The new NAFTA, the United States-Mexico-Canada Agreement or USMCA, was settled at the 11th hour Saturday, just before time was about to run out on an artificial deadline set by President Trump.

Analysts have declared Trump the winner in the negotiations, and our VectorVest community of investors agree. In a poll I conducted during Tuesday’s CA SOTW Q&A webinar, only 4% believe Canada was the biggest winner, while 75% believe the United States was the biggest winner. Only 1% chose Mexico as the biggest winner and 20% said it was a Win-Win-Win for all three countries.

That’s a bit of fun information, but what investors really want to know is, “Which industries are likely to benefit and which ones might lose and should be avoided?”

VectorVest has long advocated buying rising stocks in rising industries. So how can investors know for sure which industries are prospering under the new agreement, and which ones are lagging? The answers are in your VectorVest software.

One simple method is to click on the Viewers tab, click on Industry Viewer and begin your analysis. The Industry Viewer is sorted by RT, so right away we see which industries have been moving up. On Monday evening, the top five industries by RT Ranking were Auto & Truck (Repl Prts), Transportation (Air Freight), Media (Movies), Transportation (Rail) and Healthcare (Marijuana). From there I simply highlight them all and put them on a one-year daily graph. I used VectorVest default graph layout with Price, the 40-day Moving Average (MA) and RT, and then I add RT Ranking. The key things to look for on the industry group graph are 1. Price is above the 40-day MA and the moving average is rising or flat, but not falling, RT is rising and near or above 1.00, and the RT Ranking is rising. Holy cow! Auto & Truck (Repl Prts) was the #1 industry group or close to it since April 19th. How did I miss that? Price also crossed above the 40-day MA shortly after and RT was greater than 1.00 and rising.

There are only two stocks in the group. It’s not uncommon for many industries in Canada to have a small number of stocks, but at least in this case both stocks were priced greater than $1. Xpel Technologies, DAP.U, was at the top of the list sorted by VST on April 24th. A QuickTest to October 2nd shows DAP.U, up 244% to $6.75 per share from $1.96 per share and UNS up 12%. Great, message received. The Industry Group RT Ranking is something we must pay more attention to going forward if we want to stay on top of the trade agreement winners.

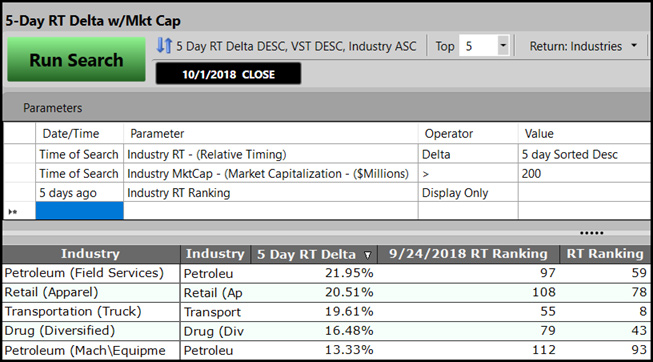

For the next industry group analysis method, we turn to UniSearch. Go to the folder labeled Delta Searches – Industries and open the search called, 5-Day RT Delta. Let’s keep the 5-Day RT Delta Sort, but let’s add one criterion to weed out the weaker industry groups. The criterion is: Industry MktCap (Market Cap) > 200.

Now when I run this search on Monday, October 1st, Petroleum (Field Services) comes to the top with a 5-day RT Delta of 21.95%. Five days ago, this industry group was ranked 97th and it has moved up to 59th. Not a great looking graph for this industry group, but Price has just crossed the 40-day MA and both RT and RT Ranking are moving up. Since bottoming around September 7th, stocks in the industry group are up an average of 6.23%.

A bit further down the list, Metal Prds (Pipe/Fab/Misc) showed up with a 5-day RT Delta of 11%. Once again, not a great looking industry graph, but I can see the RT Ranking bottomed at 115 on July 12th and it has been moving up ever since. Martinrea (MRE) is the top stock in the group and should benefit from the new trade agreement as should other auto parts makers. MRE jumped 11% early Monday on news of the agreement, while other auto parts makers such as Linamar (LNR) and Magna (MG) also gained Monday, but, it fell back on Tuesday as investors continued to digest the new USMCA agreement.

You can easily change the search to test different timeframes such as 1-day, 10, 20, 30 or even a 50-day RT Delta.

One thing is certain, if you continue to monitor the industry groups with the above methods, you will find the answer to the question, WHO ARE THE WINNERS IN NEW USMCA DEAL?

Leave A Comment