VectorVest subscribers appear to enjoy hearing and talking about dividend investing. Last Friday’s essay, titled, Stock Dividend Cuts Raise Alarms, received a terrific response. Members who emailed me said they particularly appreciated the ideas for adjusting your approach to dividend investing at different stages of work-life and retirement.

People also wanted to know how to avoid holding or buying a stock that might be about to cut their dividend. No doubt, there is more risk today of dividends being cut than we have seen since the financial crisis of 2008. More than 80 companies have already cut their dividends or suspended them altogether.

Despite this risk, with the Bank of Canada cutting interest rates to new lows, the equity markets have become more attractive than ‘safe’ fixed-income investments such as bonds, GIC’s and money markets. The market is rich with the opportunity to pick up well-known dividend payers offering higher yields than usual, much higher than fixed income. You just have to be extra careful.

HOW CAN I AVOID THE CUTS?

Often there are warning signs that a company may have to cut or suspend its dividend. It is easier to spot them when you have VectorVest. There are plenty of case studies that we could look at, but I am going to focus on Laurentian Bank (LB). LB cut its dividend by 40% last Friday, a surprise to most analysts and investors due to the size of the cut and because none of the other big banks cut their dividends despite earnings misses and steep loan-loss provisions by some.

What were the warning signs with LB that a VectorVest subscriber would have seen coming?

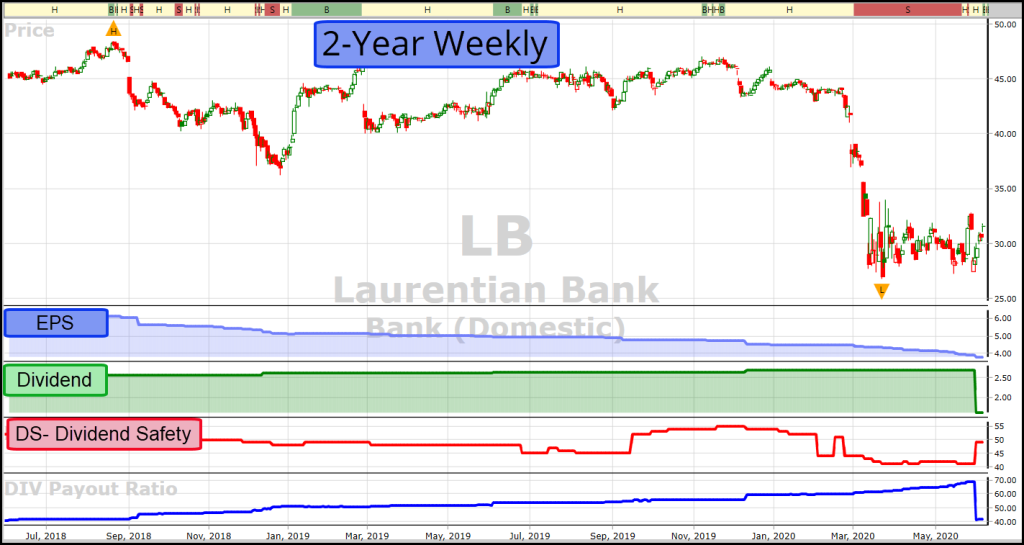

FALLING EPS

This is a big one. Our founder, Dr. Bart DiLiddo, is a big believer that price follows earnings. VectorVest instructors are always telling subscribers, “Put EPS on your graph and favour stocks that have earnings rising all the way to the right edge.” The opposite is also true – avoid stocks that have falling earnings. Laurentian Bank’s Earnings were in a steady decline for the last two years. Remember, VectorVest’s EPS is a blend of historical and forecasted earnings, so what you see on a graph is where earnings are expected to be one year from now. This is far more instructive than being limited to past earnings.

LOW RELATIVE SAFETY

Relative Safety (RS) is a measure of a company’s consistency and predictability of earnings. Over the last two years, LB’s RS never made it above 1.0 on our 0-2 scale, and it was near its lowest point, 0.80, right before the dividend cut. Another red flag. It’s a good idea to graph RS on stocks you own, especially before earnings, so that you see the complete history of a stock’s Relative Safety compared with price performance.

MEAGRE DIVIDEND GROWTH

When a company has previously cut its dividend, or it isn’t growing its dividend for two or more years, that’s a warning sign. In VectorVest, you can plot the actual Dividend payments on a graph, so look back at least five years. In the case of LB, it was growing its dividend, but at a token rate of less than 1% per year. VectorVest’s recent Dividend Growth rating of 10% suggests LB had the capacity to grow its dividend faster than it was doing, which signals a lack of financial confidence and growth potential.

LOW DIVIDEND SAFETY

VectorVest calculates Dividend Safety, (DS) on a scale of 0-99. LB has struggled to get above 50, and it dropped to a low of 41 just before the dividend cut, another strong warning of potential trouble ahead. A related indicator to Dividend Safety is the Dividend Payout Ratio (DPR). Dr. DiLiddo writes about it in Chapter 14 of his classic investment book, “Stocks, Strategies and Common Sense.” The DPR is the proportion of earnings paid out as dividends. It is determined by dividing the Dividend Yield by the Earnings Yield, multiplied by 100 to get a percent. It looks like this, (DY/EY)*100. You can create a Custom Field in VectorVest to display in Stock Viewer or use as a search criterion in UniSearch. Dr. DiLiddo writes on page 55, “A Dividend Payout of about 35% is considered to be normal, safe and reasonable. Anything above 50% is usually regarded as excessive and less likely to be maintained.” So, in the case of LB, falling earnings drove the DPR to about 68% prior to the dividend cut, perhaps the main reason why VectorVest’s Dividend Safety rating was “Poor”. After the cut, the DPR is now a more reasonable 41% and VectorVest’s DS is 49, still “Poor,” but better. In an interview on BNN this week, Francois Desjardins, President and CEO of Laurentian Bank, said the Bank’s DPR target is around 50%.

WEAK PRICE PERFORMANCE

Even before the COVID-19 crisis, LB was underperforming the big banks in price appreciation. Between January 2, 2018 and February 21, 2020, the price of LB lost more than -22%. The next worst performer was CIBC, down -10.8%.

There are other, less specific steps you can take to avoid dividend cuts. For example, avoid chasing high yields. Favour companies in defensive sectors such as telecoms and utilities and avoid sectors such as energy and industrials that have already seen dividend cuts, suspensions or eliminations. There will always be surprises, but watching out for the above warning signs is HOW TO AVOID DIVIDEND CUTS.

Leave A Comment