

Leave A Comment