One of the interesting discussions we have in our Investing for Retirement course is when we explain the importance of Stop-Prices, or Stop-Losses as they are often called. There is always a bit of pushback, and it’s understandable. We hear comments such as:

“I always regret having a Stop-Loss because it winds up costing me.”

“My broker pushes prices down to my Stop and takes me out.”

“As soon as my Stop is hit, price always goes right back up.”

It can be frustrating at times, but not one of the arguments holds up under scrutiny. We tend to downplay the times when a Stop saved us from a catastrophic loss, which is its main purpose. And, we rationalize the reasons why we’re still holding Blackberry after riding it up to $92 in 2009 and then sitting on our hands as it fell back to $6.00 by 2013. Most of us have our own examples.

There are only two things in investing that are totally within our control:

- When we get in, and,

- When we get out.

Let’s talk about when we get out. We need Stop-Losses. Why give up the power of knowing with absolute certainty when we’re going to sell if price moves against us? All we need to do is to determine before we buy at what point we will sell. We should do it every time. If used correctly, a Stop-Loss:

- Prevents you from blowing up your trading account,

- Preserves your capital so you can continue trading,

- Removes your emotions and keeps you in control,

- Limits your losses and builds your confidence.

Stop-Losses are equally important in your swing trading plan and your retirement plan. In swing trading, traders will generally set a reasonably tight Stop below a Support area or Moving Average, or a price generally between five and ten percent below the purchase price. VectorVest teaches to keep your losses small and let your winners run. As price moves up, you should raise your Stop. That’s where the new ProfitLocker Pro tool shines.

Below are some ideas about Stop-Losses focusing on your goals and stages of investing for retirement. You should also get financial advice from your trusted advisor specific to your situation.

PRE-RETIREMENT

Let’s assume you are buying quality companies that are growing their dividends, have high RS scores and rising earnings. The earlier you start, the better. Your goal is to take advantage of compounding over time to create a source of income in the future. Quality utilities, banks, insurance companies, railroads and REITs come to mind. Drawdown on capital gains can also provide future income, and, may include growth stocks that may not yet pay a dividend. Innovators and technology leaders such as Shopify, CAE Inc., CGI Group, Amazon, Microsoft and Apple are examples.

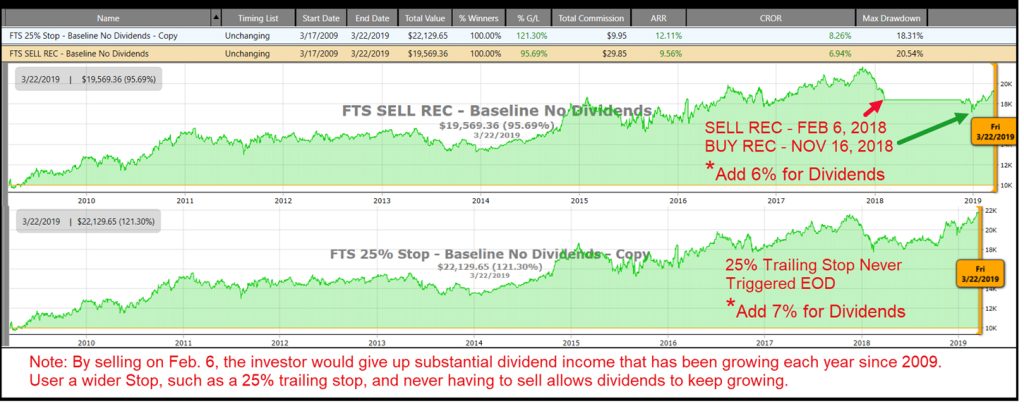

For these pre-retirement stocks, use a wider Stop such as VectorVest’s SELL REC or even wider, such as a 25% to 35%% trailing stop, and stick to it unless there’s bad news affecting the company’s business long term. VectorVest will alert you to extreme market conditions, such as 2008, and then you can decide if you want to tighten up. If you learn how to protect with options, you can hold positions longer, have more control and more peace of mind.

EARLY RETIREMENT

Continue with wide Stops with your dividend growers. They will be paying you a handsome dividend yield by this time. With those growth stocks, where you now hold significant capital gains, you’ll want to tighten your Stops, especially in Confirmed Down market conditions. Your time horizon is now shorter, so capital preservation is paramount with these positions. Your time horizon is shorter now, so capital preservation is paramount with these positions. Use tighter Stops on any new positions, including dividend payers, and be prepared to tighten your Stops in Confirmed Down conditions to lock in profits or minimize losses. You can use the “Weed Your Portfolio” techniques explained in Lesson 2 on the Training tab.

END-STAGE RETIREMENT

Only you and your doctor can guess how long your time horizon might be now, so capital preservation at this stage trumps everything, including your long-term dividend payers. You’ll want to keep making money, of course, but whatever nest egg you already have, your priority now is to keep it intact, perhaps as a legacy for your family and favourite charities. You should consider tightening all stops and move more of your assets into fixed income as cash becomes available.

I would love to hear your comments and ideas on any of the above. Please send me a note at [email protected] and we’ll discuss at an upcoming CA Q&A webinar.

For more information about Stop-Losses, please read Chapter 10 of Dr. DiLiddo’s classic green book titled, Stocks, Strategies and Common Sense. You may also wish to read my essay of November 11, 2017. By then, you’ll have a more complete understanding of STOP-PRICES FOR DIFFERENT STAGES OF INVESTING.

Leave A Comment