Written By: Mike Simonato

Presenter: “My Three Friends”, Dec. 3, 2016, VectorVest International Online User Group

(Click here to View: My Three Friends)

MKTS USA Price by and large is holding the 3 EMA with the pullback Friday.

READ Views and Strategy.

MKTS CANADA:

PTSE and MKT Timing both closed around the 3 EMA.

VENTURE Holding the 200 SMA and the 200 SMA is flattening out.

READ Views and Strategy.

What I’m watching and my strategy:

- Watching CONCERNS:

Stocks and Bonds are both booming (Not Normal) (USA).

Bond Yield curve is still ok but flirts with Inversion.

Canada continues to have a Negative Yield Curve.

Price Action getting crazy and makes no sense ie Tesla.

I’m having another banner year and I’m not that good so I have learned in the past that when I get giddy and feel really smart the market is about to tank.

Strategies:

As explained before I trade by Price action not stops. however My Favourite Strategy I will be using in the Future is the one Stan taught. In a C/DN or if worried, SELL LOSING POSITIONS and CHANGE STOP to RT<1.

Re Stan’s VIEWS Friday, February 7: I had planned on a 65 retirement but nobody to buy the business yet. My plan going forward is to work on correcting my mistakes and getting a lot better at trading so between cash and investments I should be more than comfortable in Retirement.

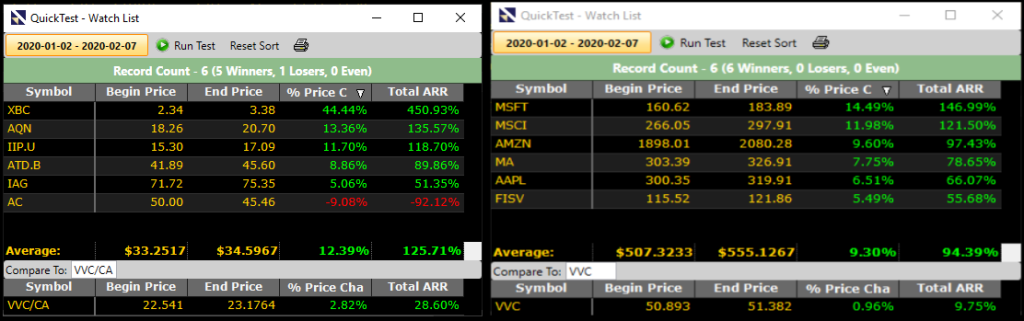

As Promised, I was going to expose all my Screw Ups. As you can see by the attachments both my US and CDN trades are kicking the market’s butt. NOTE I do not own KL or GIB.A but will in the near future. Now to the Screw Up. I usually trade the 3 &8 & 20, but AC had fallen back to the 200-sma and when I saw it taking off the 200-SMA again, I thought—good company, forget my strategy and get in early for big profits. Well of course not long after I bought it started to fall again. Sold for a $400 loss. ( I never allow a greater than $500 loss) on any trade so I never get hurt. I will continue to watch but I will only trade when my Strategy tells me to. If only I had listened to and applied Margaret Bell’s wisdom I would have saved $400) (International Online User Group Forum Presentation – March 3, 2018: Click here to view replay of Margaret’s presentation about the Finger-Four Formation Trading Plan, CLICK HERE).

As always nothing more than my 2 cents and I hope it’s of interest and value.

Leave A Comment