In 1597, Francis Bacon coined the phrase, “Knowledge is Power.” If knowledge is used properly it yields money, which is power in today’s times.

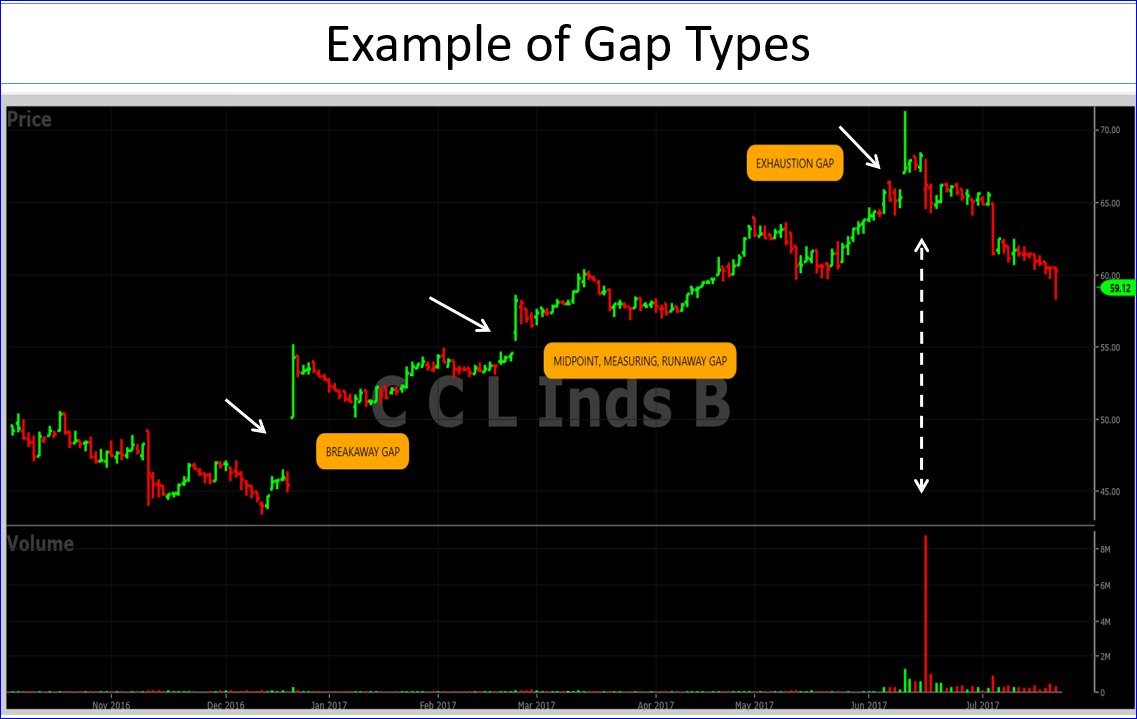

Saturday, we learned how powerful gaps are in trading. Now, after hearing Dr. Barbara Star’s amazing and valuable presentation to our VectorVest International Online User Group Forum, we have the knowledge of what to look for, the types of gaps and their function, and how to use gaps in our trading. CLICK HERE TO VIEW THE REPLAY.

“Incredible knowledge,” said David M. “Awesome presentation.” – Bob K.

“I never knew the kinds of gaps before,” said Erwin V. “Thank you.”

“Not a presentation you would want to miss,” said Rosario A.

More Questions? Dr. Star has kindly agreed to attend our regular SOTW Q&A next week to answer any additional questions about using gaps in trading. Programming Note: For next week only, our Q&A will be held Monday, December 4 at 12:30 Eastern time. REGISTER NOW. Can’t attend? Register now to receive the recording.

New GAP Searches. Dr. Star shared with us four GAP searches she created just for VectorVest, two for the Canadian market and two for the U.S. The searches identify two types of gaps: 1. Bullish Gap with High Volume; 2. Breakaway Gap Channel Search. These are custom searches that you can create following Dr. Star’s explanation in the recording, and save to your VectorVest program.

Note: The two Channel Searches were designed especially for members who have RealTime or purchased separately the Pro Trader premium plug for technical searches. If you would like to try Pro Trader free for two weeks, or if you need help in setting up any of the searches, please call Support at the toll-free number for your country.

On behalf of our VectorVest community, I wish to thank Dr. Star most sincerely for giving us her time and sharing her technical analysis expertise with our VectorVest members.

Irwin B. summed it up best for everyone, saying, “Thank you Barbara for giving us another set of investment tools and new perspectives to add to our trading arsenal.”

A planned presentation on “Reversal to the Mean” was held over. All registered Forum attendees will receive by email a recorded presentation within the next two to three weeks.

DISCLAIMER: The information contained in this Blog is for educational and information purposes only. Example trades and strategies must not be considered as recommendations. You should always do your own analysis and invest based on your own risk tolerance, investment style, goals and time horizon. There are risks involved in investing and only you know your financial situation, risk tolerance, financial goals and time horizon.

To View previous Online Forum video replays, click on the recording links below:

December 2, 2017 – Using Gaps in Trading, by Dr. Barbara Star.

November 4, 2017 – Three Ways To Invest In Europe’s Strong Markets by Susan Hayes, Cullerton.

Leave A Comment