If an investor invests based on how they feel, they will never have consistent success.

Let’s talk about fear, one of the most difficult emotions to control. At the beginning of 2019, many investors missed the beginning of a strong market rally because they were fearful. They might have lost money when the market collapsed in October, November and December. In January when the market began moving up again, they paid too much attention to the news. Everything was still negative.

Our founder, Dr. Bart DiLiddo, called it “persistent pessimism”. Investors were afraid to step in and buy stocks. But that’s exactly what they should have done. VectorVest signaled a potential market trend change with a Primary Wave Up signal on December 31st. Our fastest signal, the Primary Wave Up takes on extra significance coming as it did when VectorVest’s key timing indicators, the MTI and BSR, are near historically significant oversold levels. Additional confirmation came on January 4th with a green light in the price column of the Color Guard, a GLB or Green Light Buyer signal.

The market continued to move higher. We got a DEW signal on January 10th and finally a Confirmed Up Call on January 15th, our slowest, most conservative signal. The earlier investors began buying on these signals, the better they have done, but fear too often gets in the way. As a VectorVest subscriber, you learn to follow the guidance in the Color Guard on the home page, the Timing section in the Views, and the US Daily Color Guard Reports.

Fear will also cause investors to ignore their Stop-Price and sell an individual stock too soon while price is moving up. If price drops sharply one or two days, they worry about losing too much of their profit and they make an impulsive decision to sell, even though it may be normal price action for that stock. We need to learn to conquer the fear emotion and develop the ability to hang in there through some ups and downs through the cycle of the move. Even good stocks with high RS and RV scores don’t just go straight up every day.

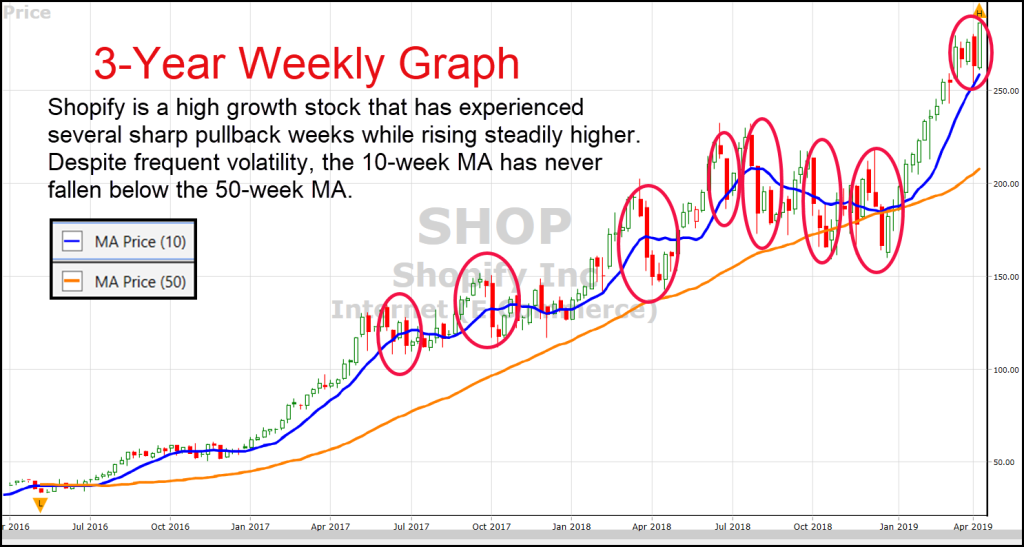

One technique you might find helpful is to study a long-term graph before making an impulsive decision to sell. Pull up a weekly graph and study price over at least two years. Look at any long red candles and determine how long it took for the stock to recover. You will get a feel for how the stock’s price has behaved in the past.

This will help answer the question, “Is this price action normal or abnormal?” What you often find is that a lot of pullbacks or “shakeouts” are normal behavior as the stock continues to climb higher over time. Knowing that occasional pullbacks is normal should keep you from panicking and selling too soon because of fear.

Your investment results will improve dramatically when you learn to control your emotions and CONQUER YOUR FEAR IN THE MARKET.

Join Us For The Toronto 2-Day Investment Seminar.

When you attend the live seminar or watch the live-streaming at home on your computer, you’ll learn how to conquer fear and achieve more consistent performance. Every session builds on each other and allows us to dig deeper into each one of the Seven Secrets to Making Money With VectorVest. To learn more or to register, just click on the link below: https://customerservice.vectorvest.com/evt__sem_Detail?id=a2Q1Q000001Tzeu

Leave A Comment