I am sure you have heard about the financial adage, sell in May and go away. It is based on the historical underperformance of the stock market during the summer/fall period between May and November. And while there can be pullbacks and even corrections during this period, there can also be mild to strong uptrends where it doesn’t pay to be sitting on the sidelines. When you have a service like VectorVest, rather than follow an adage that can be wrong almost as often as it is right, it pays instead to follow the Color Guard and our tried and true market timing signals. You can make money even in a mild uptrend such as we have seen since the beginning of May.

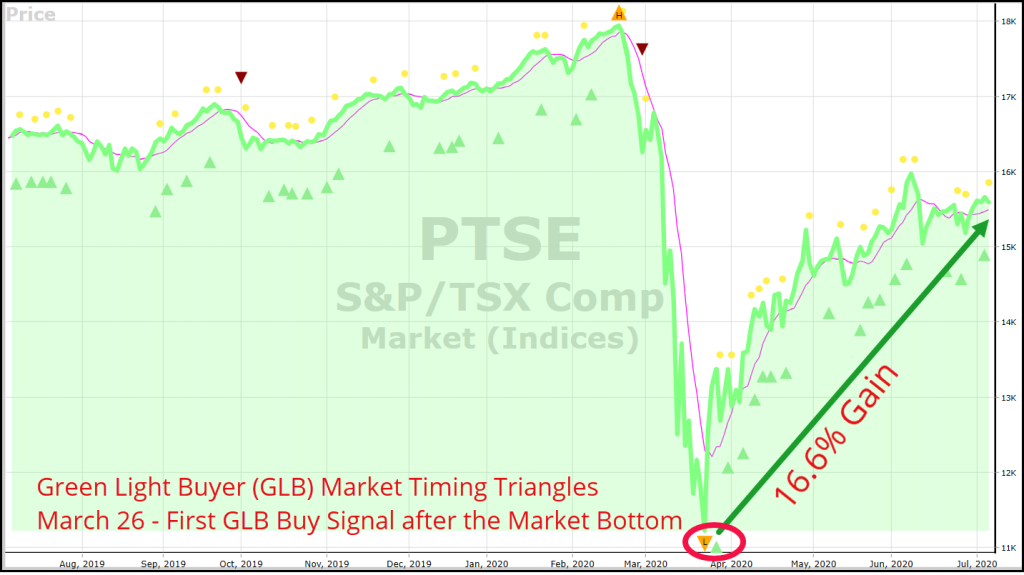

Now, consider the fantastic rebound we have enjoyed from the March 23rd market bottom. Most investors have recovered nicely, perhaps unexpectedly, from the February/March correction. After all, the TSX Composite rallied 24.0% from March 24th to July 7th. However, while the rebound rally continued into May and June, a Confirmed Up Call was even given on May 20th, momentum has slowed considerably. So, what to do now?

JOB #1 – PROTECT. PROTECT. PROTECT

When investors strategize and talk about building wealth, how to protect their money and avoid big losses is rarely part of the discussion. It is not as interesting or exciting as talking about the next big winner, but it is absolutely critical at any time, especially now in current market conditions.

The underlying issues that caused the February/March correction due to the COVID-19 virus – falling earnings, rising unemployment, and a weakening economy overall – have not changed. On top of that, September is historically the poorest performing month of the year. October is the cruellest. So, when you consider all that and given the market’s recent behaviour, it is a good time to think about protecting profits and the money you already have.

DEFENSIVE STRATEGIES

You can do it by following a few basic rules or strategies. First, the use of Stop-Prices is an excellent way to preserve your capital. VectorVest teaches that you should establish your Stop-Price or strategy even before you push the Buy button. VectorVest provides Stop-Prices on every stock based on the stock’s fundamentals and price trend. You can adjust a Stop-price higher if the market starts falling, but never adjust it lower.

If the market enters a downtrend evidenced by the DEW Down or Confirmed Down Call, you might consider tightening your Stops by using VectorVest’s “Weed Your Portfolio” method. The method is explained in Lesson 2 of the Successful Investing Quickstart Course on the Training Tab.

If you know options, you can consider buying Puts for insurance or just sell Covered Calls. They offer a buffer against losses by putting money into your account and lowering your cost base.

Second, do not buy any new positions unless the Color Guard and a preliminary market timing signal such as the Primary Wave or Green Light Buyer provide clear guidance that it is okay to buy stocks. Even then, considering the underlying issues that have put us in a Bear Market Scenario according to our Market Climate, not to mention that sell in May thing, it is best to “buy small.” In other words, open fewer positions, buy fewer shares than usual, use tighter Stops, and raise your Stops early and often if your stock moves immediately higher. Remember, the best and safest buying opportunities come during a rising market when the MTI is near or below 0.60 and the BSR is near or below 0.20. That is not where we are. Patience pays off.

Here is the reality. Most investors tend to focus on what stocks to buy and ignore the other critical part of the investing puzzle – knowing when to sell and how to protect their money. Don’t let that happen to you. PROTECT YOUR MONEY WITH THESE DEFENSIVE STRATEGIES.

Leave A Comment