Written by: Mike Simonato, Ontario Presenter: “Investing for the Long Term”, presented to the Feb. 6, 2021 International Online Forum, you can watch by CLICKING HERE.

The Challenges facing Businesses and Traders in the “New Reality”

Back in the olden days, we could research a company, get to know what it does or merely buy when this line crosses that line. Businesses merely had to focus on how do we get customers to buy what we’re selling. Then Covid hit. Workers worked from home. Kids were home schooled, businesses went into survival mode as did households.

Gradually things started to open back up, then close, then open, then close, etc depending where in the world you were.

Big Box stores and financial institutions, online shopping businesses adapted and by and large have done well during this difficult time. Small business, however, hasn’t done as well with many going bankrupt and many others taking on enormous debt trying to survive.

Trading has been a lot of business as usual ie I saw online shopping continue to get stronger, people and kids doing everything from home, so my stocks continued to do well. The markets continued to hit new highs, so Bob Turnbull’s Bull Strategy continued to do well.

Somehow during these last 18 months I must have slept through or missed an email describing the new reality. Here is the New Reality for businesses and us as traders:

- New Reality facing business: 1. Can’t get workers with any kind of work ethic and an IQ higher than an empty pop can. Back in the day when I was applying for a job, I had to show that I was qualified, I would be a good asset to the company and I was reliable. Now if you can even get somebody to show up for an interview, THEY have THEIR LIST of DEMANDS. Here are real-life examples. We get paid daily in cash. We will only work so many hours a week so we don’t lose cerb and we don’t work nights or weekends.

Here is how this new reality is affecting business. NOBODY can find good workers. Restaurants can’t take reservations because they don’t know how many staff will show up on any given day. Grocery stores have no idea if or when trucks will come because they can’t get drivers. I had to go to 3 stores yesterday just trying to find hamburger.. I went to Home Hardware to get something on sale in their flyer and they said they don’t know if it will come because the warehouse is a complete disaster. Another store said what I was looking for has been on order since April. Everyone I have talked to has said the same thing. People now have an insane level of entitlement and nobody can find a reliable source of product. That includes Grocery Stores, Coke and Pepsi and nobody can find good workers.

I was in line at Canadian Tire yesterday and a guy in line had a T-shirt and this is what was on the back in big bold lettering. “You don’t like me, F…. Off Problem Solved and I wonder why companies can’t find good workers.

If that wasn’t enough, there is no consistency on how Covid is being handled, which has left many businesses upset and confused. ie Ontario by and large has been semi strict, causing business much harm whereas Alberta has been more of let’s party much to the extreme anger of doctors. Now Ontario is in relatively ok shape with things opening back up gradually, whereas Alberta is in a state of emergency with the potential of a Critical Care Triage setup where doctors must decide who lives and who dies, which will affect them for a long time.

The short of it, Businesses has gone from How do we get customers (That’s never been easier) to can we even look after customers. I know a lot of good businesses that have gone under because of the sense of entitlement of workers, no reliable suppliers and now cost of doing business.

In England, the cost of Electricity and Heating have skyrocketed, along with a big shortage of truck drivers, have forced many businesses to close, leaving many shelves empty

Needles to say, there has never been a more challenging time for businesses just trying to survive

How about us as traders. Up until now, it’s been relatively easy for those who have a rock solid Trading Plan and know what they’re doing. How about going forward? Here is One example:

Amazon. Well run company, well diversified, well capitalized, in all the right businesses and willing to adapt ie starting wage in Canada just got raised from $17 to $21 per hr as the battle for good workers intensifies. Here is the reality.

I have an insider at Amazon. ie I knew 6 months prior the Bezos was reducing his role in the company. The reality. In the warehouses, to say they have a staffing issue is an understatement. The crimes being committed are insane. My insider had a box thrown at her by another worker breaking her arm so he got fired and she’s off work so even though Amazon is doing everything right and they’re in the right industry the inability to get quality workers could affect business and therefore the stock price. ( I know we didn’t like going from getting things in 2 days to waiting 2 months).

Nat Gas price has soared recently so expect to cost of business to soar as well, like England.

Being in a business that requires employees and suppliers has never been more difficult. As Traders, we must have 2 things:

- A Rock Solid Proven Trading Plan

- The ability to adapt to changing circumstances

As always, nothing more than my 2 cents and I hope it’s of value and interest

Now for the markets.

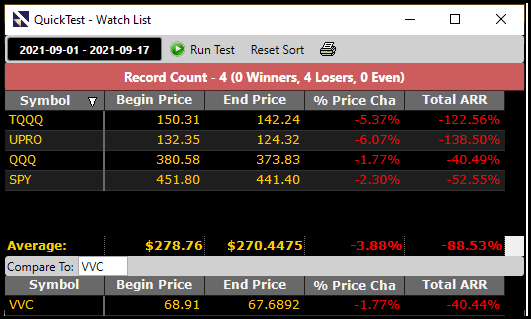

What I’m seeing is nervousness, signs of a toppy market, ie a lot of reversal days but 2 markets consolidating which could mean another leg up. Friday was options expiration day. In a strong market, traders close out positions and open new ones causing the market to go down in the morning but rally into the close. At around 3pm this looked like it would be the case but then selling resumed into the close. USA had a very short-lived C/UP. Take a look at Bob Turnbull’s ETFs performance for the month of Sept (Note he’s really smart and wouldn’t have these losses) This shows the need to be really cautious going forward until we see clear evidence of Market direction one way or another.

USA Very short C/UP BSR 54

DOW JONES: Big selling volume on Friday as was evident in all markets. Price is below the 79 SMA If price breaks downward then watch out

NASDAQ: Price is consolidating above support and RT is approaching support

S&P 500: Price is again consolidating above support RT right at a support line

MKT Timing: Price staying slightly above the 65 SMA but could easily fall below

READ Views and Strategy

CANADA BSR 36

PTSE: Price broke the bottom of a channel on huge selling vol Friday Holding the 40 SMA Rt falling hard Watch next week for any follow through

VENTURE: Price falling hard. Only one green candle in the last 9 days

MKT TIMING: Price and all 3 indicators continue to fall. Next week will be the key. Watch closely.

READ Views and Strategy

AUSTRALIA Read Strategy

BRITAIN: Read Views and Strategy

Leave A Comment