It was gratifying this week to hear subscribers sing the praises of VectorVest’s Market Timing signals. When the Confirmed Down Call came on November 30th, they protected their profits and gradually raised cash by tightening stops and selling their weakest positions. They had the patience to wait for market conditions to improve before buying any new positions.

Then, on January 24th when BSR, Buy, Sell Ratio, fell below 0.20 and the MTI below 0.60, they got their shopping lists ready as VectorVest suggested. They knew from VectorVest’s guidance that the market was searching for a bottom that was now near at hand. On Monday, January 31st, VectorVest signaled a Primary Wave Up, a fast indicator of a possible change in trend. VectorVest investors were well-positioned and ready to take advantage, stepping in to buy beaten down stocks at bargain prices.

It is exactly how VectorVest Founder Dr. Bart DiLiddo imagined investors would use and prosper from the timing system he created more than 25 years ago.

Conventional wisdom says that stock prices move in a random fashion. And while that is true of individual stocks day to day, we know that the forces of supply and demand causes stocks to move in waves. Economic factors affecting corporate earnings such as inflation, interest rates and geopolitical events have the power to move the entire market higher and lower. VectorVest’s timing signals keep investors on the right side of the major market trends.

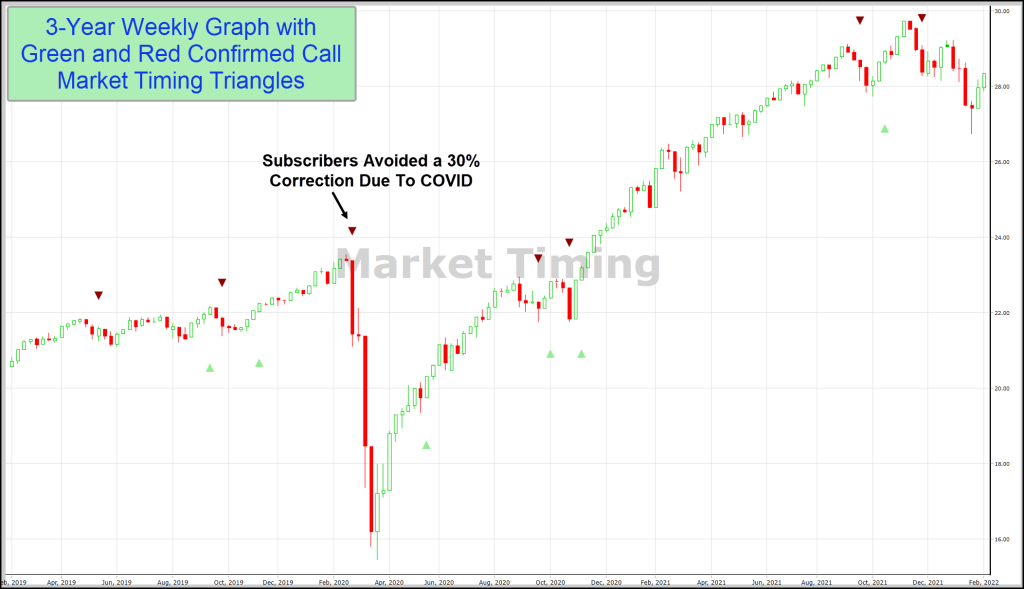

CONFIRMED SIGNALS

While the BSR provides clear insight into the health and breadth of market conditions, VectorVest’s MTI is a powerful indicator of the market’s trend. Therefore, for the Canadian market, VectorVest uses the MTI as its key indicator to give Confirmed Up and Confirmed Down signals.

A Confirmed Up Call is given when the following conditions are met:

- The Price of the VectorVest Composite (VVC/CA) is higher week over week for two consecutive weeks,

- The Price of the VVC/CA is higher than the previous day’s close,

- The Price of the VVC/CA has crossed above its 65-day Moving Average

- The Market Timing Indicator (MTI) is greater than 1.00.

The opposite of the above conditions must be true to give a Confirmed Down Call.

How effective are the Confirmed Calls? In Canada, in a typical year we will get between three and five Confirmed Up Calls, each one lasting a period of weeks and months. Plenty of time to make money on the right side of the trend. The Confirmed Down Calls generally do not last as long, but the market can suffer a severe decline when it happens.

VectorVest has other timing signals that range between fast and slow, not as fast as the Primary Wave and not as slow as the Confirmed Call. They are all designed to identify turning points in the market’s trend. It is the key to making consistent profits, protecting those profits, and GROWING YOUR WEALTH.

Leave A Comment