With the price of gold falling steadily from its February 20th high, it seems that gold stocks may have finally lost their shine over the last three weeks or so.

How do I know? One of the best ways to track gold stocks in our Canadian market is by graphing the Mining (Gold/Silver) Industry Group. The graph shows price began rising on November 28th after a forming a double-bottom pattern. It moved up in a uniform channel until March 28th when price broke below the channel and fell below its 40-day MA at the same time.

There were other warning signs. Like a guided missile, RT began falling on February 20th, a bearish divergence with price. It crossed below 1.0 on March 1. Another warning, the RT Ranking of the industry group, a valuable measure of how the industry group is performing versus its peers, has been in a free-fall and now sits at 107 among 124 industry groups. It suggests money has been flowing into other industry groups and we see a few of them at the top of the Industry Viewer: Aerospace & Defense (Manufacturers); Electronic (Components); Internet (Network); Software (Desktop); and, Internet (E:Commerce).

Interestingly, the HUI, Gold Bugs Index, on the US Market remains bullish for gold stocks on our 3-month Midas Touch graph. However, the trend of the 40-MA of RT has been falling since February 8, a sure sign of slowing momentum. With the 40-Day MA at 1.09, the Index could turn bearish in just a few days if the trend continues. The Mining (Gold/Silver) industry group in the US has fallen to 210 out of 222 groups and is down about 3.1% since February 8th. Money is moving out of gold stocks.

I’m not saying the rally in gold stocks can’t resume, but the uptrend has clearly stalled for now, so best to be careful. Graphs of the leading gold stocks all look about the same as the industry graph. It’s been a difficult three weeks.

So, momentum has dissipated, but it was a solid rally while it lasted. Here are a few measures of performance by gold stocks from November 28th to March 28th. First, a Quicktest of the top 10 stocks in the industry group ranked by VST shows the average price gained 28.5% led by Alacer Gold, ASR which rose 80.4%. Kirkland Lake, KL, 53.9%. There were nine winners and just one loser. KL, by the way, had the best combination of fundamentals of any gold miner Tuesday, April 16th with an RV of 1.40 and RS of 1.39, but its RT had fallen to 0.92, indicative of the downtrend in the stock and the pull of the industry group.

The top 10 VST stocks in the S&P/TSX Global Gold Index, (TSX WatchList folder), rose 30.7% during the same period, once again led by ASR and KL. All 10 stocks were winners.

Finally, a Quicktest of the top 10 stocks found by running the Gold Digger search gained an average of 20.5% with seven winners and three losers.

Keep your eyes on the industry graph to discover the next uptrend or watch the Enhanced Daily Color Guard Report in VectorVest US every Monday, but for now, GOLD HAS LOST ITS SHINE.

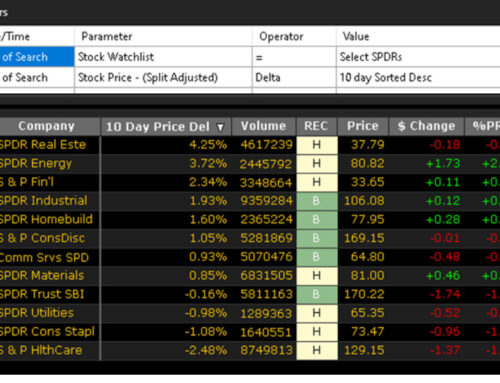

P.S. With a new conservative majority government elected Tuesday in Alberta, let’s watch for any impact on the energy sector, one of the party’s key election promises to get pipelines and the energy sector moving. They also vowed to cancel the government subsidized billion-dollar strategy to transport more oil by rail, so we’ll want to keep an eye CNR and CP. Join me and our VectorVest community for discussion at our Tuesday Q&A.

Leave A Comment