Are you worried about the safety of your dividends? You are not alone.

As sales vanish due to the Coronavirus, even well-established companies are scrambling to preserve cash by cutting or suspending their dividends. Good companies, like CAE Inc (CAE), MTY Group (MTY), Boston Pizza (BPF.U), Keg Royalties (KEG.U), New Flyer (NFI), and Chemtrade Logistics (CHE.U).

Companies in the petroleum space, already under pressure from falling oil prices, have suffered mightily. Several have cut their dividends and capital spending. These include Vermilion Energy (VET), which has paid a monthly dividend to shareholders since 2003 and never reduced it until now, Crescent Point Energy (CPG), InterPipeline (IPL), and Secure Energy (SES), to name a few.

The cuts and uncertainty about dividends could not have come at a worse time. In recent years, a growing number of investors have turned to dividends for income, seeking higher yields and better net returns than fixed income instruments could deliver in our low-interest-rate environment.

In normal times, there is no worse black mark a company can receive than being forced to cut or suspend its dividend. It’s a sign of financial weakness. Today, I’m not as worried about dividend cuts in most sectors as I would be in regular times.

Investors understand the pressure businesses are under, and they know it won’t last forever. Instead, they see investment opportunities in dividend payers when prices are at rock bottom, such as they are now. Think about it. You can acquire shares in quality companies such as the banks at 20% to 30% discounts from where they were just six weeks ago. It will likely never be the same, but most dividend payers will return to a sound business once the virus is under control. But that doesn’t mean you can go out and buy just any stock at any time. Until then, if you hold dividend payers or plan to buy more, it is essential to know if the company has cut its dividend or not. Check with your broker, and, in VectorVest, you can place Dividends on your graph and track the payment record. Just know it takes a few days for our data provider to get any changes to us and into our system.

The world has changed, and we must adopt a new set of rules.

One strategy to consider is buying on Primary Wave Up Timing or Green Light Buyer when the MTI and BSR are near or below their historic lows, and then tighten stops and raise cash when the MTI and BSR are elevated once again. Stop-prices must be in place to cut losses early, and your new trading plan should include specific rules for when to take profits.

Also, you can manage risk by insisting on minimum levels of VectorVest’s key indicators. For example, I created the following bottom fishing search with crucial minimums. It finds dividend payers that have explosive price potential from market bottoms with the possibility of additional income from dividends. Here is the criteria and the logic behind it.

SORT is RS / RT

Stock DS – (Dividend Safety) >= 50

Stock DG – (Dividend Growth) > 12

Stock YSG – Yield, Safety and Growth > 1

The Sort is the ultimate bottom fishing Sort for beaten down, quality stocks. It brings to the top stocks that have at least fair Relative Safety scores. Relative Timing on the weak side of the equation ensures they are among the most flattened in price. Like a ball held underwater, these stocks tend to explode up when the market has pushed them down too far.

We may have to accept more dividend risk than usual when the market has collapsed, but not too much. Dividend Safety at 50 or higher on the 0-99 scale is required. I am sticking with a high Dividend Growth rate of 12% or better. Stocks with Dividend Growth this high still may not be able to increase their dividends during the worst of times, but they are less likely to cut them. Finally, YSG greater than one ensures a better than average combination of Dividend Yield, Safety and Growth, essential measures for dividend payers even when bottom fishing.

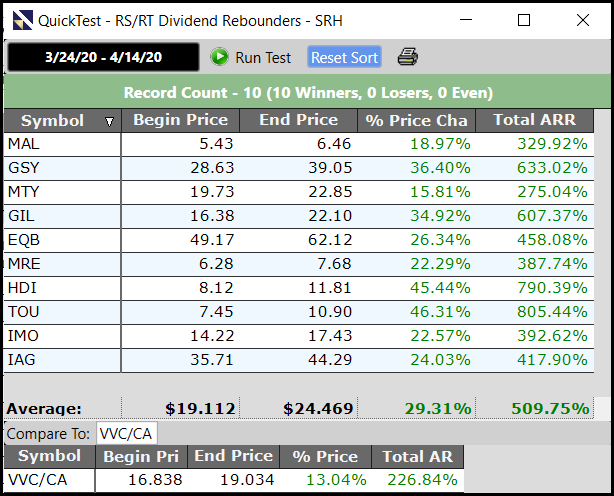

MY TEST RESULTS. A Quicktest of the top 10 stocks from March 24th to April 14th shows an average gain of 29.3% with no losers. Among the top gainers are Goeasy (GSY), Gildan Activewear (GIL), and even petroleum stocks Tourmaline Oil (TOU) and Imperial Oil (IMO). From a more recent pullback, April 3rd, the search delivered an average gain of 23.8% to April 14th. If we can consistently pull off profits even half this size two, three or four times a year, and have the discipline to sell when we should, we will outperform most investors and professional fund managers. I encourage you to do your own testing. I am sure you will agree, DIVIDENDS STILL MATTER.

Excellent, thanks for the Unisearch sort.