Canadian investors are anxious about their dividends. It’s understandable, and here’s why.

The isolation strategies needed to fight coronavirus are stifling the economy. Many companies are scrambling to shore up cash as sales vanish, taking measures such as a temporary decrease, deferral, or outright suspension of dividends.

At this point, more than 80 companies have already cut their dividends or suspended them indefinitely. Others are under considerable pressure to follow suit, especially companies in oil and gas, hospitality, retail, transportation, REIT, entertainment and financial.

A couple of examples. Dividend Aristocrat Suncor (SU) slashed its quarterly dividend by 55% and suspended its share repurchase program. On April 6th, flight simulation tech giant CAE suspended its dividend and share repurchase plan. Previously, CAE had increased its dividend every year since 2008 after cutting it in 2007 in response to the financial crisis. Interestingly, CAE gained 36.9% after the April 6th announcement to April 30th. It has since given back about 14% (as of May 26).

So, is it still a good idea to invest in dividends for the long term? Does it pay to hold dividend payers through severe market corrections even though the loss on capital can be far greater than the dividends received? These are the questions I have been getting.

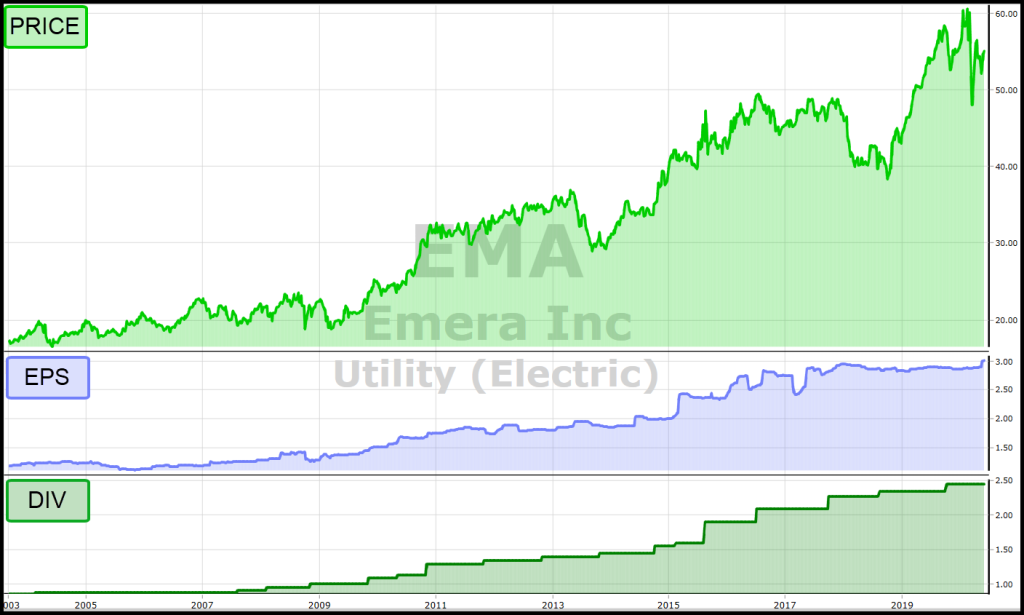

First, you need to understand that dividends still matter. Studies show that over the long-term, dividends account for more than 40 percent of the profits made in the stock market. Stocks that can maintain their dividends tend to hold up better in down markets and generally recover faster and stronger than other stocks.

That said, you can get burned by trying to hold forever a rapidly declining stock just to keep the dividend coming. Consider the example of Alaris Royalty (AD). On January 2nd, 2019, say you owned 500 shares at $16.82. Dividend Yield was 9.81%, and monthly payments were 0.1375 cents or $68.75 per month. Over the next 15 months to April 15th, dividends amounted to $1,031.25, which would be pretty useful to an income investor. However, during the same period, the price of AD fell to $9.31 per share, an unrealized capital loss of $7.51 per share, or $3,755 on 500 shares. You would not be happy, and it will take about three years to make that back through dividend payments alone. There is no dividend in May because AD announced it is switching to quarterly payments in June.

Now, if you know how to use options to protect your portfolio during falling markets, then the following guidance may not apply to you. For everyone else, until you learn to use options, here are a few suggestions for investing in dividend payers based on how close you are to retirement.

Early In Work-Life, Pre-Retirement

You should consider buying quality companies with high Relative Safety (RS) scores, Dividend Growth (DG) above 10%, and Dividend Safety (DS) above 50 on our 0-99 scale. This doesn’t guarantee your stock won’t pause its dividend during another crisis, but it improves the odds it won’t, and if it does, the stock is likely to recover more quickly and resume its dividend faster than stocks with lower scores. Dividend Reinvestment Plans, DRIPS, are ideal at this stage. You want to buy and hold and reinvest dividends using a wide Stop-Price in the order of 30 to 40% to allow the power of compounding to work its magic.

Late Work-Life, Early Retirement

Continue holding and adding to your dividend portfolio. Any new purchases will not have the benefit of as much time for dividend compounding, so implement tighter Stop-Prices for new investments. Treat new positions as swing trades until they prove themselves and keep going higher. From there, consider taking profits early or tightening stops when the MTI suggests an overbought market, VectorVest issues a Confirmed Down Call, or your stock starts to show any weakness.

End-Stage Retirement

Only you and your doctor can guess how long your time horizon might be now, so capital preservation trumps everything. You should now have tighter Stop-Prices on all your holdings, including your long-term dividend growth stocks. Tighten them further during Confirmed Down Calls, you don’t know when a pullback will worsen into the next crisis. Your priority now is to preserve your nest egg and add to it slowly and selectively for your security and enjoyment, with enough left over as a legacy for your family and favourite causes. You should consider tightening all Stop-Prices in falling markets and, over time, move more of your assets into fixed income as cash becomes available.

Consider these strategies when STOCK DIVIDEND CUTS RAISE ALARMS.

Leave A Comment