The Covid-19 crisis has brought enormous and consequential consequences to global health and economies. Safe-haven investments like gold and silver have been the most sought-after stocks and ETFs amid fears of another stock market collapse due to the virus, such as we experienced in February and March.

Investors have been piling into gold and silver ever since the market bottom in March, and they have been mightily rewarded. The Mining (Gold/Silver) Industry Group rocketed up from 96th in VectorVest RT Rankings to 11th on May 19th. After a short pullback in early June, Gold/Silver is back to 16th in VectorVest’s ranking of 122 Industry Groups as of July 28th.

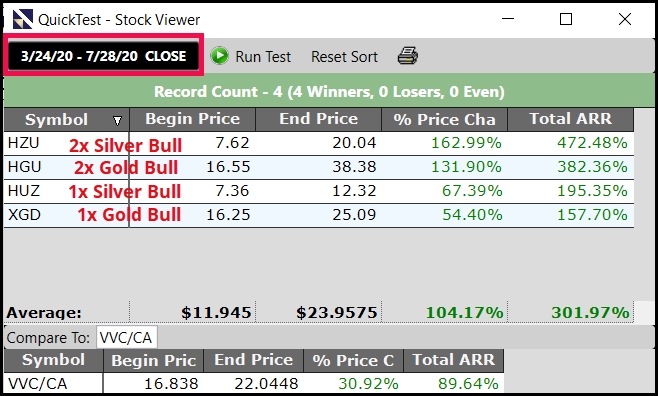

Until recently, most of the attention has been on gold, but now there is growing awareness that silver has quietly been rising even faster, and it may have a lot more room to run than gold, although both remain important investments for current market conditions. Brian D’Amico explained this brilliantly in the Friday, July 24th Special Presentation. In Canada, the 2X leveraged silver ETF, HZU from March 24th to July 28th gained 163% compared to a 2X gold ETF, HGU, which rose 131.9% during the same period. The single or regular ETFs also favour silver – although either one would have been an investor’s delight. Silver, HUZ is up 67% while gold, XGD is up 54%. All four ETFs outperformed the overall market, represented by the VectorVest Composite, VVC/CA, which gained 31%.

The story in the US market is similar but the difference between gold and sliver is even more dramatic. iShares ComexGold, IAU and iShares Silver, SLV have gained 20.3% and 71.3% respectively from the March 24th bottom. The VectorVest Composite, VVC is up 32.79%

There’s an old saying that “Birds of a feather flock together,” and so it is with stocks. Stocks of companies in the same line of business, such as Mining, have similar characteristics and experience the same market forces as their direct competitors. That is why when the Mining Sector and Gold/Silver Industry Group in particular started rising, the leaders pulled up most other stocks in the Group right along with them.

Here are some additional insights that you may find helpful to watch out for. They show other ways VectorVest investors became tuned into the surging Gold/Silver Industry Group early in its advance:

- At July 28th, 17 of the top 20 VST stocks are Miners. Now, you might think this is a one-off, but check out the Stock Viewer on May 22nd. Eighteen of the top 20 VST stocks were in the Mining Sector.

- Also on July 28th, 13 of 26 stocks in our popular Master Retirement WatchList are Mining stocks.

- In our Model Portfolios, Model Portfolio #5 Prudent has made a remarkable recovery after the February/March correction. After turning negative during the correction, the Portfolio is now up 27.49% YTD. The main catalyst has been an overweighting of Gold/Silver stocks purchased mostly in early April, after the DEW Up market timing signal – TGZ up 59.9%, FNV up 42.3%, and ABX, up 40.1%.

With so much focus on the Mining (Gold/Silver) Industry Group, it would be easy to overlook other Sectors and Industry Groups whose stocks have also been moving up nicely. That is unless you have a tool like VectorVest.

Consider Home, our current #1 RT Ranked Sector. There are only three stocks in the Sector, two if you don’t count the Class A Voting Shares of one of the three, but those two stocks, Sleep Country, ZZZ and Dorel Industries, DII.B, are up 111% and 382% respectively from the March 24th bottom. The Industry Group Ranking was a near-last 115th on April 2nd before climbing into the top 5 on May 20th, where it pretty much has stayed. The Building Sector has also been on fire due to low interest rates and high demand for new housing and renovations. Do you see how you can use this Sector/Industry Group Information to find big winners?

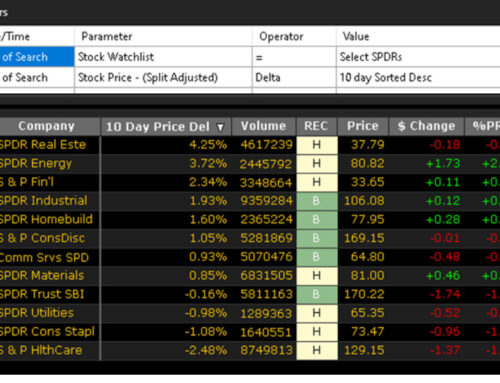

If you want to learn a few simple strategies for staying on top of Sector and Industry Group rotation, I have created a short video to show you how, including my favourite Delta Sector search to find the biggest movers.

For more information on the subject, watch this video, titled “Beyond Silver and Gold—How to Find the Hottest Stocks in the Hottest Sectors and Industry Groups”.

Leave A Comment