Written by: Mike Simonato, Ontario Presenter: “My Three Friends”, Dec. 3, 2016, VectorVest International Online User Group (Click here to View: My Three Friends)

Next week kicks off earnings season on both sides of the border which will be very interesting and may move the markets. Bankruptcies continue both big companies and small businesses. I talked to some high-end clients this week and it’s the same story, people aren’t going back to work. An extremely high-Level client said the Legal Firm they use is going from 5 floors to 2, so 3 floors will be empty. This continues to suggest there will be a lot of commercial space sitting empty. The client also said they haven’t been to Toronto for at least 5 months and no sign of them going back. ED NOTE: This observation supports the view of analysts who say REITs could run into serious trouble going forward. The reason is they depend on rental income which is under serious pressure right now. Legal firms giving up office space and delivering services in other ways could be the tip of the iceberg. Now for the markets:

CANADA: MTI 1.63 BSR 2.05 Back to June 25th levels

PTSE: Squeeze going on. 200 SMA sloping down and acting as resistance. 3&8 and 20&79 MA’s sloping up and acting as support. Low volume Friday but that was expected. RT still falling

VENTURE: Still going straight up with big buying this week Remember you can add a line to your fav search that will return only Venture stocks

MKT TIMING: Price broke above the 200 SMA today BSR and MTI curled up this week. Consumer Confidence took a hit this week.

READ Friday’s Views (Stan continues to amaze), Strategy, Climate (Earnings indicator fell back into Bear territory this week)

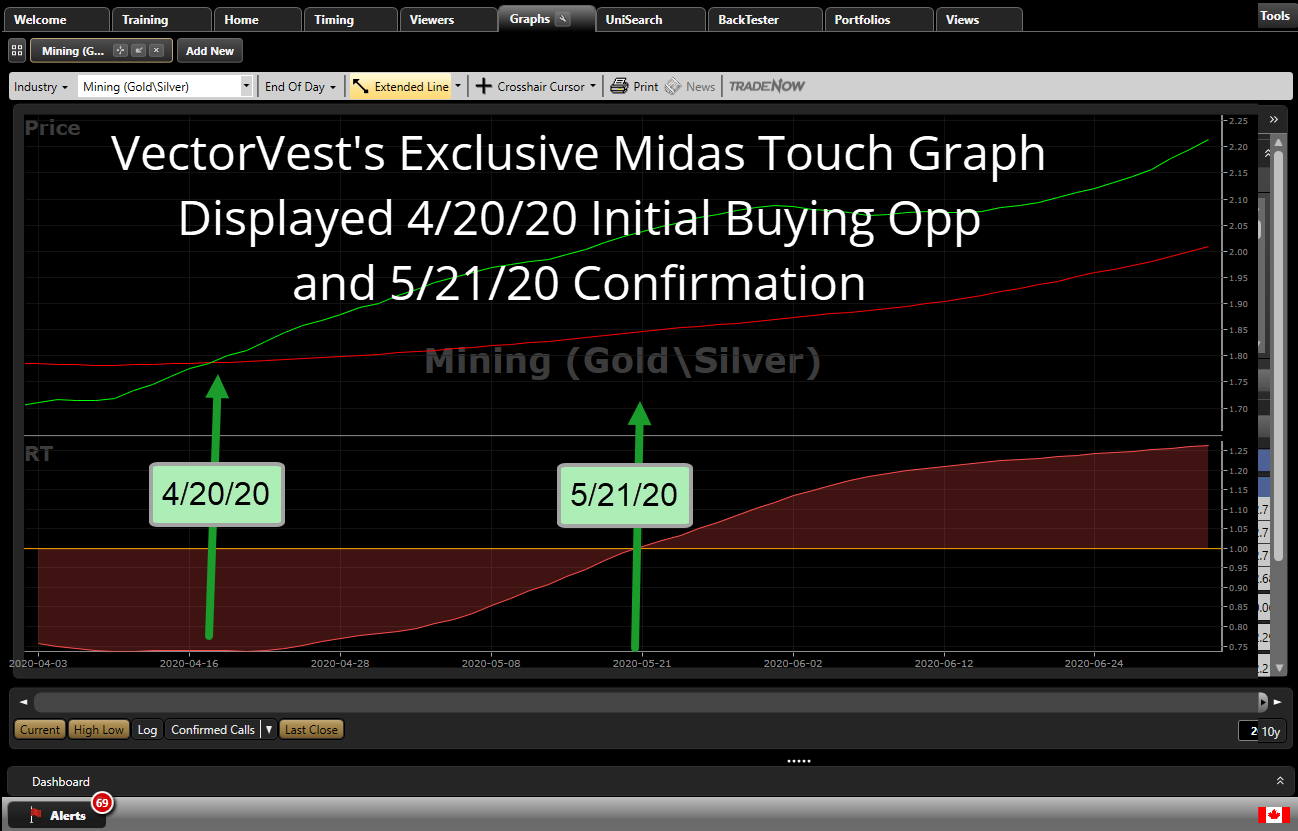

Strategy of the Week showed how to know when to buy and what to buy in the Gold Industry. It was quite good and has me already thinking about other ways to apply this. Anyway here is how you can apply it in Canada:

- Go to Graphs – Industry – Mining Gold/ Silver

- Go to Graph Layouts and select Midas Touch.

- Want the moving averages cross and RT rising (This happened April 18th)

- Look at the different ways to find Gold Stocks

- Go to the Industry Viewer. Go to Mining Gold/ Silver and double click Set date to Apr 20 and Quick Test Top 10 RESULT 20.08% MKT 10.61%

- Go to Viewers – TSX – Global Gold Index- Set date to Apr 20 Quick Test Top 10 RESULT 20.84% MKT 10.61%

- Go to Unisearch – Special searches – GOLD DIGGER – Set date to Apr 20 Quick Test Top 10 RESULT 56.92% MKT 10.61%

Makes it quite easy to know When to Buy and What to Buy ( Sounds familiar doesn’t it:)

Model Portfolios 1, 2 and 5 continue to do well.

USA MTI 1.62 BSR 2.86

DOW JONES: 200 SMA still acting as resistance, 7 touches since June 3

NASDAQ: Broke to new highs but RT is falling so watch QQQ near top of channel

S&P 500: 4 touches at resistance since June 17 RT falling so again a Bearish Divergence

MKT TIMING: Gapped up June 7 then gapped back down on heavy selling June 11 since then 4 touches at resistance BSR still falling but BSR and MTI starting to rise

READ Views, Strategy of the week, Strategy, Climate Earnings Indicator continues to fall

Nothing more than my 2 cents and I hope it’s of value and interest

Leave A Comment