Written by: Mike Simonato, Ontario Presenter: “My Three Friends”, Dec. 3, 2016, VectorVest International Online User Group (Click here to View: My Three Friends)

Well another interesting week both in the news and in the markets. When you look at the graphs you’ll see why I like the 79 SMA so much. Many of the graphs either held the 79 SMA and bounced or pulled a little below the 79 SMA and bounced. I find it to be a very good buy point a lot of times as well of course the 200 SMA but I find pullbacks to the 79 SMA far more often than the 200 SMA thus my using it more. Now for the markets:

USA:

DOW JONES: 8 EMA & 20 & 50 EMA all Very Close Price closed below the lowest MA (8) Stochastics Bullish but RT Staying below 1.10

NASDAQ: Closed just above 8 EMA 3&8 EMA above 20 SMA Both Dow and Nasdaq bounced off the 79 SMA

S&P 500: Closed right at the 8 EMA & 20 SMA Trading in a wide channel for Sept and now falling from the top of the channel

MKT TIMING: After falling below the 79 SMA briefly now back in the middle of a channel. RT below 1 Stochastics Bullish

READ Strategy section in the Views.

CANADA:

PTSE: Held the 79 SMA this week 3 EMA crossing 8 & 20 and right at the downtrend line so a key level to watch and see what next week brings

VENTURE: Been in a channel since first of Aug Brokedown to 79 SMA but now back in the lower end of the channel

MKT TIMING: Fell back to the 79 SMA and recently rising. 3 above the 8 and above the 20 but stalled the last 3 days BSR and MTI Rising RT still above 1

How does Stan keep doing it week after week) I have a lot of homework when the business shuts down and STRATEGY

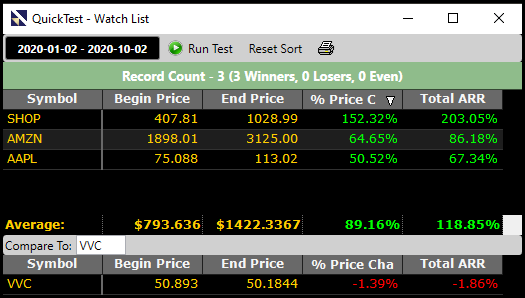

I’ve been a Buy and Hold Guy for a long time. Throughout it all I’ve been told how crazy that strategy is and that I’m Stupid for doing it. Could I have done better having a system to sell at certain points and the buy again on a Buy signal? The truth is yes I would have done better. However, in my busy season I work 7 days a week and I’m so exhausted all I do is Sleep and Work and have no time or energy to look at charts. So My Strategy was to Buy companies that I felt were Well Run Rock Solid companies that should do well under most conditions and should continue to grow. As I have mentioned numerous times I have owned Apple and Amazon the longest. I have consistently highlighted Shopify. Recently I have shown that the Pros have been selling the high flyers to book profits and raise capital for what’s coming. So how has my strategy worked this year? Note this has been a real test of any Strategy. See attachments re Jan 2 to Oct 2 results and this factors in the recent pullback (See attachment) Note there are days I need a hug for sure but year after year has put a lot of money in my bank.

GOLD/ SILVER

This has been a very good year for the Precious Metals, Especially Silver. They sold off starting Aug 4 but looks like they were trying to do something this week.

NOTE: I Still feel it’s too early to buy but since it’s holding the 79 SMA it could be a low-risk early entry or there could be a further pullback before what I hope is a nice profitable run.

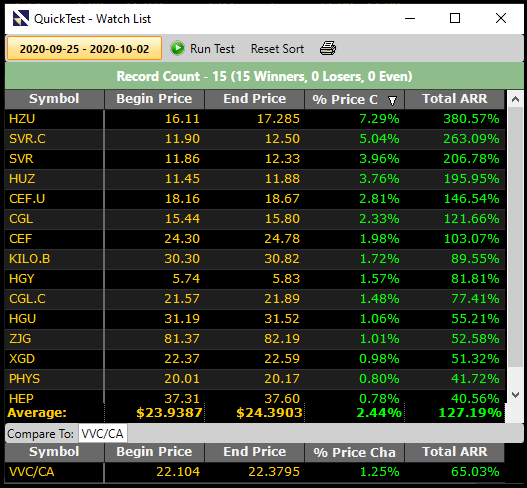

This week the Canadian Gold/ Silver did better than the USA. Also, I was asked what my favourite Stocks/ ETFs were in the sector. See the Quick Test results for the answer to that question. The same ones continually do the best and therefore are my favourites.

As always nothing more than my 2 cents and I hope it’s of value and interest

Leave A Comment