Mike Simonato, Ontario. Presenter: “Investing for the Long Term”, presented to the Feb. 6, 2021 International Online Forum, you can watch by CLICKING HERE.

This week certainly highlighted that my off-season market curse is still in effect. While Wells Fargo (a previously poor performer) gave good earnings and the stock popped, JP Morgan gave scary forward guidance and their stock fell 6% taking the entire sector down.

As I mentioned earlier, I’m watching closely the earnings, but even more so forward guidance. A simple way to do this is to watch the Earnings Trend Indicator. At this point, the ETI is holding steady except Australia, which fell 0.04 points. Another Metric I’m watching is consumer sentiment which fell hard in the USA. All Markets went into a C/DN situation except Europe. As mentioned last week, I feel the period until the end of Feb could be very dark and dangerous, especially trying to trade. (Note this is mainly due to Covid which I hope we will see light at the end of the tunnel at that point). Issues that will not be resolved at that point are serious labour problems, Inflation, and crime. This week was a prime example of a time to stay out of the market. There were a number of reversal days showing the danger of trying to trade this market.

One area doing well is energy stocks (See Below). Everything else had a tough week, Currencies, Crypto, a number of Commodities etc. Even Gold continues to break hearts. It can’t break out above the 79 SMA. Until it does on strong volume I have no interest.

Now let’s look at each market:

USA

DOW JONES: Battle between the bulls and bears. As soon as it comes close to the 79 SMA the Bulls step in

NASDAQ: Held the 200 SMA 2x this week

S&P 500: 79 SMA is acting as support

MKT TIMING: Price had been holding strong support. Today closed right at support

READ Views and Strategy

CANADA

PTSE: Tight channel between resistance and the 79 SMA

VENTURE: Still no clear direction or strength

MKT TIMING: Support line holding for now

READ Views and Strategy

EUROPE

MKT TIMING: Fell this week Price well below the 65 SMA

Economic Sentiment Really low

UK

MKT TIMING: 10 touches at support in the last month

READ Views and Strategy

THE CHALLENGES AHEAD

NOTE: This is my 2 cents only and is not to be taken as investment advice.

This will highlight 3 things:

- The challenges that will face us as individuals and businesses throughout 2022

- The reason why I never listen to BNN or CNBC

- The importance of research and networking with other like-minded people

First, here is what I see we as individuals and businesses will face this year.

INFLATION: There will be several reasons this will not end anytime soon. The key to a strong economy is the willingness of people to spend money. While there is a lot of talk about interest rates rising, I personally don’t see this as a major problem since even if there are 3 or 4 raises this year. That will still have an interest rate around 1% – still low. What will be more of an issue is all costs will rise ie Groceries (estimate 7%) Heating, Property Taxes, Gas (Demand will continue to rise if life gets back to normal) etc etc. Most big money is in the hands of retirees who will adjust their spending due to increased cost of living which may affect business earnings.

LABOUR ISSUES. Nobody in any business can get any good workers. In the USA, close to 5 million workers are quitting each month. To make matters worse, Reddit started an Antiwork Forum which has become very popular all around the world, thus adding fuel to the fire. The situation is so bad that we got an email from the Retirement home my mom is in (The best run and only one without any Covid cases) asking if anyone (including family members of residents) if they can serve meals, work in the kitchen etc. That is just one example, but it makes the point that earnings in all businesses will be severely hampered if they can’t get workers to handle the volume of business at hand.

Second Why I don’t listen to CNBC or BNN.

For those who don’t know, I was a top Pro Photographer for a number of years. My work is literally all over the world. When shopping for a camera, most people have the thought that Nikon or Canon, for example, are the best brands. They would be wrong. For 95% of the public, the Panasonic FZ 200 or 300 are by far the best and sold for around $500. Anyone who received my calendars saw the quality of pictures it produced.

Now I have a successful window cleaning business. So often I see people buying the brands they have been told was the best. All I hear is you got screwed. The higher the cost, the worse the quality. It is so bad now I won’t work on a house 5 yrs old or newer.

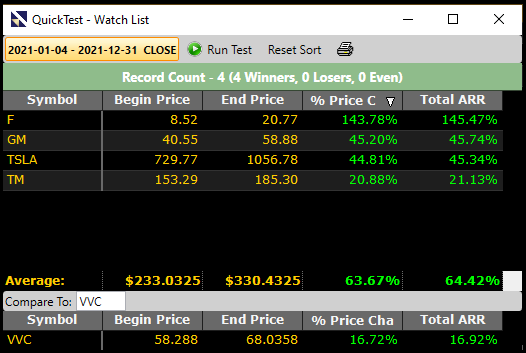

In Trading, an example is all you hear people talking about in the Automotive industry is Tesla Tesla Tesla. Last year however, they were the 2nd worst performer. Ford kicked butt. (See Below)

Finally the Importance of Research and Networking:

While Research is very important, talking with people who are knowledgeable is most important. An example is where I work, there is a company that says they are very highly rated, but the reality is their work is so bad I wouldn’t let them work on a dog house. People in the know can warn others, preventing a potential catastrophe. Fortunately, I’m in a large number of houses of people of all income levels etc so I can notice trends. I also talk to key people ie Courier drivers (vol has dropped off in the new year however I’ve been told Amazon is still going 7 days a week). I also talk to the workers at Canada Post to hear about what they are seeing, as well as top CEO’s, traders etc. I can’t over-emphasize the importance of this. I know that I can learn from everyone I meet. The key is to always treat everyone with Kindness and Respect. This will really gain in importance as 2022 progresses.

Lastly, the other Key to Success is to know what is the current Market Condition.

I said when My Stock Watchlist Average Graph (Weekly) hit the 79 SMA COULD be a buy point. It is there now. Am I buying NO! The Current Mkt condition is too dangerous. I will be patient and watch. It may hold the 79 SMA or it may fall to the 200 I don’t know the future. I do know when the Market says it’s safe I will be buying. It’s a lot easier to do Buy and Hold when you Buy at the right point (Price).

Bob Turnbull’s Strategy is holding the 79 SMA on the Daily Graph and the 20 SMA on the Weekly Graph (Bob uses the Weekly for his strategy)

As always nothing more than my 2 cents and I hope it’s of value and interest

Leave A Comment