– submitted Jan 16 by Don Fanstone, Member of the Kitchener/Waterloo User Group

PUT options are used for several reasons.

Puts allow you to profit from a falling stock price. This is a safer and easier way to profit from a falling stock as opposed to selling short.

A second reason is to BUY Insurance against a current holding. Buying PUTS will limit losses on either an individual stock or a complete portfolio.

The third reason is to earn income and possibly BUY good stocks cheaply.

With the current decline in many good energy companies and others such as Magna who have fallen with the market, selling naked PUTS can provide income and possibly allow one to purchase good companies at a reduced price.

Ideally, this would be done when the stock price and/or the MTI starts to rise. A DEW signal was received on Friday January 16th.

If the market continues to move up in the days ahead, selling naked PUTS on stocks you want to purchase is a trade that will reward you in one of two ways.

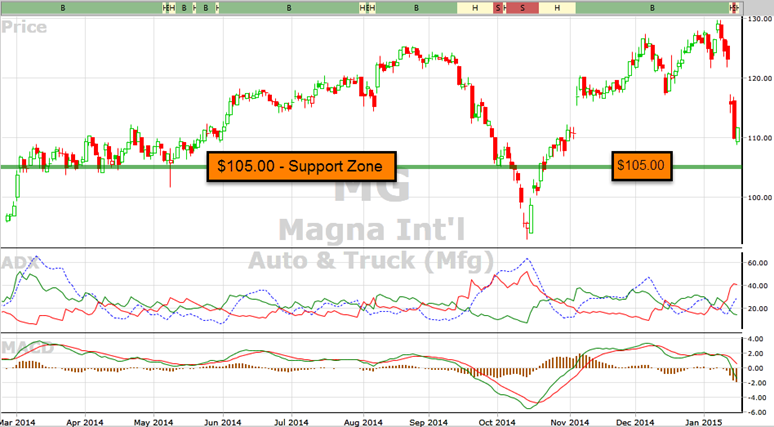

For example, Magna has fallen from $126.00 to $111.62 based on a recent earnings report and forecast. If you believe that Magna will rebound, Sell a Magna February 105 PUT for income of about $1.80 per share or $180 per contract, (or a Magna $110.00 for about $3.40 income per share).

If the stock falls below $105 by Feb. 20th, 2015, you will be obliged to BUY the shares. Likely a good price and you will be buying them at $105 – $1.80 or $103.20 per share.

If the stock does not fall below $105 by Feb. 20th, you get to keep the premium received.

Selling naked PUTS requires you to have the value of stock in your account if you are “PUT TO”, which means you are required to buy the stock.

Editor’s Note: If you are using VectorVest’s Options Analyzer to set-up and study the Magna trade illustration above, the trade is called, Bullish Short Put. For a free, two-week trial of the Options Analyzer, please call Support at 1-888-658-7638.

DISCLAIMER: Options trading involves risk and is not suitable for everyone. The information contained in this Blog is for education and information purposes only. Example trades should not be considered as recommendations. Options training is strongly recommended before placing any trades. VectorVest offers a basic options course online and occasional intermediate options workshops in Canada each year.

Hello Don. Thanks for joining the VV Blog. I have completed the VV Beginners Option course and I am reading everything I can get my hands on as well as YouTube stuff. I hope to buy my first Long Call next week. Although Options initially appear complex and intimidating, I am ready to take the plunge. Its an exiting alternative to straight equity trading.

Thanks for the above blog entry on selling Puts. It is refreshing to know that you are sharing your trades and knowledge to us Rookies and I look forward to your future entries. “Keep those cards and letters coming in.”

Thanks.

Warren Gilbert ([email protected])

Hello Warren:

Thanks for your comments regarding the option posts. If you’re going to make an option trade and want a second opinion, I would be glad to share my experience with you.

The market tends to do things we don’t expect, such as the Bank of Canada’s action today. Everyone was caught off guard. For the most part, it was a happy outcome for many.

Don

Hi Warren

I am offering these comments because of my past experiences and your comment on “Buying Calls”

Before you do put real money into play – Please take the time to read Lea Lowell’s Book ( also recommended by VectorVest) This book explains the differences between Buying and Selling Options There is a Very Important difference Also you should understand the importance of “Time Decay” before you trade with real money Time decay works in the favor of Option Sellers and against Option Buyers -I learned the Hard Way and believe me Selling Covered Calls (never naked Calls) and selling Naked Puts is by far a better way to go. Finally it is absolutely Vital to be sure you have identified Market Direction “before you place a Option Trade” Go to Views and type in (1) Covered calls and review some of the STOW — and (2) also type in Thelma Dr. D tells you about a woman named Thelma who only sold Naked Puts hope this helps

Hello Bob and thanks for your reply and advice. Looks like I have some more reading to do before I start trading. Also I am attempting to get my head around the new language encountered in the Options world. Sometimes what I read becomes overwhelming and confusing but I will perform my due diligence carefully and methodically until I feel comfortable. We all have to start somewhere on the ladder of learning and it looks like I am still on the ground. 🙂 Besides, I have not allocated a large sum of money in my broker’s account for Options trading. That way I will be less remorseful if I take a hit in the beginning. Nevertheless, Bob thanks again and I look forward to your future participation with the VV Blog. Bye the way, I think we are all better off with VV in our pockets to help guide us through the jungle.

Warren G.

Hi Rober,

I can’t find the article on Thelma. I put it in the search in Views but it did not come up. Could you be more specific.

Thanks

Gerry

Hi Gerry, In the US Views, if you type Thelma into the US search bar you will get two essays.

Hi Robert,

Sorry for the trouble. I still can’t find it. I get ‘no results found’

Gerry

The dates of the two essays are: 5/30/1997 and 8/10/2012. I’ll send you by email a screenshot of the search in the US Views that delivers the two dates when you search on Thelma.

Thanks Stan for doing the Thelma search for the 2 essays Bob recommended I read. . Appreciate it.

Warren G.

You’re welcome Warren. Thanks for your comments on the Blog.

This strategy must be done in a margin account here in Canada. We cannot sell naked options in any of our registered accounts (TFSA and RRSP). It is a good strategy for income in a uptrend but as the article says YOU MUST HAVE THE CASH TO BUY THE STOCK if put to you. So if you sell 10 contracts make sure you have money to buy 1000 shares of stock.

In Canada this strategy can only be done in a margin account, we cannot sell naked options in any of our registered accounts. It is a very good strategy for income while the stock is in an uptrend. If you do play it in conditions like we have now, as the article states, be prepared to get put the stock. So if you sell 10 contracts have the cash to buy 1000 shares. You can be put the stock at any time during the life of the option, not just at expiration. If the stock plummets way below your strike the owner can sell it to you at that strike to save him self some losses and your stuck with buying a stock at a higher price than what it is trading at. I have been exercised early on covered calls so it can happen. If you feel uneasy about the direction of the stock, or the market, and some time decay has passed you can buy the option back at a lower price than you sold it for and keep the difference. To see how much your option will decay per day just look at the theta column. The closer to expiry you get the cheaper it will be to buy the option back. You can make money and not even have to own the stock.

Useful comments Kevin. Thank you. Generally I will trade fewer contracts with this strategy to reduce risk. For me, that’s from 2 to 5. Also, just to clarify, you can make money on this trade if the stock goes sideways, if it goes up, and even if it goes down slightly to around your strike price. Despite your best analysis, there is always a risk the stock will fall below your strike price, that’s why you should only make this trade on a stock you wouldn’t mind owning if you could buy it cheaper than it is today.

Yes agreed Stan, this is a very useful income generating strategy on stocks that you like. Theta decay is your friend here because you get paid to wait. If the stock does not get put to you you still get to enjoy the profit from the trade and do it all over again for the next month.