Written by: Mike Simonato, Ontario Presenter: “My Three Friends”, Dec. 3, 2016, VectorVest International Online User Group (Click here to View: My Three Friends)

USA

DOW JONES: Failed at Resistance but still holding the 3 EMA RT is falling

NASDAQ: Bull Flag??? Watch for breakout. Stochastics still good but again RT Falling

S&P 500: Watch for a breakout above Feb high. Stochastics still bullish but RT Falling

MKT TIMING: Watch for a breakout above resistance and the Feb high. Stochastics still bullish. RT, BSR and MTI fairly flat in the last month

READ Views (Very Important) and Strategy of the Week.

CANADA

PTSE: Not seeing a lot of strength. Sideways the last 8 days. Closed just below 8 EMA today. RT flat last 5 weeks

VENTURE: Watch to see if uptrend can continue. Still above the 3 EMA but RT Falling

MKT TIMING: Price stagnant last 8 days. MTI, BSR and RT sideways the last 5 weeks

GOLD: Stan completely covered in the views. I hope for more weakness but expect a huge rally before year-end

READ Views, Strategy. Climate USA Earnings indicator still the same but Canada fell another point

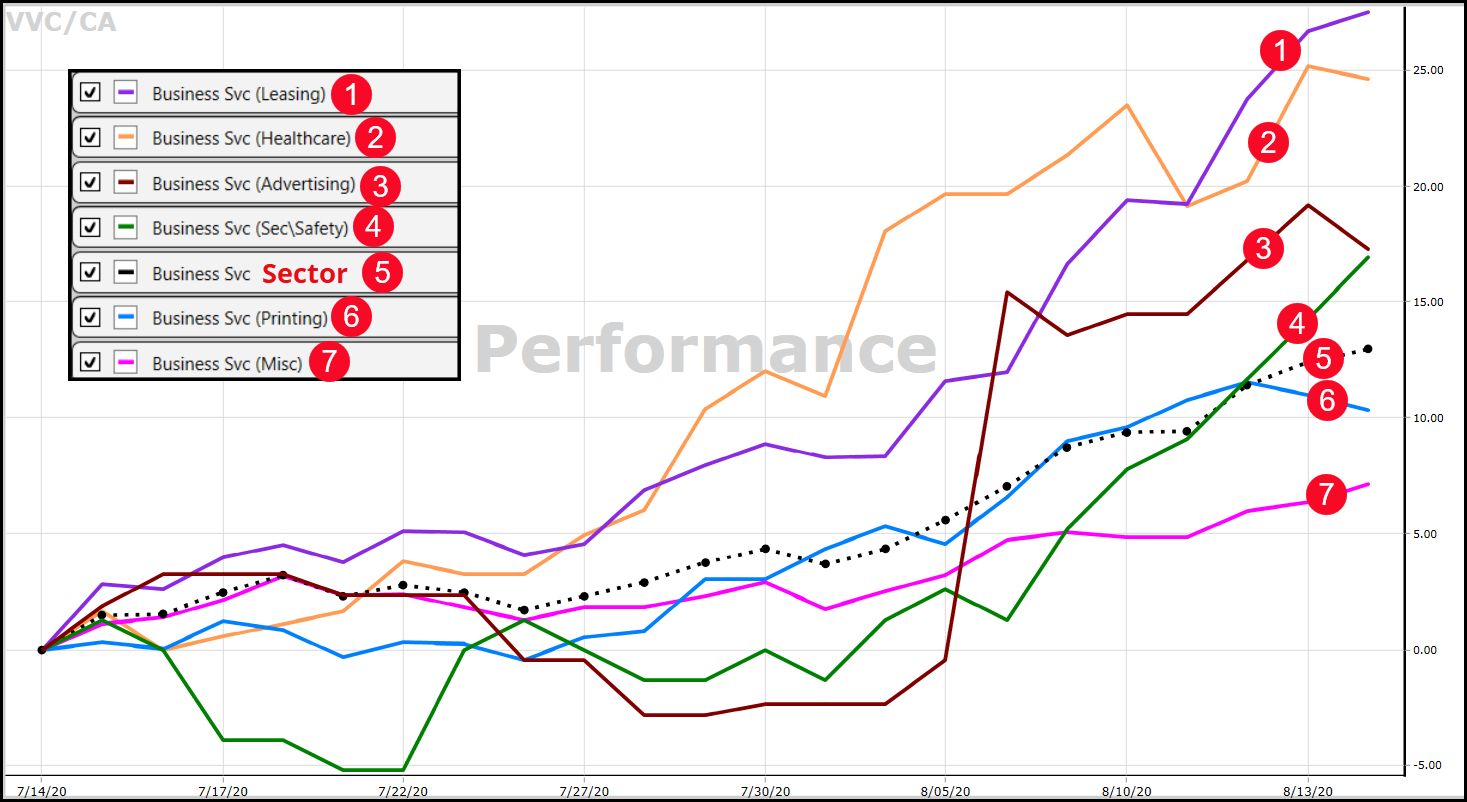

The Business Svc Sector still looks good, particularly the Business Services Leasing Industry Group within the Sector. ( See the Performance Graph Below). Top stocks in the Leasing Industry Group during the last three months: Goeasy (GSY) up 44.1%; Ritchie Bros (RBA) up 44.5%; Chesswood Group (CHW) up 30.1%.

As always nothing more than my 2 cents and I hope it’s of value and interest.

Leave A Comment