STRATEGY OF THE WEEK: “TRADING HIGHER HIGHS AND LOWER LOWS.”

STRATEGY OF THE WEEK: “TRADING HIGHER HIGHS AND LOWER LOWS.”

Finding stocks, industries and sectors hitting new highs and lows is a powerful approach. But, which type should you use: a 52-week high, a 13-week high, or maybe a 5-day high? Todd Shaffer, Manager of Research, showed us some valuable approaches in this week’s “Special Presentation” titled, “Trading Higher Highs and Lower Lows” for more insights on using this powerful tool.

Our Weekly Q&A. View Todd’s presentation from the VIEWS Tab or VectorVest University, then join me for our live Q&A webcast on Tuesday, November 17th at 12:30PM EST. We’ll answer your questions related to this strategy presentation and show a few examples. We’ll also review current market conditions and analyze a few stocks. CLICK HERE TO REGISTER.

FORUM NOTES: VectorVest members loved our first Canada User Group Forum! For a limited time, you can still get the recording link in case you missed it or if you just want to review the outstanding presentations on Bottom Fishing and Jake’s Patent Winners. CLICK HERE TO GET THE RECORDING. Don’t miss our next Forum, Saturday, Dec. 5 at 11:00 a.m. Eastern. We’ll have a number of member presentations including the 3/8 EMA crossover technique, analysis of the Energy Sector and industry groups such as Banks – Investment and Gold/Silver. We’ll do a market review and study a few U.S. and Canada Game Changers – Fundamental Characteristics and Technical Analysis of Canadian and U.S. stocks that went on to achieve monster gains. Reserve Your Seat Today! Space is limited.

Market Conditions Continue to Worsen. The TSX fell all five trading sessions last week, cementing another 3.5% loss. VectorVest does not advocate buying stocks at this time. Despite a rising energy sector on Friday, last week’s oil report by the IEA (International Energy Agency) was not good. Oil is trading near its lowest level in two months and crude stockpiles rose three times more than forecast. Inventories in developed nations have reached a record.

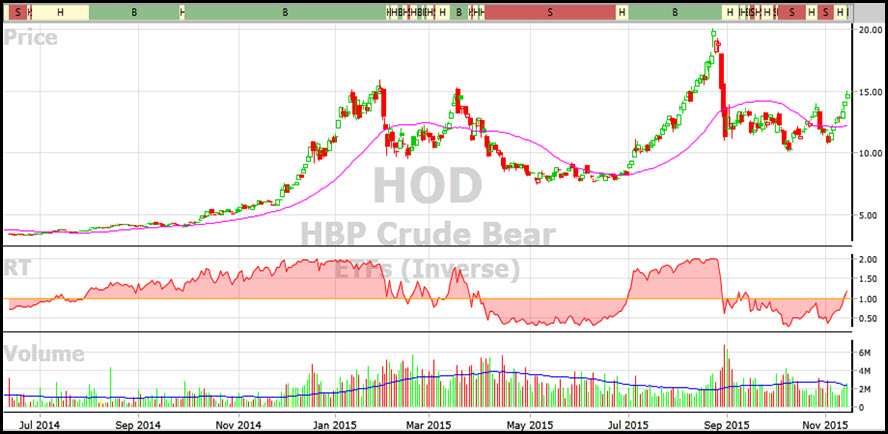

HOD AS A HEDGE.

HOD, Horizons 2X leveraged inverse ETF, has proven a good hedge for anyone trying to hold onto their petroleum stocks when the price of crude is falling. HOD has just pulled above its 40-DMA and RT above 1.0, both bullish signs. On Friday HOD got a new BUY REC from VectorVest. Just be aware that HOD can be volatile because of the leverage. Investors should only buy when oil prices are falling and HOD is rising. Important to maintain a reasonably tight Stop Loss.

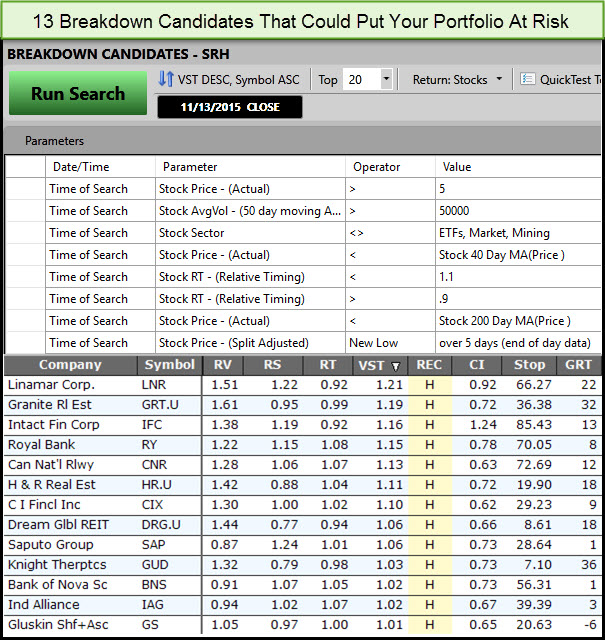

13 Stocks That Are Breaking Down. Finally, in falling markets like we’re experiencing again, it’s important to monitor our portfolio of stocks regularly and maintain effective sell rules. In Video 2 of our Successful Investing Course we learn to heed the four warding signs. The video is titled, Weed Your Portfolio. You can find it on both the Welcome Tab and the Training Tab. Below are 13 stocks that are showing two or three of the first 3 warning signs: 1. Increasing Volatility; 2. Price breaking below the 40-DMA; and 3. RT falling below 1.0. The fourth warning is our ‘line in the sand’ SELL REC. The 13 stocks below have reasonably good fundamentals but have broken down and are starting to show early warning signs.

DISCLAIMER: The information contained in this Blog is for education and information purposes only. Example trades must not be considered as recommendations. You should always do your own analysis and invest based on your own risk tolerance, investment style, goals and time horizon. There are risks involved in investing and only you know your financial situation, risk tolerance, financial goals and time horizon.

Presented by Stan Heller, Consultant, VectorVest Canada

Exceptional post Stan. Thx for all your hard work on our behalf

Many thanks Mike.

Good Work Stan:

Can’t wait to hear your presentation on the 17th!

Keep up the Spirit!

Regards

Ken

Thanks Ken. Looking forward to it as always.

Canadian Banks are the safest in the world

Thanks for commenting Ernie. RY has recovered its 40-DMA so all is good. BNS is the weakest performer of the Big 5 YTD, down 8.57%, about the same as the TSX Composite. Dividend payments are not included so overall, the banks have held up pretty well and remain a good investment over time.

Hey Stan,

Thanks for another great search. I will use this one often. It’s never fun to find one of your stocks in the “short searches” folder. Hopefully this search will help weed them out before they get that far.

Take care,

Tom

Thanks Tom. I agree the search is useful to focus ourselves on VectorVest sell rules.

Hello Stan.

It is hard to believe that the VectorVest Canada Blog is now a year old! How quickly time passes. I am surprised, frankly, that more of Canada’s VectorVest Users are not making good use of the blog (Including myself).

I look forward to your posts Stan and looking back there is a wealth of education and information available thanks to your efforts with your entries. Thanks to you I have saved a few UniSearch scripts that have been very helpful in searching the VV database. When I first looked at the UniSearch feature 3 years ago as a ranked beginner, I found it a little perplexing and intimidating but now with your guidance over those years I feel comfortable and can actually go into UniSearch and write some worthwhile enquiries with positive results.

Happy Birthday VV Canada Blog and thanks Stan for keeping it up as a valuable part of being a VectorVest User. Thanks you!

Warren G.

Hi Warren, Wow, I have to say I didn’t realize it’s been a whole year already. Time has gone quickly. Thanks for your comments about the information gathered here. I believe it has become a tremendous resource for everyone and we have many member contributors and VectorVest to thank.

Hi Stan,

Thanks for another great post as well as another great search. I just entered it into my program and was glad to not find any of my stocks turnnig up (tonight)

Take care,

Tom