Does it feel like your portfolio isn’t making the gains it should? Do you have too many stocks that are underperforming the market or worse, costing you money? Is volatility causing you sleepless nights? I’m sure you are not alone, and here’s what you can do.

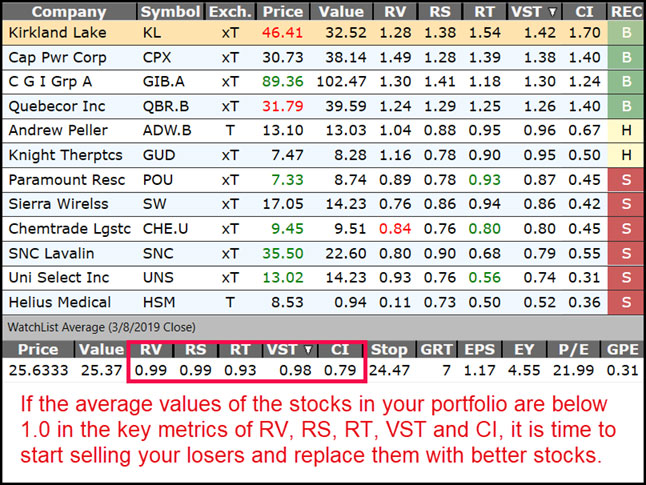

Place all your holdings in a WatchList. Study the bottom row of WatchList Averages. Do you have too many indicators such as RV, RS, RT, VST and CI that are below desirable levels (1.0)? Next, right click on the WatchList Average row and choose, “View WatchList Average Graph”. If this graph of “your portfolio” was an individual stock, would you be happy with its price performance over the past six months, one year, two years and five years? Would you still like to own it?

If not, you have a couple of choices. You can use the “wish and hope” method and wait to see if things turnaround. Or, you can begin a simple, strategic process to transform your portfolio in just a few weeks to one that holds better stocks that are rising in price.

Our VectorVest Founder, Dr. Bart DiLiddo, calls this rebalancing method, “Healing A Broken Portfolio”. I first saw him demonstrate it to an enthralled audience at the Toronto MoneyShow a few years ago. Here’s how he did it.

BUILD A WATCHLIST

Go to the Viewers Tab and WatchLists. Create a New Group and give it a name such as OO MY PORTFOLIO. Next, create a sub-folder and call it, MY STOCKS 2019. Add every stock you currently own. Your stocks will be ranked and sorted by the default VST-Vector. It brings the best stocks overall to the top of the list. They should have well above average VST scores with BUY or HOLD ratings. These are your money-makers. You don’t need to touch them right now.

For this exercise, change the sort to RT descending. This brings the weakest stocks to the bottom of the list, usually SELLS or HOLDS. Contrary to the way many investors operate, these are the stocks that need your attention. They are the cause of your portfolio’s underperformance, and they represent the greatest risk going forward. Check the WatchList Averages in the bottom row. Your goal is to raise the average values to above 1.0 in all the key indicators: RV, RS, RT, VST and CI. The higher, the better.

READ THE GRAPHS

Graphs don’t lie. Start with your lowest RT stocks. Use the VectorVest Simple graph layout showing Price, STOP, RT and EPS. For good measure, add Value from Capital Appreciation. Check for the warning signs – price falling below the 40-MA and RT falling below 1.0. If the stock is a SELL, how long ago did that happen? If Price movement has been from the upper left to lower right and it’s still heading lower, it’s a candidate to sell as soon as possible.

Notice that RT probably started trending lower before Price. What about EPS? If EPS is falling or volatile, that’s a warning. In the Viewer, in the right click menu, click on the NEWS tab to find out if bad news is one reason price is falling.

With Value on the graph it’s easy to see if the stock is undervalued or overvalued. If a stock is overvalued, and value is not rising, it’s another bearish factor to consider.

SELL YOUR WEAKEST STOCKS FIRST

In Dr. DiLiddo’s demonstration, he showed how a portfolio could be transformed by selling your weakest stock every week and replacing it with a high VST stock that is safe, undervalued and rising in price, only when the Color Guard is bullish and the market is rising. It might be a stock cherry-picked from your favourite search, from the Stock Viewer or from a top WatchList such as the Midas Touch or TSX Composite. Compare your stocks to the new Master Retirement WatchList, a list of outstanding growth and dividend stocks that is updated every week.

By the end of a few weeks, depending on how many stocks need to be weeded out and market conditions, you will have a portfolio that is less volatile, safer and more likely to outperform. Try it and let me know what you think of this methodology at [email protected]. I’m sure you will find it A VALUABLE EXERCISE.

Here’s an opportunity to learn more about this valuable exercise I have just described. Our Two-Day Investment Seminar is now available for at home study.

Leave A Comment