What a start 2016! Global markets tumbled as China halted trading twice and tried to jumpstart their faltering economy. Bloomberg analysts said stocks closed out the week with the worst start to the year ever.

Commodity based markets like Canada really felt the pain. Our TSX Composite fell more than 4%, adding to the 11.7% loss in 2015. The Venture fell only 2%, buoyed by the ‘safe haven’ Gold index which rallied 9.4%. US indexes SPY, DIA, QQQ and RUT crashed, however, volume was lower at the end of the week suggesting the sellers were losing steam.

So, what can we expect this week? From the graph below, we can see the Canadian market fell below lower trendline support and is now near a support level established way back in 2013 during the months between February and October. The MTI (market timing indicator) is also near 0.60, searching for bottom that is historically significant, and it too is at a recent support level. Stochastics shows the market is oversold. So, it follows that while there could be a little more downside pressure, there should be at least a temporary bounce to the upside this week.

On the US side, graphs of the DIA, SPY and QQQ seem to support a bounce back next week as well. RUT looks like it could continue to fall and shows a bearish head and shoulders topping pattern, but it too is nearing a support level.

The NEW BIRTHDAY GAME – Special Presentation (Click here to register for our Jan 12 Q&A)

You will recall the VectorVest Special Presentation on Dec 11. It was titled, Play the Birthday Game and Win a Free Month of VectorVest. Using a 20 stock basket sorted by VST in the Stock Viewer, all you had to do was have one year in the last three years that didn’t show a positive return. That’s how confident VectorVest is in its sort by VST – Value, Safety and Timing.

You will recall the VectorVest Special Presentation on Dec 11. It was titled, Play the Birthday Game and Win a Free Month of VectorVest. Using a 20 stock basket sorted by VST in the Stock Viewer, all you had to do was have one year in the last three years that didn’t show a positive return. That’s how confident VectorVest is in its sort by VST – Value, Safety and Timing.

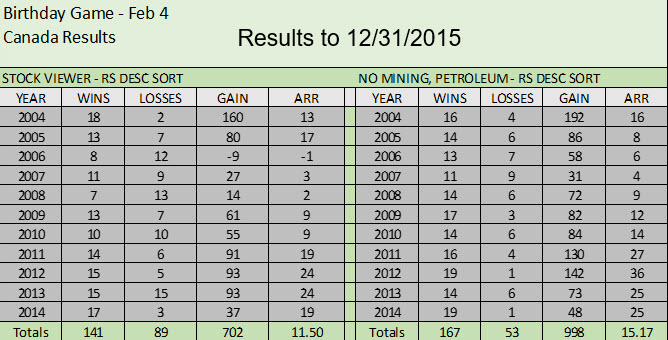

You will also recall in our regular Tuesday Q&A that followed, I showed you how you could improve results even more by changing the sort to RS – Relative Safety. My logic is set out in Dr. DiLiddo’s little green book on P. 60 and 61 in an article titled RS – The Missing Link. I went a bit further and suggested in Canada, you will have even more amazing results if you eliminate Mining and Petroleum stocks.

Well, I may not have been the only one who suggested to Dr. DiLiddo that RS is a better sort for the long term. This week’s Special Presentation unveiled the NEW BIRTHDAY GAME. The rules are the same except, guess what, it uses the RS sort. And now you can go back and use your birthday with any starting year in the database up to 2014 and run a QuickTest to December 31, 2015. If there’s any year where you didn’t see a positive result, in other words, any single run that didn’t make money, you can get 1-month free added to your VectorVest subscription. I expect there will be more winners in Canada than the U.S. Why? Our commodity and resource based market may well cause a losing run here and there.

So join me Tuesday for a discussion of all of the above during our regular weekly SOTW Q&A Tuesday, January 12 at 12:30 p.m. ET. Click here to Register.

By the way, below are my results. I had one losing year, so I win 1-month free. My runs with no mining and no petroleum, no losing years. By the way, I also tested the New Birthday Game using only the 40 stocks in our new WOW Dividends WatchList. The results? Priceless! Join me Tuesday or register to have a look in the replay if you can’t attend live.

YOUR COMMENTS PLEASE! I would also love to hear about your results.

Presented by Stan Heller, Consultant, VectorVest Canada

DISCLAIMER: The information contained in this Blog is for education and information purposes only. Example trades must not be considered as recommendations. You should always do your own analysis and invest based on your own risk tolerance, investment style, goals and time horizon. There are risks involved in investing and only you know your financial situation, risk tolerance, financial goals and time horizon.

I won too September 5. I also won with VST last week. Can we play using other indicators or other dates, such as when you first took out a subscription to VectorVest, your dog’s birthday, etc?

Hi Mark, Only RS Sort Desc is eligible for 1-month free. It can be a great learning exercise to try other indicators however. One investor emailed me to let me know he had great results using RS*CI.