If you have any doubts that interest rates are low and have been falling for a good part of 2019, look no further than the Climate section in VectorVest Views. Using the search engine on the left, I typed the following text to search for: “interest rates are falling”. I chose “Selected Sections” and then “Climate”. Between 01/04/2019 and 11/22/2019, there were 24 weeks where “interest rates were falling”. That’s more than half the time. Is it any wonder then that dividend paying stocks in sectors such as REITs, Utilities, Banks and Telecoms have been among the best net performers so far in 2019? Investors are seeking higher income sources.

VectorVest Canada’s newest Special Report is titled, “Dividend Growth Investing”. Non-subscribers have been paying $9.95USD for it, but as a current subscriber, you can get it free by going to the Views tab, Special Reports. Barry K., a long-time subscriber, had this to say about the Report when it was released in October: “The Dividend Growth Investing Report is fantastic. It should be required reading for anyone interested in successful long-term investing, which is just about everybody I would think.”

The Report starts off by quoting our Founder, Dr. Bart DiLiddo, “Shrewd investors know that reinvesting dividends is the surest way to accumulate wealth in the long-run.” From there the report explains the reasons Why Dividends Matter and highlights the returns in three of our Model Portfolios whose core holdings are dividend payers: Model Portfolio #2 Conservative; Model Portfolio #3 Retirement; and, Model Portfolio #4 Conservative. Since inception seven years ago, #2 has an average annual rate of return of 23.8%; #3 – 23.3%; and #4, a remarkable 29.5%.

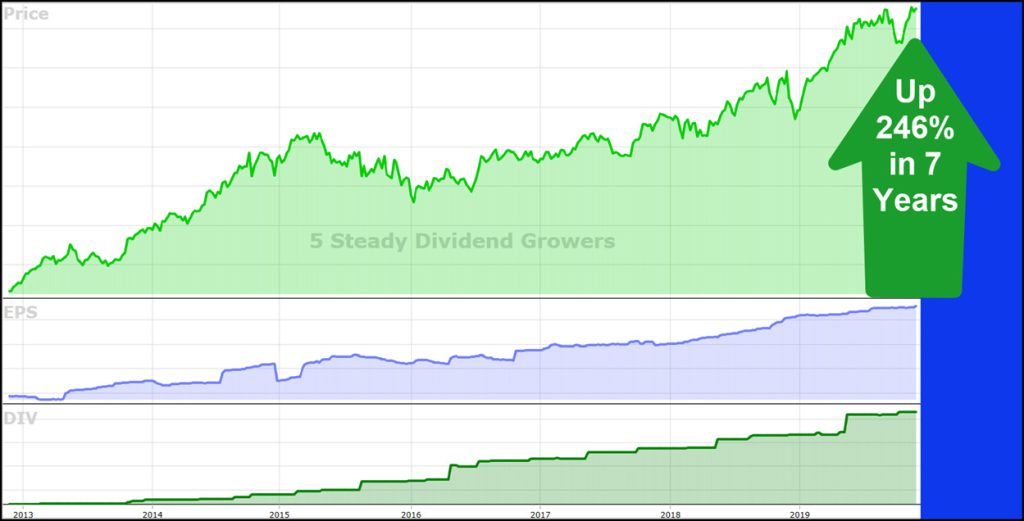

Five Steady Dividend Growth Stocks are highlighted in the report, displaying an excellent graph layout exclusive to VectorVest subscribers. The stocks are ATD.B, Alimentation Couche-Tard; BAM.A, Brookfield Asset Management; CP, Canadian Pacific Railway; CAE, CAE Inc; and EMA, Emera Inc. At the time of writing the report near the end of September, a portfolio of these five stocks had an average return of 28% YTD, not including dividends.

The stocks haven’t slowed down from there. The current YTD return as of November 26th is a portfolio-transforming 34.7%. The average dividend yield, DY, has come down a bit as prices have increased, but it is still a significant 1.38% and growing with a Dividend Growth, DG, rate of 14% per year. The portfolio has been consistent as well, averaging a gain of 26% per year over the last six years.

As a companion to the Dividend Growth Report, VectorVest has placed the stocks in a WatchList titled, “5 Steady Dividend Growers.” It’s under a new folder called, “Special Report WatchLists.” With an average Relative Safety, RS, of 1.28, these stocks have consistent and predictable earnings, making them among the safest stocks in the database. And, while these would likely be considered defensive stocks, I don’t see earnings growth and price performance slowing down any time soon.

If you haven’t read the Dividend Growth Investing Report, I hope you will take the time to do so now. By all accounts, IT’S A GOOD READ!

Don’t Delay. Subscribe Now: Get immediate access to the Dividend Growth Investing Special Report for just $9.95 USD PLUS a 30-day free trial to VectorVest Canada and US.

Very clear efficient and sound information , as usual with Vectorvest

As a US subscriber, am I allowed to read the report?

Thanks, I never miss the international sessions

Guy

Hi Gleason, unfortunately it is built into the CA VectorVest program.