We had an unusual situation yesterday when the top 10 strategies in the Derby were all bullish, even as the TSX fell more than 180 points shortly after the open. The strategies were all from the BOTTOM FISHING folder in UniSearch. Which stocks do you think might qualify best for bottom fishing right now? You guessed it, the majority of stocks in each bottom fishing strategy were energy and petroleum stocks.

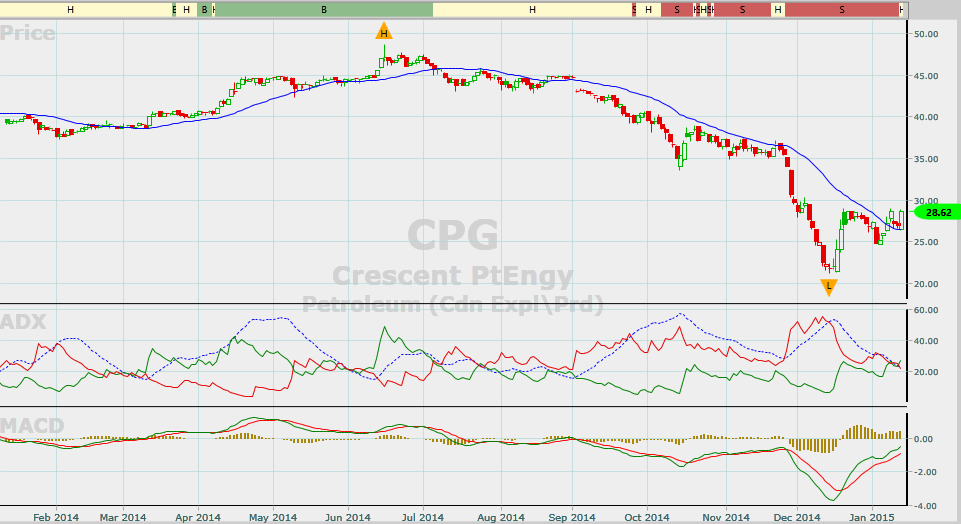

Have crude, energy and petroleum stocks bottomed? We still need to be cautious, but some quality stocks are starting to move up. Look at the chart of Crescent Point set out below. In yesterday’s Colour Guard video I explain a little bit about what might be happening and the overall market in yesterday’s Canada Colour Guard report and video. The video was posted yesterday to our VectorVest Canada Investment Blog.

What’s Up With Gold? I continue to be bullish on the gold/silver industry group while the average price of the group remains above its 40-DMA on its industry graph. Gold Digger stocks as an average up more than 15% since the industry group priced crossed the moving average. The rally pulled back the last two days as the industry came up against a resistance line. You can see from the graph that there is support immediately below the current price, so I think we’ll take another run at the overhead resistance and perhaps break through this time. The ADX is gaining strength despite two down days and the MACD is still in positive although the histogram is starting to slope down. We’ll have to wait and see. Gold futures are up sharply so far this morning.

DIVIDEND STOCKS. You’ll also find a video link on the BLOG to Tuesday’s Questrade/VectorVest presentation titled, How To Find Canada’s Top Dividend Stocks. The video reminds us to buy top quality stocks that rise over time, so that we don’t have to worry quite so much about short term downtrends. In the video I show you how you can modify a Conservative search to achieve outstanding long term results, not every year, but over the long term if you’re patient.

Here for your convenience is the link to that video: https://attendee.gotowebinar.com/recording/8095045871674233602

Thanks everyone, and have a great trading day.

VectorVest Canada

January 15, 2015

Hi Stan,

Do you use the same type of system to play energy as you do with gold ? – meaning that you would want to see the energy industry stocks rising above their 40 Day Moving Average and having at least the ADX and MACD to confirm that move before buying any of them ?

Cheers and Thanks !

Barry

Hi Barry, I prefer the industry group to pull above its 40-day MA, the 40-MA moving up or at least flattening and the ADX turning positive. That said, it’s hard to be patient when some of my favourite energy plays are moving up and showing signs of life. I think we still have to be cautious and selective. Lot’s of volatility ahead.

Has anyone started trickling back into oil stocks? What are your favourites? Thanks.

I have bought PRE, LEG and PHX.

They were all beaten down pretty bad.

The price of oil seems to be falling this morning as fast as it went up yesterday – apparently due to “short covering’

Now – Gold: Gold Equities as measured by the Mining (Gold / Silver) industry broke through its 40 Day MA on December 31 – if you had purchased the Top 10 Gold Digger stocks the next morning and held through this morning – you would be up 20.93 % (Quicktest) as compared to the VVC/CA being down 2.39 % – Fantastic

but

If instead you purchased HGU – you would be up 35.84 % – this is why I love Leveraged ETFs – because if you get them right – you make great money and only have to deal with one entity and never have to even consider the fundamentals

Yep. The caution light is still on.