Last week a subscriber emailed, “What does the term retirement mean with VectorVest? Does it mean you are already retired and living on the income and buying mostly REITs or high dividend paying stocks similar to the positions held in the Canadian model Retirement portfolio?”

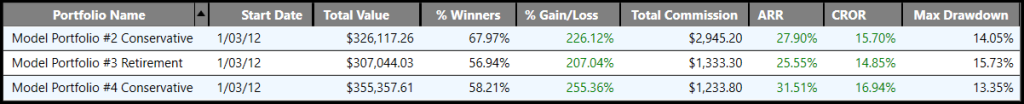

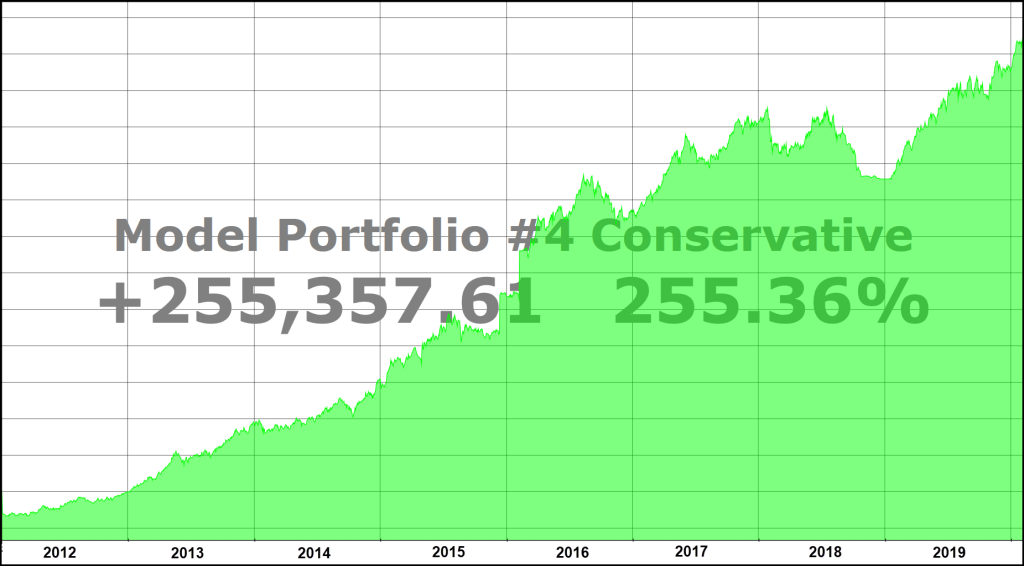

Well, no matter how you define retirement, you could do a lot worse than simply following the Retirement Model Portfolio. Or one of our two Conservative Model Portfolios for that matter. After all, over seven-plus years, #4 Conservative has a 31.5% ARR, Annualized Rate of Return; #2 Conservative 27.9% and #3 Retirement 25.6% and a high Dividend Growth rate. These returns do not even include the dividends which would be substantial through the magic of compounding.

Clearly, retirement in the context of investing means different things to different people. Financial advisors say, “How you invest depends on your stage of life.” But does it really? VectorVest believes the secret to a successful retirement is to learn how to make money in the stock market, make as much money as you can as safely as you can, and just keep doing it.

In his classic investment book, “Stocks, Strategies and Common Sense”, our Founder, Dr. Bart DiLiddo, dispels a persistent myth. That is, “Young people can afford to take high risk.” He says of all the myths in the market, this may be the cruelest and most foolish. “If any group needed to watch every penny, it’s the young. They need money to start a family, buy a house, buy furniture, save for the future and on and on. Furthermore, young people usually are at the low end of the earnings scale. They have precious little disposable income.”

He goes on to say, “Young people have an invaluable asset on their side, however: Time. They don’t need to take risk. They can invest in tried and true companies that make money year-in and year-out. At a growth rate of 10% per year, their investments will double every seven years. By the time their baby is off to college, that initial safe investment has increased by a factor of eight. When you have time, you can afford patience. Patience pays off in the market.”

It’s true when you are younger, you generally have less money to invest. But that shouldn’t stop you from investing, making regular contributions to the extent you can in your RRSP and TFSA, focusing on high Relative Safety, RS companies with consistent and predictable earnings. Our VectorVest retirement courses show you how to find the types of stocks you should consider investing in, including DRIPs, where you can make regular small monthly or quarterly contributions. Dividends are reinvested on your behalf with no commissions, allowing the power of compounding to grow your wealth. Over time, those investments will set you up for a successful retirement.

During your peak earning years, conventional wisdom, including the Government of Canada in one of its financial literacy publications, says that if your goal is to make as much money as you can to secure your retirement, you must be ready to take some risks. Spoiler alert, conventional wisdom and the Government of Canada is wrong.

Dr. DiLiddo and Jim Penna, VectorVest Manager of Retirement Services, advocate we should continue to focus on what VectorVest calls “Worry-Free Investing”, a philosophy on which the above-mentioned model portfolios ascribe. You can read all about it in our “Guide To Worry-Free Investing”, found in the VIEWS tab under “Special Reports”. The guide explains how to minimize downside risk with proper buy rules, diversification, and well-defined sell rules.

By the way, the subscriber who asked the question that was the genesis for this essay also noted he is not retired yet, maybe 9-10 years away. He typically looks for growth. He wrote, “In any case, after taking the original VV successful investor course, I realized I am a prudent investor.” Then, he says, he took the retirement course with me last year, and he is a bit confused. You see, after the course he had great success buying from the Master Retirement Watchlist, beating the index by nearly 2.5%. “Prior to last year I would not think this would be possible with ‘Retirement Stocks’.” Thus, his confusion about INVESTING AND RETIREMENT.

Leave A Comment