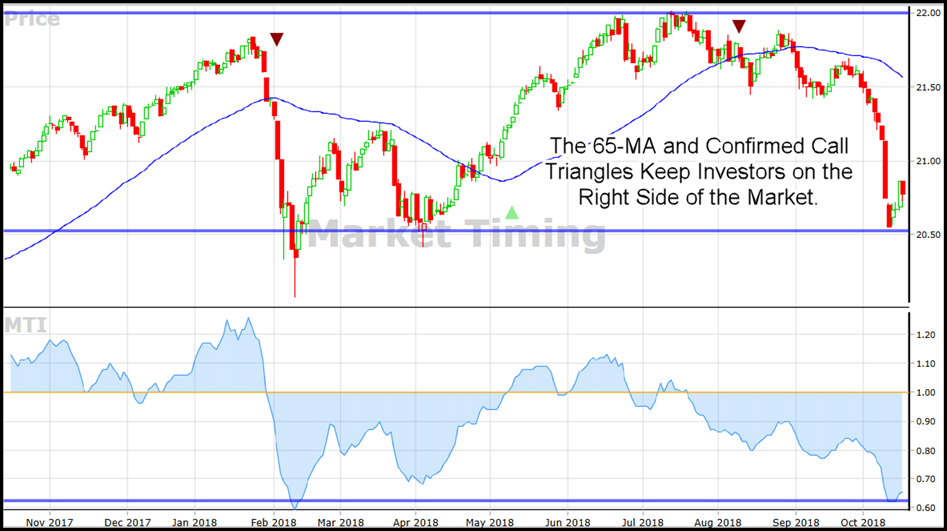

If you’re like most investors, you’ve probably seen your long-term retirement portfolio drop a bit since VectorVest issued its Confirmed Down call, C/Dn, on August 10th, or maybe a lot if you don’t consistently “weed your portfolio” of the weakest stocks or take other defensive measures such as options, for example.

Market Analysis

Why does this happen? Well, if “a rising tide lifts all boats” is true, then the opposite is also true. Studies show that 70% to 80% of stocks move in the direction of the overall market. Even high Relative Safety (RS) stocks are prone to pulling back when market conditions worsen. VectorVest’s Confirmed Down call on the market is like a receding tide, pulling most stocks lower along with it. Here’s what is happening, in general terms at least, because nothing in the markets or stocks follow the rules to the nth degree every time. Just like the tide, the bulls push the market higher and higher in waves until it reaches a peak. That’s the point at which investors begin to believe prices have gotten too high. They stop buying and begin selling to take profits. The effect on the market is like a receding tide. It pulls the market lower in waves until it reaches the point where prices are attractive once again. Buyers step back in, and the cycle begins all over again.

Fortunately for VectorVest investors, our MTI graph and Color Guard working together does a great job of letting us know when the market is near a top, and when it’s near a bottom and it’s okay to stop defensive selling and start buying again. In Canada, we have had just six C/Dn calls in the last five years, and only five C/Up calls. Some have been shorter than others, but generally the C/Up calls are fast enough and safe enough to do most of our buying, and the C/Dn calls give us early enough warning to prevent catastrophic losses if we play good defense when the stocks we own start to show weakness. The warning signs of such weakness and what to do about it are explained in Lesson 2 of the Successful Investing Quick Start Course found on the Training tab.

Five Steps for Better Profits

Here are five basic steps that will help you consistently make money in the stock market. You can learn more by reviewing all five Successful Investing lessons on the Training tab in VectorVest 7 and attending our webinars each week, especially Glenn Tompkin’s Training Tuesday, our CA SOTW Q&A every Tuesday, and the Successful Investing Coaching by Brian D’Amico and Todd Shaffer every Thursday.

STEP 1

Don’t get caught in the trap of paralysis by analysis. That is, ignore the blizzard of data, stock tips and breaking news that comes your way every day. VectorVest has the vital information you need, not just data, to make good decisions and quickly. You need to know three things:

- What are your stocks worth, and is price under or overvalued?

- How safe are your stocks measured by the Relative Safety, RS indicator?

- Is price trending up or down?

STEP 2

Weed your portfolio. As we discussed above, this is especially important when the market is topping and starting to fall. Sell any stock that has met your initial Stop criteria that you set when you bought the stock. If you failed to do that important step, or market conditions are worsening, identify and sell any stock that is hurting your portfolio with falling RT and/or price. Take the time now to set stops on all your remaining stocks. When you know exactly when you will sell a stock, you will feel so much more in control, your confidence will increase, and you will reduce your losses.

STEP 3

Only buy when the market is rising. That means the overall market is in an uptrend with the Primary Wave Up as a minimum and or a green light in the Price column the Color Guard. Make sure the market and your stock are also rising on the day you make your purchase.

STEP 4

Be patient. Buy only the best stocks and the best set-ups. What you see in the past is likely what you will get in the future, so be picky. That means stocks that are steadily rising in price preferably from bottom let to top right on a 1-year graph, and not volatile. Favour undervalued stocks, and stocks that are making money and growing their earnings.

STEP 5

Set a goal that is realistic, and, write out a plan that is likely to get you there. Your plan should contain three main pieces:

- When to Buy;

- What to Buy; and

- When to Sell.

Review your progress regularly, at least every quarter.

I hope you will take some time and plan out your own FIVE STEPS TO CONSISTENT PROFITS.

Start your portfolio action plan today and cash in on your profits. Get your 30 Day Risk-Free Trial

I used to subscribe to your services but since retired living on fixed income and quit. How much is the payment monthly now after the 30 day trial? I only invest in USA stocks. Thanks, Steve

Hi Steve, My apologies for the late reply. The monthly payment for end-of-day service is $59 USD or you can save a bit with an annual subscription at $645 USD. If you are a Canadian resident you will receive access to both Canada and US databases. Here is a link to our product description and pricing page: https://vectorvestca.azurewebsites.net/product-pricing/

Thanks for your inquiry and please let me know if I can be of any further assistance.

Stan Heller, Consultant, VectorVest Canada

Hi Stan,

I am a Canadian resident. If I am subscribing the VectorVest Canada Intraday (15-minute delayed) Services, can I also be able to access the US Intraday database?

Thanks, Joe

Hi Joe, As a Canada intraday subscriber, you will have access to the US end-of-day database at no extra charge. Please call Support if you need intraday for the US and see what they can do for you. Thanks Joe!