Mike Simonato, Ontario. Presenter: “Investing for the Long Term”, presented to the Feb. 6, 2021 International Online Forum, you can watch by CLICKING HERE.

Another interesting week. I officially shut the business down, so expect a big sell-off or really difficult trading environment for the next 4 months

My 2nd post, copied below, will show what I’m looking at for 2022: both my concerns, what I’m seeing, and some ideas for a Buy and Hold Retirement Portfolio. I love it when Ollie sends me Stan’s Views in Advance.

Now for the Markets:

USA

DOW JONES: Pulled back to the 20 SMA Nice up day Friday on good volume

NASDAQ: Pulled back but up days Thurs and Fri on good vol Friday

S&P 500: Same as Dow Watch next week for a clearer idea as to a continued rise or a stronger pullback

MKT TIMING: Similar to the DOW and S&P 500 All 2 indicators were lower but started to recover Friday

READ Views and Strategy

CANADA

PTSE: Continues to power higher with strong vol and a nice big candle Fri

VENTURE: Same as PTSE (I don’t get to say that too often) Both CDN Markets looking good

MKT TIMING: Continues to power higher. Everything powered higher this week

READ Views and Strategy

GOLD: Finally broke out of the tight squeeze between the 40 and 79 SMAs Now the 200 SMA is acting as resistance. The 40 SMA is now rising and so if Gold can break above the 200 SMA on strong Vol, then Santa may be early this year.

AUSTRALIA: READ Views and Strategy

BRITAIN: READ Views and Strategy

Finally, how are the Nov picks doing? Let’s just say it will be obvious why I pay Very Close attention when Stan Speaks.

Looking ahead to 2022

Looking back at 2021, it was truly the Year from Hell for me. I had so many crimes committed against me (I lost $30,000 and came within inches of losing everything), I could have died twice, my mom broke her neck and my sister has so many serious health issues and has to wait at least another year for much-needed surgery, yet her employer forces her to work 11 hour days. Yet, I can also look back and realize through it all I still have a rock solid business that pays me very well. Once I get rid of the few remaining rude customers, then I will have an amazing group of customers from all walks of life that teach me so much. Something I also deeply appreciate is my VectorVest friends from many parts of the world. Because I did an International Online Forum presentation in Feb (Highly recommend you do this if Stan asks as it will not only be very rewarding but if you are any good on the computer (Unlike me) you can get contacts all over the world). I have a lovely young lady, for example, in England, I can email and find out really what’s going on in that part of the world.

Through my clients, news feeds and VectorVest here is what I’m seeing. This will help cut through the hype and hopefully show reality and help in making wise investment decisions. IMPORTANT: What I’m about to share is nothing more than my 2 cents and we are all responsible for our own investment decisions.

First, and very important, people are getting totally fed up with Rude, Disrespectful, Low IQ people. I did a business yesterday and on the front door there was a big sign that read: ATTENTION ANGRY and MISERABLE PEOPLE NOT ALLOWED, HAPPY PEOPLE WELCOME. Sums up the business sentiment I’m seeing everywhere. Me, personally I will be no longer looking after or wasting time on anyone who is rude, disrespectful, or a bully. I’m hearing the same from everyone in business. People with those qualities are going to find it very difficult to get anybody to do anything for them. This also applies to Business owners who display these qualities. I have also been told there are a lot of businesses that will no longer be supported because of rudeness or dishonest behavior . There is a lot of false and misleading info from many businesses and sectors that can cost us our retirement money in many different ways from dishonest tradesmen to fraudulent online scams. How can we avoid the pitfalls and make wise Investment decisions:

Anyone who watched my International Forum Presentation knows My Trading Style is Prudent Punk. I cry when I lose any money and I have no time for Pepto stocks/ industries so let’s look at what’s out there and see if we can’t get some good ideas so we can build rock-solid Retirement mined Portfolios that will let us sleep at night.

CRPTO: Everyone wants to get into this. Is it safe? Many people are losing all their money in this area. In one week, one fake Crypto linked to Squid Games went to leaving everyone involved penniless. Crypto scams have nearly doubled in 1 year and it is still the number one way criminals want to be paid. This week, two ladies lost everything (they even borrowed money as this looked so good) and now they not only lost everything they had saved, they are now in debt. This week AMC said they would accept Crypto as payment. The problem here is how do you report earnings considering the volatility of Crypto ie this week one day Bitcoin is at $69,000 and the next it’s at $63,000. For those who want to play this Industry perhaps the safest are BITF (CDN) or RIOT, MARA, and BTCS in the USA.

REMEMBER Position Size NEVER spend more than you can afford to lose (See attachments for real returns)

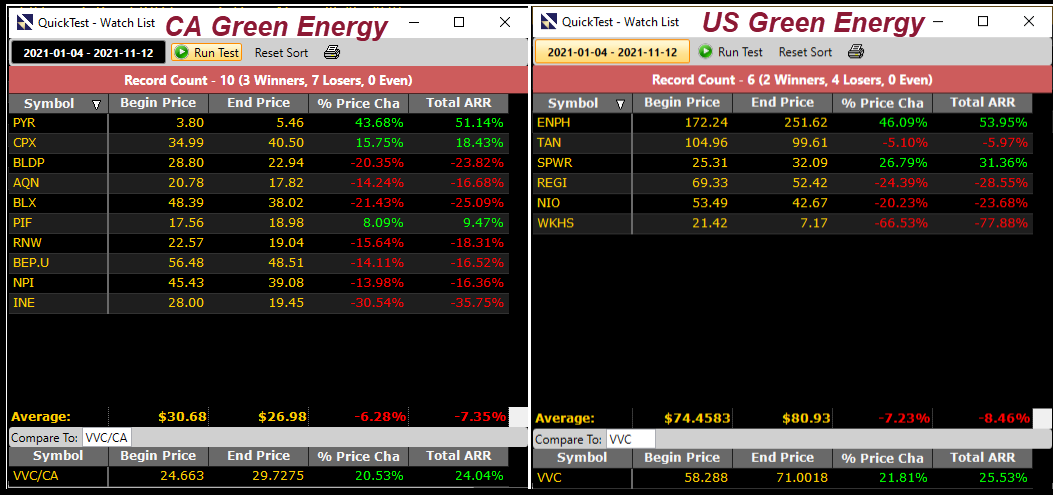

ESG GREEN: This is another popular Industry/ Sector Like most recent fads, caution is advised. Now you hear the term “GREEN WASHING” That’s where these so-called environmentally friendly companies falsify what they do or the actual benefits of their products. (Sounds like half the vitamins I buy) My ESG Green Watchlist is likely not anywhere close to complete but in the USA the return is MINUS 7.23% and in Canada MINUS 6.28% (See attachments) Again I’m not saying this isn’t one to watch I’m merely saying be cautious and do your homework and Remember Position Size.

Now let’s look at some safer Time Tested bets:

1. Bob Turnbull’s BS Strategy (Watch the upcoming Dec International Forum for an update) This strategy can be played in the USA or Canada both with excellent results The attachments show My Buy and Hold way but Swing Trading can be even more profitable. You have to do what suits you best. See attachments for an idea of the  results.

results.

2. Online Shopping. This is here to stay. In the attachments, I show ways to trade this Sector. I also included the Thematic ETFs to get ahead of any possible questions. To me, the key stocks are the way I will continue to play it.

3. Credit/ Debit Card payment systems. This one really baffles me. I see very few people using cash anymore when shopping and with everyone shopping more and more online, this should be exploding to the upside but this sector had a really bad year. This makes no sense to me, but hopefully, somebody out there can help me see what I’m missing. As for me, it is an area I will continue to watch very closely and take a position when appropriate.

NOW for those who like Dividends:

4, Banks. I have included the CDN Banks which have had a very good year and on average for the group, pay a 3.37% Div Yield with a Dividend Safety of 79 and Div Growth of 11%. Note Stan’s Pick National Bank continues to outperform (I really hope someday I can be like Stan) CAUTION only 26% of new mortgages are insured and Canada has the 2nd frothiest housing market in the world. Experts are predicting a close to a 13% correction in the housing market which will put the banks in a tough spot. Also both Canada and USA are expecting to start raising Interest Rates in 2022 making life very difficult for those with big debt loads and when you add inflation into the mix, at some point the balloon will burst. On the plus side, Banks can do buybacks and raise dividends again, so watch and see how this all plays out but definitely a Sector to watch and play.

5, Long Term Care Again Very good Dividend payouts and while the Capital Gains aren’t where they should be yet from what I’m seeing (Huge Facilities being built and existing buildings bursting at the seams) and with an aging population this should again be a good future play.

One To Watch. Computers. I don’t know how to play this yet, but with nobody able to hire any good workers, this is a Strong Trend I’m seeing, and it’s really picking up steam. Here is the current reality: A large number of businesses are putting in Self Checkouts (Even the Dollar Store I’m told) Computers have been used on assembly lines for years but now in Toronto there is a chain of coffee shops where computers take the order, Make the coffee and accept payment. There is a chain of stores in Toronto called 24 with no cashiers. (Amazon had this concept years ago). In Italy, computers do everything in Pizza Shops (as an Italian who makes his own best pizza this is crossing the line) and in Australia, computers are building houses. This is definitely an area to watch and if anyone figures out a safe way to play it please let me know.

There is no doubt 2022 is going to be a challenging year with labour shortages (USA continues to see record numbers of people quit every month) Supply Chain issues and soaring inflation and now consumer confidence fell off a cliff. Only those businesses that are well-capitalized and able to adapt to the ever-changing conditions (ie Bay is not even mentioning stores in their Xmas ads, it’s only talking shopping online) will survive. In the next month there are two events that you don’t want to miss:

VectorVest Subscribers Next Saturday’s Canadian Regional Forum. Stan will help us set up two Retirement Portfolios.

For Everyone The VectorVest International Forum the First Saturday in December (Dec 4) where Bob Turnbull will give us an update on his strategy For those not a Vector Vest Subscriber, before a 11 am ET, go to You Tube and Search VectorVest International Forum and it should take you there

As always nothing more than my 2 cents and I hope it’s of value and interest

Leave A Comment