Is it safe to buy stocks this long into the current uptrend? How can I avoid the risk of a big loss? As a VectorVest subscriber, you have the answers if you know where to look for them.

My essay of 1/10/20 about Five Trading Resolutions for 2020 was a good start, setting out tried and true principles for growing a retirement portfolio. Jim Penna, VectorVest’s Manager of Retirement Services, provided more detail in his timely Special Presentation Video last Friday titled, “Climbing the Wall of Worry”.

We believe the key to consistent success is buying quality, high RS, “Buy-rated” stocks and knowing when to buy and when not to buy, placing your priority on avoiding large losses.

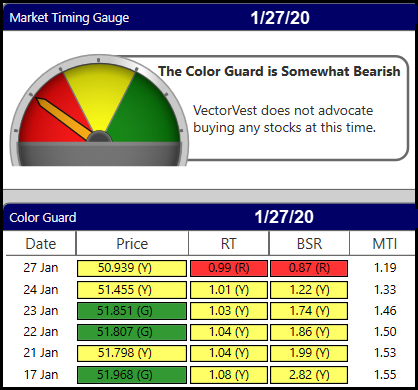

Understanding market direction is critical. VectorVest doesn’t try to predict where the market is going. Instead, we time the market by following its trend and using our exclusive indicators such as the Color Guard, MTI, BSR, RT and Derby strategies.

Here are the places Jim identified where you can go for guidance on the market.

- THE DAILY COLOR GUARD. It’s like a traffic light on the market. That’s why we put it front and centre on the Home Page. For details about the meaning of the colors and what action to take for each combination of lights and trends, go to the Views tab and open the Special Report titled, “Color Guard”. And listen to the Daily Color Guard Report in your US database.

- THE MARKET TIMING GRAPH. We use Timing Signals ranging from fastest (Primary Wave) to slowest, most conservative (Confirmed Calls). Historical benchmarks on the MTI give guidance about when it’s okay to be more aggressive and when it’s better to be more defensive. In both Canada and the US, when the MTI is near or below 0.60, the market is said to be near a bottom and it’s okay to buy aggressively when the market begins rising from there. On the defensive side, in Canada when the MTI is near or above 1.30, it’s still okay to buy when the Color Guard is Bullish and the market is rising, but it’s best to buy fewer shares and use tighter stops. A drop off or pullback could come at any time. Strictly adhere to your Stop-Losses. Your primary objective at this stage should be to protect the gains you’ve made during uptrend. In the US market, the benchmark is MTI near or above 1.50.

- THE DAILY VIEWS. Pay particular attention to the guidance for Prudent and Aggressive investors and the 1-day and 5-day Derby Winners. Are the winning strategies bullish or bearish?

- THE FRIDAY VIEWS. Read the Views or even better, listen to a senior instructor present the Timing the Market video. I can’t emphasize enough how important this is. If you do nothing else, never miss reading the STRATEGY SECTION. To me, it provides the most important guidance for the week ahead that you will find anywhere. Take last Friday, January 17th, in the US Strategy section you would have read: “All of our other key indicators, the BSR, RT and MTI, also moved higher when compared to their levels last week. However, the BSR closed lower today while the Price of the VVC moved higher, the MTI is above its historically overbought level of 1.50 and three of our 1-Day Derby Winners were Bearish today. THESE ARE NOT GOOD SIGNS.” That guidance would have given you a defensive mindset and helped you prepare for what happened Tuesday, January 21st – a 152-point decline on the DOW and an ominous 0.80-point decline in VectorVest’s BSR. After a one-day reprieve Wednesday, the overall market has continued to fall. The Canadian Strategy section provides the same insights and guidance for the Canadian market.

- THE MARKET CLIMATE. This section with its data table lets you know if the market is Bullish or Bearish and the reasons why. Earnings drive the market, and the Market Climate Graph shows you if earnings are rising or falling as well as the momentum behind the trend.

So, is it safe to buy stocks in the current uptrend? Yes, if you follow VectorVest’s guidance when we’re CLIMBING THE WALL OF WORRY.

P.S. Saturday, February 1 – International Online User Group Forum. Thematic ETFs are still relatively new. New themes are constantly being developed, offering investors flexibility and better choices. To better understand the risks and rewards, please join us for our Saturday, February 1st International Online User Group Forum. Ed Subak of the The Villages User Group, Florida will deliver our keynote presentation titled, “Thematic Investing – Finding More Opportunities.”

Click here to register: http://news.vectorvest.com/CA_VectorVestForums_020120_registrationR.html

Where do I find the market climate section.

Hi Ed……It’s in the Friday Views section. You can use the drop down menu or just scroll down to that section. Thanks.