Written by: Mike Simonato, Ontario

Presenter: “My Three Friends”, Dec. 3, 2016, VectorVest International Online User Group (Click here to View: My Three Friends)

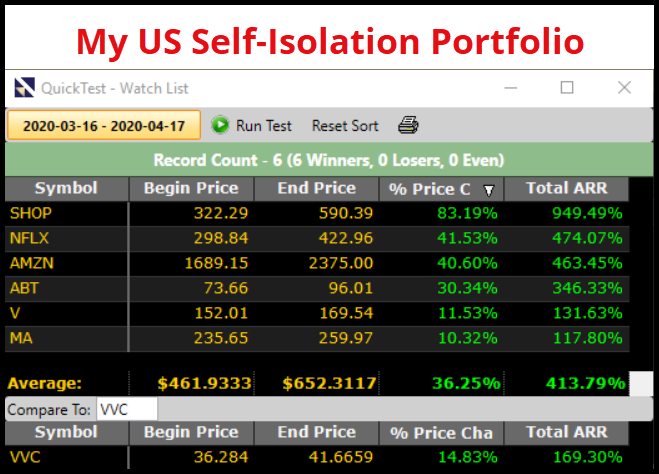

I’m sure we are all anxious for life to get back to normal. There will be some tremendous challenges ahead for sure. As many know, I like to trade what I see ( thus the self isolation portfolio). As always this is nothing more than my 2 cents but here is what I see as well as some news stories that pertain to the discussion.

The TIME TABLE to REOPEN

The Govt knows it has a real problem ahead. Most events have already been cancelled until at least Mid August ( some longer) which is costing cities, venues, athletes and performers of all genres huge money, tourism dollars, restaurants etc.

The larger problem is with the warmer weather on the way more and more people are not following the self-isolation guidelines and with the big May holiday weekends coming up, people are going to want to go to the beaches, parks etc. Already in the US there have been protests to get the restrictions lifted. The Canada-US border is now closed until mid-May, affecting a lot of tourism dollars as well.

My 2 cents: look for at least some easing of restrictions starting in May ( I believe the restrictions will be lifted in stages)

BUSINESSES that have the potential to EXPLODE out of the gate :

- Hair and Beauty Salons

- Medical includes Doctors, Dentists, Chiropractors etc 3. Canadian Tire, Home Depot etc as people get what they need for all their summer projects and activities.

- Construction and renovations. ( no new projects have been allowed to start so builders are behind and a lot of trades have been taking advantage of getting paid to stay at home) and with the now shortened season there will be a rush to get projects done before winter.

BUSINESSES that may have a temporary bump or may disappoint.

- Real Estate Air BNB has collapsed with nobody being able to travel, ban on short term rentals and a reluctance to stay in someone else’s home. Listings may explode thus driving down prices as availability surges. Also many businesses will not reopen thus making a glut of Commercial Real Estate available and will no rent money coming in owners may be forced to sell.

- Restaurants will see an initial surge but it may be short lived now that people’s lifestyles have been greatly altered.

- Travel Industry. Will be people be travelling like they did before or will the airlines and cruise industry suffer. For now they are saying Cruise bookings are a record levels but time will tell.

My business is booming already booked solid until June and no real change on how I’m being paid other than its a lot faster. Even people I haven’t heard from in years are calling and everybody is tipping. When the restrictions are lifted, expect a pull back in the Self Isolation Portfolio as there could be a temporary lull in online shopping and Netflix. However going forward what people are telling me is they won’t be going back to paying with cash. They like the ease and options (i.e. Self Checkout) that paying with Debit and Credit offer.

For me going forward MasterCard and Visa should be good long term holds. I will continue with Amazon and Shop as they should continue to be good long term holds as more and more people switch to online shopping. I will likely do Canadian Tire and Home Depot as Swing Trades only.

Once again National Bank is outperforming so I’ll likely take a position there as well. As tempting as CCX is I think I’ll pass as for now the risk is too high re oil price and volatility . I will also be buying the rest of my Retirement Portfolio in the US ie MSCI and MSFT. In Canada I’m taking a more cautious tone as I believe Canada is in a very bad spot between a Massive Govt debt, ( look for a lot of new taxes to pay for everything). Large household debt people getting accustomed to being paid to stay at home are challenging problems.

I clearly have no idea on how this will all play out. I have my plan in place and I’m smart enough to know that not everything will work out according to my strategy e.g. Self Isolation Portfolio – Amazon, Shop and Netflix thank you very much ( as well as NG. Much appreciated ) however MasterCard disappointed. Oh well that’s why I’m still a Wannabe Trader I guess.

As always nothing more than my 2 cents and I hope it’s of value and interest .

Leave A Comment