Of all the trading rules you may have learned from VectorVest and others, I believe the most important is TRADE WITH THE TREND. This applies to the overall “market” trend and individual stock trends.

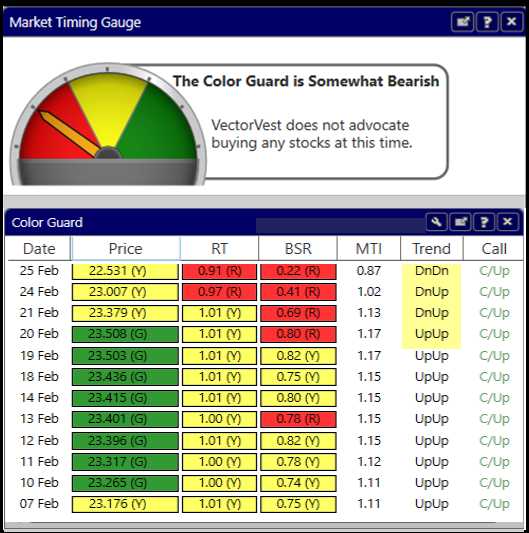

I bring this up now because the market has absolutely been crushed the last couple of days, February 24th and 25th, after rallying steadily higher ever since VectorVest’s DEW Up signal November 1st and Confirmed Up Call (C/Up) on November 14th. Geopolitical concerns including Coronavirus finally took their toll. Fortunately, VectorVest began Friday, February 21st preparing investors for a possible change in market direction. One red light showed up in the Color Guard on Thursday, then another on Friday and the Primary Wave turned Down from Up.

During Friday night’s Timing The Market Report, Steve Chappell, VectorVest’s Director of Trading Systems, explained VectorVest’s timing signals and urged caution. “This might be the onset to some further weakness, so do take note of that. If you haven’t already started getting defensive, I think now is the time to do so.” The TSX fell 280 points on Monday and 385 points on Tuesday.

At VectorVest, we urge our subscribers to just follow the trend, getting in early when indicators are bullish and playing good defense when momentum has slowed and indicators turn bearish.

Let’s face it, t’s easier to take a step back and play defense when you’ve made significant gains during the start of nice uptrend. Unfortunately, not everyone, including the professionals, participated fully in the recent uptrend. Some even “shorted” the market when it was going up, believing that the bull market has persisted for too long, is “too high”, and overdue for a serious pullback. Such thinking has caused short sellers to have their heads handed to them. In fact, frantic short covering contributed to the lengthy rally.

So, here’s the number one cardinal rule. When VectorVest gives us a bullish timing signal such as the DEW Up and C/Up, aim to get fully invested as quickly as possible on days when the market and your chosen stock is rising. Often the best days in a new rally are the earliest days. Stay long until your Stop-Loss Prices demand that you sell. If the timing signal turns Bearish such as the DEW Down or C/Dn, stop buying stocks until at least the next Primary Wave Up or Green Light Buyer signal. Consider tightening your stops on positions that you own. Remember, the Daily Color Guard gives you guidance every day on whether it’s okay to buy stocks or not okay, but only you can decide when you must sell.

Similar to trading with the trend, you should BUY ON STRENGTH AND SELL ON WEAKNESS. In other words, trade where the money is going and not against it. Many investors do the opposite at their own peril. They want to trade when a stock’s price has fallen steeply, hoping for an explosive bounce and a new rally. It’s like trying to catch a falling knife. Professionals, including our VectorVest instructors, recommend waiting until price has hit the floor and started moving up again. Rather than follow the adage, “Buy low and Sell high”, they prefer to “Buy high and Sell even higher”. Waiting for a VectorVest “Buy” rating is a great way to ensure that you have a good stock that is in an uptrend before you buy.

Here’s a baseball analogy that’s often used to drive home the concept. If you were a major league ball player, would you prefer to get traded to a team that’s near last place and sure to miss the playoffs, or a strong team that’s near the top and playoffs are almost a certainty? The latter, right? The same holds true when looking at different stocks within a sector for example. You should want to buy the strongest stock and sell the weakest. VectorVest makes the task easy with its exclusive indicators: Relative Value (RV), Relative Safety (RS), Relative Timing (RT), and Value, Safety and Timing, VST. The default sort is VST, a master indicator that combines RV, RS and RT. Subscribers can change the sort to any of the indictors by themselves or in different combinations such as RS*RT.

In summary, there’s no question the market has been on an amazing, lengthy bull run. Trying to guess how long it will continue or how soon it will end is a mug’s game. Instead, follow the guidance of our Daily Color Guard and Market Timing graph, including the trends of the MTI, BSR and RT. When it’s okay to buy stocks, favour stocks that have proven themselves with consistent and predictable earnings and prices that continue to move higher over time. Such stocks will earn a Buy rating from VectorVest. VectorVest makes it easy to follow these TWO CARDINAL RULES TO MAKE MONEY AND MANAGE RISK.

Leave A Comment