We’re in the thick of another earnings season so it’s a good idea to reflect on a few best practices to keep us on the right path.

An earnings announcement increases the risk of loss, and that risk must be mitigated as much as possible. Avoiding the big loss is a key tenet of successful trading. A weak earnings report can crush your portfolio – and your confidence.

Here are four best practices that can help you protect your portfolio ahead of earnings.

#1 – KNOW YOUR EARNINGS DATES

Before you buy a stock, you need to know if its Earnings Release Date is coming soon. You can avoid risk by waiting to buy until after earnings. If you own the stock, do some additional research and make an informed decision whether to hold or sell through earnings. With VectorVest, you can get the earnings dates in three simple ways:

- Add the Earnings Dates to the stock viewer in your Portfolios. That can be a portfolio of stocks you own or a portfolio that holds your WatchList of stocks you are studying for possible buying opportunities.

- Use UniSearch to find all upcoming earnings within a specified date range, less than 30 days out for example.

- Go to the Events Viewer to see which stocks are reporting on certain days. Change the calendar to add more days and then scroll down to see what is coming.

#2 – GET USED TO SELLING EARLY

If you want to avoid risk completely, Sell before earnings. This is especially important If the overall market is bearish and your stock is showing signs of weakness such as falling RT or falling EPS. Yes, the company could surprise with positive earnings and go up without you, but if your goal is to keep your gains and avoid the risk of a major loss, just Sell early.

Selling early can also help you avoid periods of flat performance. Have you noticed that volume and price often turn quiet prior to earnings? When this happens, it’s generally because investors don’t have sufficient confidence or enough information to gauge whether the stock will have good earnings or bad. They take a wait-and-see attitude, which makes price goes flat or slightly lower. If you’re in the stock, you have your capital tied up and at risk for less potential reward during this period. It’s best to avoid making a purchase or lock in gains early if you own the stock when you see this happening.

#3 – LOOK FOR WARNING SIGNS

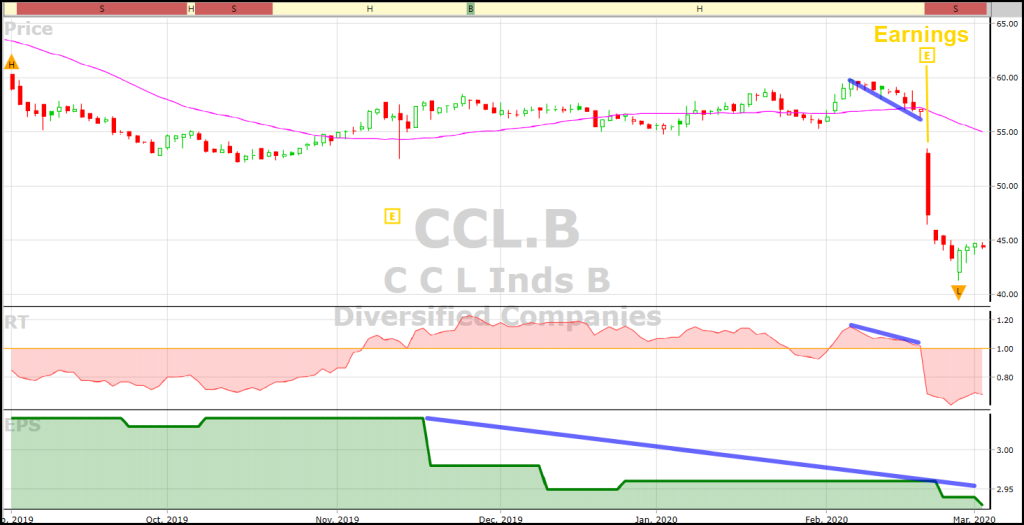

Some recent examples on widely held stocks. IAG – Prior to earnings 2/13/20, IAG showed a strong bearish divergence. Price continued rising and hit a new high on 2/07/20 while RT, Relative Timing was falling, hitting a lower low on 2/07/20. More subtle was that EPS had flattened out prior to earnings. TECK.B – A disastrous earnings announcement on 2/21/20. There were several warning signs. Price was in a downtrend. RT was at 0.65 the day before earnings, having fallen below 1.00 on 01/08/20. EPS had fallen steadily on one a 1-year graph. CCL.B – Prior to its 2/21/20 earnings announcement, price was quiet and consolidating, which often happens as noted above. During the nine days prior to earnings, however, although movement was quiet, both price and RT were hitting lower lows. Perhaps the biggest warning, however, was the slow but steady decline of EPS leading up to the earnings announcement. Always check the slope of EPS prior to earnings on stocks you own and before you buy.

#4 – KNOW YOUR OPTIONS

There may be good reasons why you don’t want to sell even though earnings are coming. It may be a strong dividend payer that you’ve held for a long time. You may not want to trigger tax consequences. If you know Options, you can buy a PROTECTIVE PUT before earnings to protect or hedge against a potential loss. VectorVest offers terrific courses that will give you the basics.

Successful investors and traders will tell you, knowing how to make money in stocks is important, but knowing how not to lose money, especially big money, is more important. Following these simple best practices will help you in AVOIDING RISK PRIOR TO EARNINGS.

Leave A Comment