Written by: Mike Simonato, Ontario Presenter: “Investing for the Long Term”, presented to the Feb. 6, 2021 International Online Forum, you can watch by CLICKING HERE.

Golf Part 2

While there is a certain amount of physical need to be good at golf, Pros will tell you 90% is Mental (Emotions).

Anyone who can’t control their emotions during a round usually won’t do well. Here are 3 examples:

- I was once playing a round with the course pro. The first hole we both played the same. The 2nd hole was a par 3 with the Tee box, a huge water hazard, and the green. I went first and put my tee shot one foot from the pin. He hit his tee shot into the pond and proceeded to throw his clubs into the pond and stormed back to the clubhouse (yes, he lost his job as course pro shortly after). Even though we were only playing for fun, he put so much pressure on himself and soon fell apart.

- People who know me know I can be a jerk. I have always hated arrogant, disrespectful people who look down their noses at others. These were easy. As we were on the Tee, I would say how about $20 to whoever hits their tee shot the furthest. All of sudden they went all Adam Sandler from Happy Gilmore and completely changed their stance and swing etc. The result, they either sliced, hooked, or skyed their tee shot. I could have hit a putter off the tee and won the $20. The key was they allowed a situation to completely change their game plan, and it cost them and it upset them so much they rarely recovered.

- This is probably the biggest mistake I saw people constantly make. After having a bad hole they tried to make up for it all in one hole. Again rarely worked and usually let to disaster.

How can we apply this in trading:

In trading, there is so much info floating around to get us off our game, such as short-sellers trying to get us to sell thinking the company is bad and the stock is about to sink.

Also, we get info such as today’s big miss in the jobs report as well as the CDN economy shrinking. Both are shocking considering everything is opening up again and the economy should be booming. Part of the CDN economy’s shrinking was a big fall in exports. Heading into the fall, which can be a scary time of year, can panic us and cause us to change our strategy.

Lastly, a biggie is we have a bad trade and make a really risky trade to make it all back in one trade, ie put a bigger than usual position on a high-risk trade ie crypto.

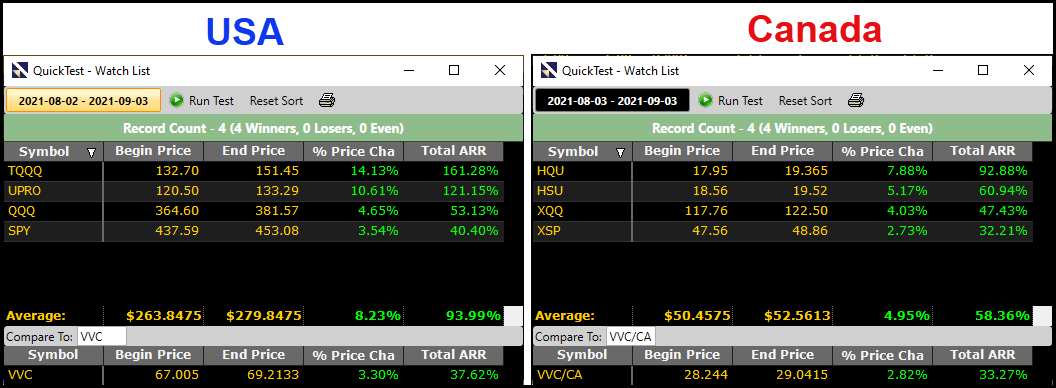

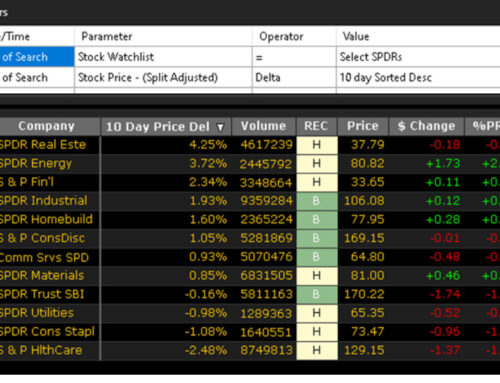

Two of many people I have great respect for are Bob Turnbull (Dec. 5, 2020 International Online Forum), and Margaret Bell (May 8, 2020 International Online Forum). These are 2 people who you will not get to and get them to give up their strategy (What they know and do best) That is why they are so successful in trading. Personally, I never listen to BNN or CNBC. I do get news feeds that I watch, but as I have said many times, ride the Bull until he throws you off. Look at the attachments to see how well Bob Turnbull did this month.

When we have a proven strategy, we know and understand that works month after month and year after year, we must control our emotions and not let anything distract us or get us to fall into the many traps others fall into in their trading lives.

As always, nothing more than my 2 cents and I hope it’s of value and interest

Leave A Comment