By Michael Wuetherick, P.Eng. User Group Leader: Red Deer Alberta Jan.11, 2015

Energy Sector Update – Are you trying to pick a bottom, here are some insider tips?

The price of crude oil, and the price of stocks focused on the energy sector, has continued to fall since my last Blog post on November 17th. Since that time, the OPEC ministers (i.e. Saudi Arabia) have repeatedly stated their intentions to regain market share. But how can you find out when the war might end?

Members of the Red Deer, Alberta VectorVest users group recently learned how to access up to date drilling and production reports from the US Government Energy Information Administration (EIA) webpage. The EIA publishes monthly regional drilling productivity reports for each of the major US shale plays. These reports outline the number of current rigs drilling, and equally important the productivity estimate from these new wells. The rig data for each major play can be accessed as follows:

| Shale Play | EIA webpage link |

| Permian | http://www.eia.gov/petroleum/drilling/pdf/permian.pdf |

| Bakken | http://www.eia.gov/petroleum/drilling/pdf/bakken.pdf |

| Eagle Ford | http://www.eia.gov/petroleum/drilling/pdf/eagleford.pdf |

| Niobrara | http://www.eia.gov/petroleum/drilling/pdf/niobrara.pdf |

As you can see, new-well productivity continues to increase as completion techniques are improved. Therefore it will take a much deeper drop in rig counts to truly see an impact on weekly production totals. You can again refer to the weekly crude production report available from the EIA which can be found at:

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WCRFPUS2&f=W

US production has risen to all-time record high of 9.132 million barrels for the week ended January 2, 2015 up from 9.077 million barrels at the time of the OPEC announcement. Until this upwards trend reverses, we will not have a true bottom in the crude markets.

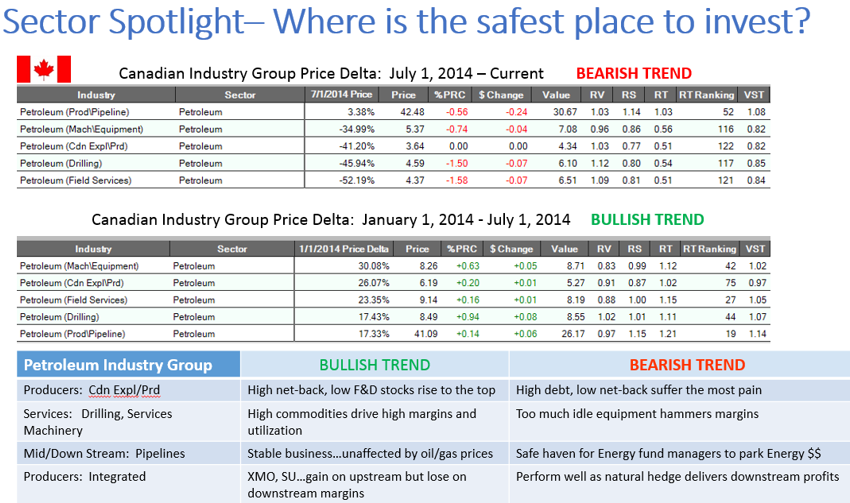

If you are like most Canadians you either already own energy stocks or can’t seem to avoid wanting to call the bottom. But if you must own energy stocks, how can VectorVest help you find the best sector to be in and when. Using the Delta search on price, I prepared the following summary of the best and worst performing industries in the Petroleum sector from July 1, 2014 to current.

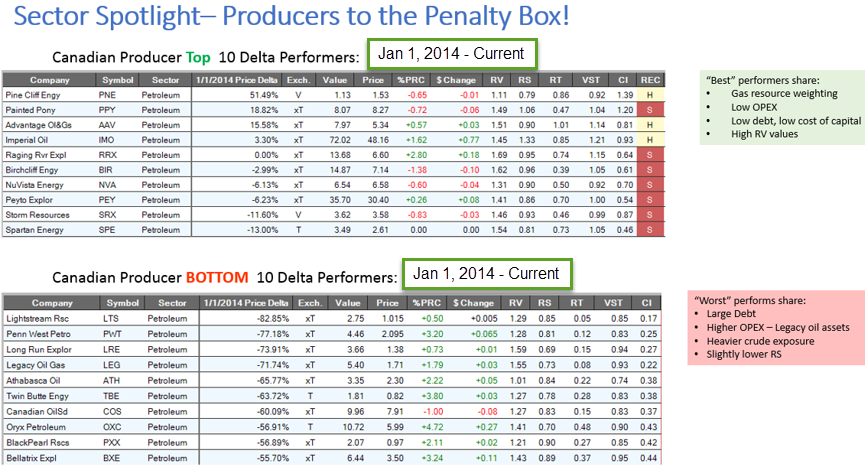

Lastly, you might be surprised to see that some Exploration companies have drastically outperformed their peers. Using the Delta sort again on the best and the worst producers since July 1, 2014 produces the following list.

The oil industry is a fast-paced, complex world but that doesn’t mean that you can’t effectively trade this important sector for short-term gains or longer term dividend investments. By combining the tools of VectorVest, and some sound fundamental research you have all of the tools the pros have!

May the trend by with you….

YOUR COMMENTS PLEASE: Are you buying petroleum stocks yet?

What stocks are in your Watchlist?

Michael Wuetherick, P.Eng. Red Deer User Group Leader, VectorVest Canada January 15, 2015

Hello Michael,

Thank you for all of this information and putting this all together for all of us. I am doing some short term plays and holding them with tight stops. that is all I am doing with this sector at this time.

Petra Hess

Hello Petra, anytime a stock/industry is trading well below its 40 day SMA is a time for caution. I have been playing the energy space mostly with Bear Put spreads as the price action of the stocks continues to follow the downward trajectory in oil prices. A recurring pattern is oil stocks going up despite oil falling, only to be crushed again after a sizeable move upwards.

The blog piece is a snapshot of the information we reviewed in the Red Deer user group meeting. In the full presentation I provided an overview of the major North American shale plays, drilling and production statistics that are driving the oil rout, and how to determine if weather patterns will drive natural gas prices.

If anyone would be interested in seeing the full presentation slides, I would be happy to email it too you. Simply send me an email at [email protected] and I will get it to you!

I bought the Energy Bear ETF “HED”. I simply don’t understand how energy companies can produce stable or increasing earnings in this environment.

HED and HOD have been useful contra ETF’s for hedging if you own energy stocks or simply to profit. Both are leveraged, so they can move quickly up and down and we’re starting to see some volatility in their pricing.

Thanks for sharing your work on energy. I have been following 2 stocks trying to decide at what point to take the plunge. Like so many I am following Raging River from the perspective it has a very high drilling success rate, apparent excellent management team and good financials and also looking at the potential price gain given its current levels. So see this as a potential growth opportunity.The other is Whitecap Resources, again with a good record, strong management team, and if I remember correctly a barrel cost in the mid to high $50,s., which would put it at the lower end of the herd. I am following this one given the dividend of 5+% and the growth potential.

Any thoughts?

Hi Bob, Raging River is one I’ve followed closely and written about previously for all the reasons you’ve mentioned, plus its BUY/HOLD REC from VectorVest almost steadily from its price of $2.65 Oct 2012 until July 2014 when it finally slipped to a sell at $9.45. Both RRX and WCP have been prudent in their revised capital spending plans while still cutting less than most. WCP said in December it can maintain the current dividend at least for now. I have both stocks in my Radar Watchlist for when the industry shows signs of bottoming. The dividend of WCP makes is especially tempting, but best to be patient for now I believe. Would be great to hear from others who follow this industry group.

Bob, you have certainly picked two of the best in the junior energy space for possible buys. Raging River as you may recall recently completed an equity issue which further improves their balance sheet, and most importantly gives them some significant capacity to complete some timely acquisitions when others are struggling to stay alive. Another recent equity deal saw ARC Resources raise over $300, again with the likelihood of possible acquisitions in the pipeline.

Whitecap is another extremely well run company with Grant Fagerheim at the helm. The company is well hedged, has a decent balance sheet and can maintain growth at a drastically reduced capital budget. However, it is my belief that we will continue to see lots of these little rebounds only to be followed by a further down leg on oil prices, and the stocks as well. Therefore even the strong dividend payers may continue to struggle with total payout ratios. If you are a long term investor however, picking up a strong dividend potential company like WCP can be a great play for bottom-fishing.

In my blog piece I encouraged everyone to start watching the total US horizontal rig count, specifically in the four plays listed in the links. Of particular interest today, was the weekly release of the Baker-Hughes rig count which showed a material 15% reduction in operating rig count in the US since the OPEC announcements in November. The rigs simply must stop drilling in the US basins in order for crude to find a firm footing. Watch for the impact of US shale production to lag the falling rig count by at least 4-6 months.

We are quickly approaching the season for an enhanced focus on M&A discussions in the Calgary energy patch as the year-end reserve reports and the subsequent impact on company’s bank credit facilities will be starting to hit the CEO’s desks right now. Those that have some problems will be looking to sell before having to publish all of the results. The acquirers will be companies like RRX, WCP, CPG, CNQ where as the targets will be the smaller-cap high debt companies like, LTS, LEG, PWT etc. how will be forced to sell the company or key assets.

I have been selling Bear Put Spreads on the high-leverage companies every time the sector does one of these little rebounds. You can pick up a considerable gain in a very short period of time with the very high probability in the sector right now. The spreads let me collect some premium to benefit from the high volatility while still getting some decent returns.

Good luck to all!!