Written by: Mike Simonato, Ontario Presenter: “My Three Friends”, Dec. 3, 2016, VectorVest International Online User Group (Click here to View: My Three Friends)

I hope everyone is staying safe during these challenging times. I have mentioned a number of times that the keys for me are the 2020 Q4 numbers as well as the Q1 2021 numbers. I believe these numbers will not only be an early warning but also help identify the K Shaped recovery more clearly. It appears that Interest rates at or near zero are here to stay for an extended period of time. A 3-year GIC After Taxes will get you .46%. Seems like a waste of time to me. Thus the Market will continue to appear to be the only place to get a reasonable return. However, we must be extremely careful where we chose to invest.

The announcement was made Friday that Toronto and Peel region will continue in Total Lockdown. (Peel is Brampton and Mississauga). That means the 4 weeks leading up to Xmas and at least 3 weeks into January all businesses (Except Essential) have had little to no sales. When I was in Toronto in Sept I couldn’t believe the number of empty stores and others on greatly reduced hours. Now in the new year, I would expect to see tumbleweeds rolling up Yonge and Bay streets and along King and Queen. On top of that Windsor Essex has been under lockdown as well as York Region and now Hamilton. With the meetings held on Friday and the upcoming announcements Monday, there could well be a Province-Wide lockdown over the 2 week holiday period , similar to Quebec, which would cost Collingwood/ Blue Mtn since those 2 weeks are 2 of the biggest money-makers for them. In Owen Sound, there is one mall. 60% of the stores are closed or will be in the New Year and that is an area that has not been under any lockdown. While I fully expect that 2021 will see a tremendous number of bankruptcies and a market reaction to the numbers, we are setting up for another possible extremely profitable time for those who have done the work, have a solid Trading Plan and created a Quality Watchlist to help quickly choose the winners going forward.

The K Shaped recovery will not only be from a Business standpoint but also a human (Individual standpoint). Let’s work together and help each other stay safe, stay strong and come out the other side in good health, both physical and financial

Now for the Markets:

USA:

DOW JONES: Price sideways the last 3 weeks. Still no sign of strength and still in a Big Megaphone Pattern (bearish).

NASDAQ: Price still looks good but RT has been in a tight channel

S&P 500: Price similar to Nasdaq but RT is also rising so again at this point looking good

MKT TIMING: Price still a textbook slow steady up however MTI, RT and BSR are relatively flat

Summary Seeing signs of a tired market or it could be traders have made a killing this year and are ready to go home and rest until 2021. Time will tell.

READ Strategy Earnings Indicator continues to rise.

CANADA:

PTSE: Still stuck at January levels Last 2 weeks Price and RT have gone nowhere

VENTURE: Nice Run Price and RT rising nicely Good looking graph

MKT TIMING: Price, MTI, RT and BSR rose and hen flattened. Still looks ok but again be cautious.

READ Views, Strategy, Earnings indicator rose this week

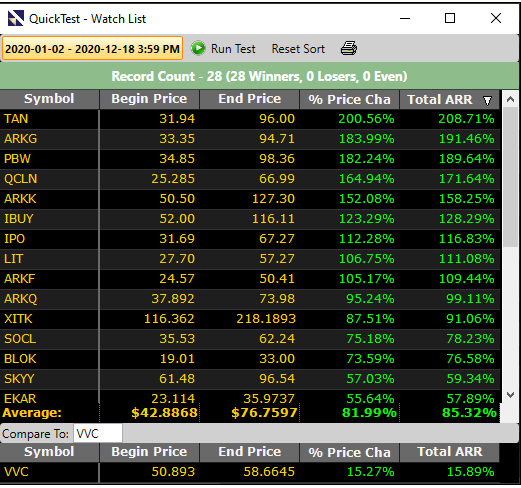

In a catastrophic time in the bible, an Ark was used to carry many to safety. Might be time to look to a different Ark for safety during this difficult time. See the attachment. Out of the top 10 performers from Ed Subak’s ETF WatchList from the November VectorVest International Online Forum, four of them were Ark ETFs.

As always nothing more than my 2 cents and I hope it’s of value and interest.

Leave A Comment