Written by: Mike Simonato, Ontario Presenter: “My Three Friends”, Dec. 3, 2016, VectorVest International Online User Group (Click here to View: My Three Friends)

I’m always looking for ways to improve and get better, not only for myself but also to improve the quality of my weekend reports. When I look to improve I turn to a higher source, Stan and the Burlington 3, As a result, I ordered bottled water from Burlington and Lethbridge thinking there must be something in the water to have so many amazing traders in those 2 communities in particular. One thing I did learn is I Really Need to get a copy of Stan’s Views in advance before I go to all the work I just did.

Here is one key thing I have learned though that is looking key – OCT/ NOV could be the worst time ever with COVID-19. My information is that staff at Royal Bank, CIBC and Wall Street have ALL been told that they will be working from home until well into 2021 at least. Even then they will likely only come to the office 2 days at the most.

Now for the Mkt Summary:

USA:

DOW JONES: Price is close to a new high. Stochastics are at the top level. (Can stay here for a while) RT is rolling over

NASDAQ: Price pulled back to the 8 EMA today and bounced to close above the 3 EMA. Stochastics at the top and RT rolling over

S&P 500 Same as above

MKT TIMING: Price still ok, and like the above, Stochastics is at the top

READ Views and Strategy

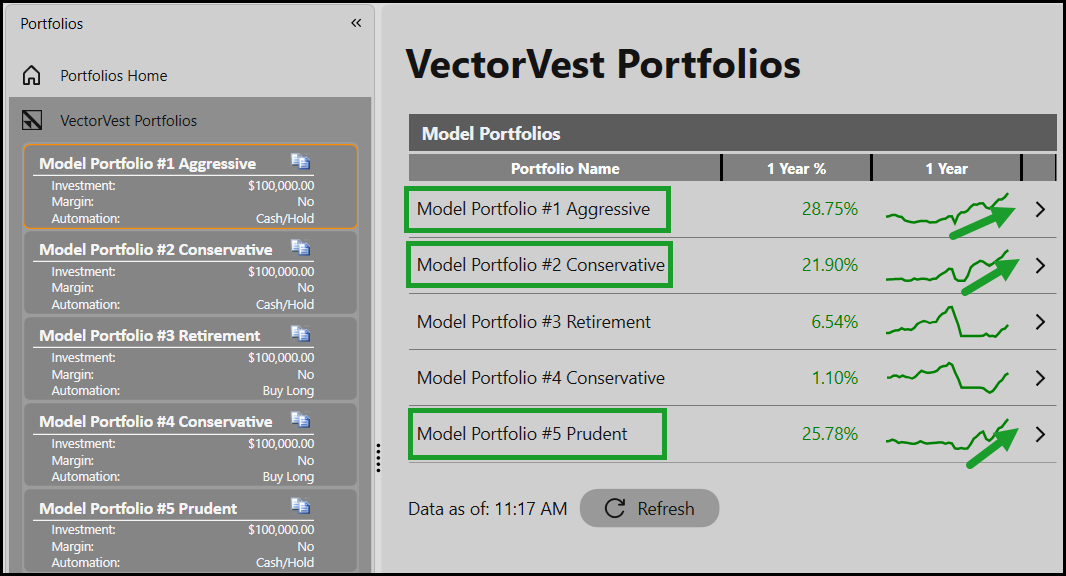

When we want easy money just follow the MODEL PORTFOLIO’S 2,3,5 & Money Makers still rock

CANADA:

PTSE: Price Doji today but still above 3 EMA so no real concerns yet. 3 & 8 & 20 still rising nicely

VENTURE: Selling-off the last 2 days. Today bounced off the 8 EMA and closed just above the 3 EMA. It has been holding the 8 EMA for a while

MKT TIMING: Price still holding the 8 EMA MTI, RT and BSR rose above Bearish lines so still no real concerns yet

MODEL PORTFOLIO’S 1, 2 & 5 Still rock

READ Views and Strategy

When I was thinking about this weekend’s report, I was thinking on how to do better, and I truly did think: “What have the Burlington User Group speakers Tom, Steve, Bob and Stan featured in various presentations, and I remembered how they all liked the Performance Graphs. Now after reading Stan’s Views I know I need to get an advance copy of the views to save me a lot of time. Anyway, I’ve already done all the work so here is the process I followed.

- Quick Test the Gold/ Silver Stocks and ETF’s July 2nd to date

- Do a Performance Graph comparing the Gold/ Silver Industry to the VV Composite (Note the cross and a possible Buy Signal)

- Do a Performance Graph comparing the Stocks/ ETF’s to the Industry

RESULT:

Stock Quick Test: Stocks: PVG, AEM, K, TGZ, KL,BTO, ELD, CG, WPM, PAAS

ETF’s HZU, SVR, SVR.C, HUZ, HGU, CEF.U, CEF, ZJG, XGD,

After doing the Performance Graph comparisons the only Stocks to outperform were: PAAS (Best), TGZ, CG

ETF’s to outperform where: HZU, SVR, SVR.C, HUZ,

As I have mentioned previous times, the direction I reviewed was Silver would outperform Gold and the above has proved true.

As always nothing more than my 2 cents and I hope it’s of value and interest

Leave A Comment