I was pleased and grateful last weekend to receive an essay topic idea from subscriber Dr. Gord Nixon. Dr. Nixon, you will recall, was a keynote presenter along with Mike Simonato, to our September 2nd, 2017 International Online User Group Forum on the topic, “Strategic Investing with VectorVest’s High CI Indicator.” His essay idea was essentially a retweet of some sage wisdom by popular investing book author Steve Burns.

The tweet was titled, Trading: Understand What You Can Control. In his email, Dr. Nixon said the VectorVest software and the strategies we teach addresses each point of what you can control and how to monitor the things that you cannot control. I agree. This week I will write about the things Steve Burns says you can’t control. Next week, I’ll complete the picture by writing about the things Steve Burns says you can control.

3 Things You Can’t Control

- PRICE MOVEMENT I don’t know of any investor who wouldn’t love to be able control price movement. It can’t be done. Some advisors and newsletter services claim to be able to predict price movement. That’s also hogwash. What investors can do is put probabilities, past performance and trade management in their favour. VectorVest believes in buying safe, undervalued stocks that are rising in price and in a rising market. To accomplish this, our software gives us simple, reliable indicators we can use to compare every stock in the database in relation to its Value, Safety and Timing. It assigns a Buy, Sell or Hold rating on every stock, every day. We have searches to save hours of time finding stocks that meet our fundamental and technical criteria. Graphs are vibrantly clear and flexible in plotting price, earnings, value, sales, dividends, moving averages and technical studies. VectorVest’s edge is trend following, not only with price, but everything that affects price.

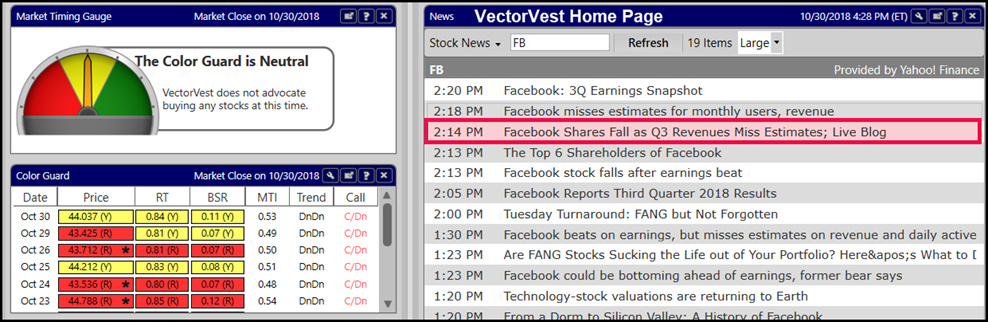

- MARKET NEWS We’ve seen plenty of examples in the past 18 months or so to show that news and even “fake news” is something that affects stock prices. We can’t control it, but VectorVest gives us the tools to scrutinize the news and most important, to monitor how the news is affecting our stocks. You can display Market News right on your home page in the US, a feature our team is working hard to restore for Canada. For the latest stock news, right click on any stock and choose “View Stock News” from the drop-down menu. What’s important is how investors interpret and react to the news. Positive news, such as a good economic report, can drive the overall market higher. Healthy earnings growth, sales numbers, new orders and a positive outlook almost always moves a stock’s price higher. Keep in mind, stock prices tend to react more slowly and steadily to good news and more quickly and heavily to negative news. So, be especially alert to any bad news. One of our subscribers shared a trading rule for her stocks on our CA Blog that I have adopted: BAD NEWS, BAD EARNINGS – SELL IMMEDIATELY.

- OUTCOME OF THE TRADE. Let’s face it, you can do everything right and still have the trade go against you. It happens. A good trade is one where you followed your trading rules and your process, regardless of whether you made money or not. A bad trade is one where you didn’t follow your process or your rules. If your backtesting shows that if you follow your trading rules and money management rules, you will win more trades than you lose, and you will make more money on the winning trades you than lose on the losing trades. That’s how you compensate for not being able to control the outcome of individual trades.

I trust this review of what we can’t control and how to monitor it has been helpful. My thanks again to Dr. Nixon for bringing the information and essay idea to my attention, and to Steve Burns for his excellent tweet about TRADING: UNDERSTANDING WHAT YOU CAN CONTROL.

Unleash the Power of VectorVest. Start Your 30-day Trial.

Looking for more Vector Vest info — the sales types are interesting…

Hi Jay, Please go to http://www.vectorvest.ca for more information. You can grab a 30-day trial for $9.95 USD. Check out our Blog for more articles. Thanks for your interest Jay.