by Don Fanstone, Kitchener/Waterloo User Group Member

January 14, 2014

Editor’s Note: In the spirit of sharing investment ideas for the benefit of our VectorVest community, Don Fanstone has agreed to provide a regular article for our Blog in the Options Category. Don is an experienced investor and successful options trader. He makes regular presentations to the Kitchener/Waterloo User Group. Don will provide weekly or bi-weekly updates on past trades and new trades. Frequency will depend on market conditions so be sure to check the Blog regularly. Trades will be on Canadian stocks unless otherwise noted.

On Jan. 8th, Bought May 38 Call Options on CGI Group, (GIB.A) selling at $7.45.Each Call Option purchased represents a cost of $745.00 as this controls 100 shares of stock.

This was purchased due to the positive technicals as well as VV showing a new DEW signal on Jan. 8th. GIB.A Price above 30 DMA, DPO, ADX, STO all Positive. MACD slightly Negative, a slow indicator.

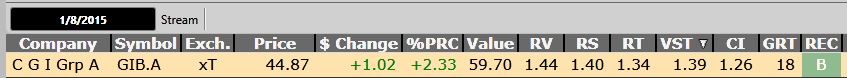

VectorVest Indicators shown above at 1/8/2015: RV 1.44, RS 1.40, RT 1.34, VST 1.39, CI 1.26, GRT 18.

VectorVest Indicators shown above at 1/8/2015: RV 1.44, RS 1.40, RT 1.34, VST 1.39, CI 1.26, GRT 18.

The research used for fundamentals has a price target of $53.00 while VV has a value of $59.00. Stock selling at $44.87. CGI has signed several new customers of late, this can be seen under the VV News.

Sell signals employed are the Price falling below the 30 DMA and/or the DPO turning negative.

DISCLAIMER: Options trading involves risk and is not suitable for everyone. The information contained in this Blog is for education and information purposes only. Example trades should not be considered as recommendations. Options training is strongly recommended before placing any trades. VectorVest offers a basic options course online and occasional intermediate options workshops in Canada each year.

I am of the opinion that we have passed the lows on the price of oil. Companies have reduced their capital budget outlays, and the best of the biggies are turning the corner. (SU and CNQ) Buying quality companies low is an opportunity at this time.. Holding options 4 to 6 months out on CNQ, VET, IPL and ENB.

Don

Thanks again Don for sharing your trading ideas and knowledge of the options world. Much appreciated.

This is goIng to be a great Service.Thank you Don for sharing your wisdom with us.

Thanks for this Don.

Questions…

1. The colour guard on 8 Jan was really very poor…yellows in price, RT and BSR. Also a dn / dn day in a C/Dn…not too sure why you went long? Any comment? Yes the basics (VST, RT, RS, RV etc) in CGI look very good…that I understand.

2. Where did you get (compute) a target price of $53….and when would you see that target coming to fruition?

3. time for closing the option…would you DPO setting be 20 days?

.And the sell point would be BOTH the 30 DMA and DPO going negative…or either ONE or the other?

4. Do you always go for a 6 month expiration on your long calls and puts?

5. Do you have any rules of thumb for where the strike prices might be?

Appreciate your blog….keep up the good work…..we all win from your input.

Robin.

HI Robin:

I chose Jan. 8th mainly due to my BUY signals being positive. You are correct, the color guard did not recommend buying stocks this day, for me, it was a personal choice based on signals and fundamental information.

The price of $53 comes from RBC research, while VV values the stock at $59.51 on Jan. 8th.

I have learned (the hard way) not to be Greedy. A bird in the hand is worth two in the bush.

If I have a 25% profit, I frequently take the profit. Small profits add up. There is nothing worse than seeing your option being “way up” and for no good reason, open down the next day.

Too many times I have had remorse in such a situation. Alternately, taking profits often leaves money on the table. That’s a part of trading.

Yes, I always endeavour to buy options with 6 months to expiry, need to give the stock time to work to a higher price.

I use the VV option analyser to determine the options that have a delta of .80 or greater. Options with a delta of .80 will usually go up $$.80 for each $1.00 the stock appreciates.

Hope this helps you.

Don

Thanks Don…yes this is s great help…bought the Op Anal when I was at the Toronto VV love in late last year…and still playing with it….a bit of a newbie still, but last time I attempted Options, I did not have the advantage of VV, timing, direction, etc. etc. Also I am following your blogs, and trying to learn from them . ( so….keep them coming)

Nothing wrong taking a 25% profit…that in a year is really quite good, even great…however in a 11 day period….Amazing! Well done! And Tks again!.

Robin.